A Breath of Fresh Eir.

To unsettle the settled, eir has to unsettle itself.

Published 31/10/2019

“We want to break the mould and completely shatter tradition”, a fitting quote from a month that has seen Ireland’s telecoms industry shook to the core by its largest player.

The radicalisation of eir is in full swing, and it has the full ferocity of its fangs on display for competitors, fixed and mobile. If you reside in Mountainview or on Sir John Rogerson’s Quay, any notion of cosiness will have evaporated, superseded by a frantic turning of cogs at the analytical department.

It’s jarring. Who could have predicted that a one-time state-owned monopoly would transpire to be the breather of competition into Ireland’s drab mobile market? But, in hindsight, the arrival of Xavier and his zealous French brigade should have been writing on the wall for an abrupt end to the status quo.

Converging like clockwork, eir’s recent announcements, spread across its fixed and mobile divisions, are emblematic of a company in a state of transformation. What’s particularly unique is that this transformation is just as profound on the exterior as it is on the interior.

The radicalisation of eir is in full swing, and it has the full ferocity of its fangs on display for competitors, fixed and mobile. If you reside in Mountainview or on Sir John Rogerson’s Quay, any notion of cosiness will have evaporated, superseded by a frantic turning of cogs at the analytical department.

It’s jarring. Who could have predicted that a one-time state-owned monopoly would transpire to be the breather of competition into Ireland’s drab mobile market? But, in hindsight, the arrival of Xavier and his zealous French brigade should have been writing on the wall for an abrupt end to the status quo.

Converging like clockwork, eir’s recent announcements, spread across its fixed and mobile divisions, are emblematic of a company in a state of transformation. What’s particularly unique is that this transformation is just as profound on the exterior as it is on the interior.

GoMo: The Allure of an Unlimited Mobile Experience for €9.99.

Credit: GoMo

Colourful, playful and closely aligned to resonate with a lucrative youth segment, Ireland’s newest mobile brand has been met with truly unprecedented fanfare. It turns out that a cheap, to put it lightly, and limitless mobile experience strikes a chord with price-sensitive Irish consumers.

Juxtaposed with the current market in Ireland, GoMo’s offering is groundbreaking, in a similar fashion to the aggressive strategies employed by iliad in France and Italy. The headline €9.99 price is less than a third of the current industry average revenue per user (ARPU) for a postpaid plan.

Juxtaposed with the current market in Ireland, GoMo’s offering is groundbreaking, in a similar fashion to the aggressive strategies employed by iliad in France and Italy. The headline €9.99 price is less than a third of the current industry average revenue per user (ARPU) for a postpaid plan.

The cost per gigabyte of data is a mere €0.125. That’s pretty extraordinary for the frugal, and at the same time, terrifying for eir’s competitors.

In fact, a recent study by analytics firm, Tefficient, has found GoMo to offer the least expensive so-called unlimited data plan on the continent of Europe. The cost per gigabyte of data is a mere €0.125. That’s pretty extraordinary for the frugal, and at the same time, terrifying for eir’s competitors.

Heck, there are even people capitalising on GoMo’s offer for the purpose of a makeshift mobile broadband solution. Tethering is permitted and the potent combination of a low price and large data allowance makes it so that every other alternative appears wildly extortionate.

Anticipate an onslaught of pouting and shouting across rival operators. For them, GoMo is a radically new disruptive energy that will damper any hopes for a return to revenue growth or monetisation of data usage. The small cluster of MVNOs, in particular, must be unsettled by the prospect of a race to the bottom.

They command a disproportionately meagre share of revenue (7% - Q3 2019) relative to their subscription share (9.4% - Q3 2019). With virtually no enterprise customers, little service diversification and already razor-thin margins, MVNOs are incredibly vulnerable to GoMo.

For Vodafone and Three, the emergence of GoMo is an indicator that eir is no longer happy to sit in third place indefinitely. The operator has renewed aspirations to compete on every front possible, from price to network quality (detailed later). To stand still on either of these fronts is to sign a death warrant.

Heck, there are even people capitalising on GoMo’s offer for the purpose of a makeshift mobile broadband solution. Tethering is permitted and the potent combination of a low price and large data allowance makes it so that every other alternative appears wildly extortionate.

Anticipate an onslaught of pouting and shouting across rival operators. For them, GoMo is a radically new disruptive energy that will damper any hopes for a return to revenue growth or monetisation of data usage. The small cluster of MVNOs, in particular, must be unsettled by the prospect of a race to the bottom.

They command a disproportionately meagre share of revenue (7% - Q3 2019) relative to their subscription share (9.4% - Q3 2019). With virtually no enterprise customers, little service diversification and already razor-thin margins, MVNOs are incredibly vulnerable to GoMo.

For Vodafone and Three, the emergence of GoMo is an indicator that eir is no longer happy to sit in third place indefinitely. The operator has renewed aspirations to compete on every front possible, from price to network quality (detailed later). To stand still on either of these fronts is to sign a death warrant.

Rather amusingly, however, eir itself is the crux in any speculation about the potential impact of GoMo on Ireland’s mobile market. The threat of revenue cannibalisation is very real, especially when we consider the fact that the underlying network experience is identical across the two brands (except for the omission of WiFi Calling on GoMo).

Eir is gambling that the reduction in revenue from the churn of its own mobile customers to GoMo will be more than compensated for by the generation of revenues from the addition of new customers outside the operator. This is a ballsy move, and one which should shine a light on the state of customer retention across the industry.

Eir is gambling that the reduction in revenue from the churn of its own mobile customers to GoMo will be more than compensated for by the generation of revenues from the addition of new customers outside the operator. This is a ballsy move, and one which should shine a light on the state of customer retention across the industry.

In choosing not to address the lucrative high-end market, where enterprise customers reside, eir is fortifying the duopoly of Vodafone and Three.

The detachment of GoMo from the eir brand means the “stickiness” of dual, triple and quad-play bundles will no longer apply. In fact, this very point was one of the reasons why eir decided to phase out the Meteor brand in 2017. One could also argue that the prospective customers of GoMo are low-hanging fruit from a price and revenue perspective.

If nothing else, the introduction of GoMo serves as a remarkable reminder of just how fast-paced the mobile industry is. Before the turn of the decade, Ireland was considered to be one of the most expensive places in the world to use a smartphone. The quasi-oligopoly of Vodafone and O2 is nothing but a distant, and dark, memory.

If nothing else, the introduction of GoMo serves as a remarkable reminder of just how fast-paced the mobile industry is. Before the turn of the decade, Ireland was considered to be one of the most expensive places in the world to use a smartphone. The quasi-oligopoly of Vodafone and O2 is nothing but a distant, and dark, memory.

How 5G fits into eir's mobile network transformation

Leaving GoMo aside, eir’s other major announcement from recent weeks has been the commercialisation of Ireland’s second 5G network. But, before casting our eyes to this, it is important to understand how it forms a small part of the operator’s fascinating mobile network transformation programme.

With the enlistment of Huawei to become the sole RAN vendor across 2G, 3G, 4G and 5G, eir’s mobile network is undergoing perhaps the most profound overhaul in its history. The pursuit of an SRAN architecture means ripping out legacy kit from vendors such as Ericsson, and at the same time, rebuilding the network to maximise performance and minimise complexity.

To maximise performance, the operator is splurging on Huawei’s latest RAN equipment, which has been universally extolled as best-in-class on a number of fronts. The introduction of more advanced MIMO, including 4T4R with 4G and 64T64R with 5G, and higher modulation schemes (256 QAM) is enabling eir to achieve greater spectral efficiency across its network.

With the enlistment of Huawei to become the sole RAN vendor across 2G, 3G, 4G and 5G, eir’s mobile network is undergoing perhaps the most profound overhaul in its history. The pursuit of an SRAN architecture means ripping out legacy kit from vendors such as Ericsson, and at the same time, rebuilding the network to maximise performance and minimise complexity.

To maximise performance, the operator is splurging on Huawei’s latest RAN equipment, which has been universally extolled as best-in-class on a number of fronts. The introduction of more advanced MIMO, including 4T4R with 4G and 64T64R with 5G, and higher modulation schemes (256 QAM) is enabling eir to achieve greater spectral efficiency across its network.

Credit: Getty Images

In terms of capacity, a medium in which Three currently dominates, the network rebuild will enable eir to increase the proportion of sites that feature two-carrier aggregation (10MHz of 800MHz aggregated with 15MHz of 1800MHz).

The above development is sorely needed - much of the operator’s traffic currently flows over a single 800MHz carrier, even in urban areas. That’s pretty ludicrous when, in parallel, Three’s network has reached a stage where 45MHz of capacity is commonplace across vast swathes of urban, suburban and even some rural lands.

Of course, we should not forget to dwell on eir’s coverage aspirations either. The operator is still insistent on the fact that it will, in under two years from now, provide coverage to 99% of Ireland’s geographic landmass “on the most expansive 4G mobile network in the world”. I don’t need to tell you that eir is playing catch up here.

Nonetheless, progress is afoot. Eir, in conjunction with infrastructure providers such as Cignal (which was recently acquired by Cellnex) and Shared Access, continue to submit a significant number of planning applications for new rural and urban in-fill monopole sites.

The above development is sorely needed - much of the operator’s traffic currently flows over a single 800MHz carrier, even in urban areas. That’s pretty ludicrous when, in parallel, Three’s network has reached a stage where 45MHz of capacity is commonplace across vast swathes of urban, suburban and even some rural lands.

Of course, we should not forget to dwell on eir’s coverage aspirations either. The operator is still insistent on the fact that it will, in under two years from now, provide coverage to 99% of Ireland’s geographic landmass “on the most expansive 4G mobile network in the world”. I don’t need to tell you that eir is playing catch up here.

Nonetheless, progress is afoot. Eir, in conjunction with infrastructure providers such as Cignal (which was recently acquired by Cellnex) and Shared Access, continue to submit a significant number of planning applications for new rural and urban in-fill monopole sites.

Notably, many of these sites are located within the amber intervention area of the National Broadband Plan, and Imagine is co-located on quite a few. The multi-user nature of the sites means there is additional antenna space available for Three and/or Vodafone to join in the future.

Participation in ComReg’s upcoming multi-band auction will be critical for eir to complement its network rebuild. The unprecedented amount of spectrum on offer is truly tantalising. With the 700MHz band, eir will be able to ramp up its coverage expansion further, and mid-bands such as 2.6GHz stand out as an opportunity to reduce the current level of capacity asymmetry.

Participation in ComReg’s upcoming multi-band auction will be critical for eir to complement its network rebuild. The unprecedented amount of spectrum on offer is truly tantalising. With the 700MHz band, eir will be able to ramp up its coverage expansion further, and mid-bands such as 2.6GHz stand out as an opportunity to reduce the current level of capacity asymmetry.

Those who succeed in ComReg's upcoming multi-band award are setting themselves up to triumph in the journey to standalone 5G.

Without stating the obvious, while eir pushes ahead with its own network transformation, competitors won’t stand still. Three, for example, is in the early days of an Ericsson RAN rebuild, ridding its network of Samsung and the complexity that comes with a multi-vendor approach. Gaining performance leadership won’t be a walk in the park for any mobile operator.

The Ins and Outs of the 5G Launch

Credit: eir

Moving to eir’s 5G launch, there is an abundance of insight at our disposal. In one fell swoop, and on a number of levels, the operator managed to make an effective mockery of Vodafone’s earlier debut - a debut that increasingly comes across as being rushed for the sake of being “first”.

Marketing the launch under the banner of “Ireland’s largest 5G network”, eir has been astute in capitalising on the surprisingly impressive level of coverage. More than one-hundred sites have been graced with 5G across ten towns and cities. The latter will balloon to seventeen before Christmas, when the number of 5G sites will have almost doubled.

And to the benefit of consumers, who may want to know where 5G is available before making the leap, eir has released coverage maps and committed to updating a list of sites that are scheduled for upgrades on a weekly basis. Why oh why has Vodafone neglected to adopt the same level of transparency?

Marketing the launch under the banner of “Ireland’s largest 5G network”, eir has been astute in capitalising on the surprisingly impressive level of coverage. More than one-hundred sites have been graced with 5G across ten towns and cities. The latter will balloon to seventeen before Christmas, when the number of 5G sites will have almost doubled.

And to the benefit of consumers, who may want to know where 5G is available before making the leap, eir has released coverage maps and committed to updating a list of sites that are scheduled for upgrades on a weekly basis. Why oh why has Vodafone neglected to adopt the same level of transparency?

While Vodafone has placed value in demonstrating an artificially idyllic application ecosystem for 5G with remote surgeries, eir has focused on delivering transparent and wildly superior coverage at launch.

As an aside, eir’s 5G coverage map reveals an interesting, but hardly surprising, tidbit regarding indoor coverage (or apparent lack thereof). Only outdoor coverage is viewable, in contrast to the ability to view both outdoor and indoor coverage for every previous cellular generation.

While not obvious at face value, this highlights just how much site densification will be required to make the 3.6GHz band pervasive in Irish towns and cities. It is pretty scary from a capital expenditure perspective, and in the case of eir, exacerbated by the pricing strategy pursued with GoMo.

While not obvious at face value, this highlights just how much site densification will be required to make the 3.6GHz band pervasive in Irish towns and cities. It is pretty scary from a capital expenditure perspective, and in the case of eir, exacerbated by the pricing strategy pursued with GoMo.

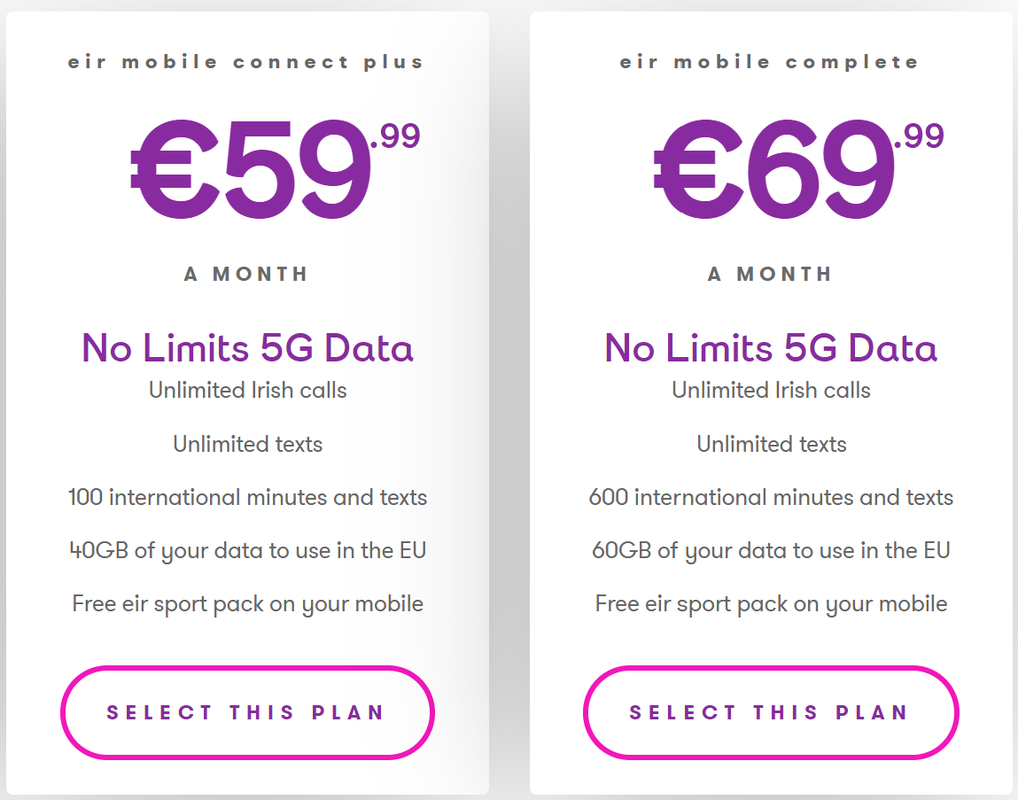

Speaking of pricing strategies, the one that eir has employed for 5G is rather startling, especially in the backdrop of GoMo. While “No Limits Data” (80GB) is front and centre - as it should be if one is to properly reap the benefits of a gigabit-class network - eir is sending a message that the cream of the crop doesn’t come cheap - from €60 per month.

Beyond connectivity, eir’s price plans will grant subsidised access to a choice of four 5G-capable smartphones on a 24-month contract. But tread carefully here - the initial wave of 5G modems in these smartphones lack support for frequency bands such as 700MHz, which will form a critical part of network deployments from next year.

In my eyes, the price is prohibitive, particularly in the early days of “pepper pot” 5G coverage. The use case ecosystem for 5G has yet to mature to a stage where it can derive meaningful benefit from gigabit download speeds, and as such, consumers will be resistant to paying a premium for a mobile experience that is, essentially, the same.

Beyond connectivity, eir’s price plans will grant subsidised access to a choice of four 5G-capable smartphones on a 24-month contract. But tread carefully here - the initial wave of 5G modems in these smartphones lack support for frequency bands such as 700MHz, which will form a critical part of network deployments from next year.

In my eyes, the price is prohibitive, particularly in the early days of “pepper pot” 5G coverage. The use case ecosystem for 5G has yet to mature to a stage where it can derive meaningful benefit from gigabit download speeds, and as such, consumers will be resistant to paying a premium for a mobile experience that is, essentially, the same.

Interestingly, as was the case with Vodafone’s 5G launch, there is no focus on a mobile broadband offering. Given the existence of eir’s fixed business, it may be the case that the company is keen to minimise any cannibalisation that a fixed wireless offering could inflict.

The above points on pricing and mobile broadband may very well be flipped on their head by Three when it launches its own 5G network. As a mobile-centric operator that transformed the market in Ireland with the democratisation of unlimited data, Three is uniquely positioned to replicate its move with 4G and make 5G available to all - at no extra cost.

The above points on pricing and mobile broadband may very well be flipped on their head by Three when it launches its own 5G network. As a mobile-centric operator that transformed the market in Ireland with the democratisation of unlimited data, Three is uniquely positioned to replicate its move with 4G and make 5G available to all - at no extra cost.

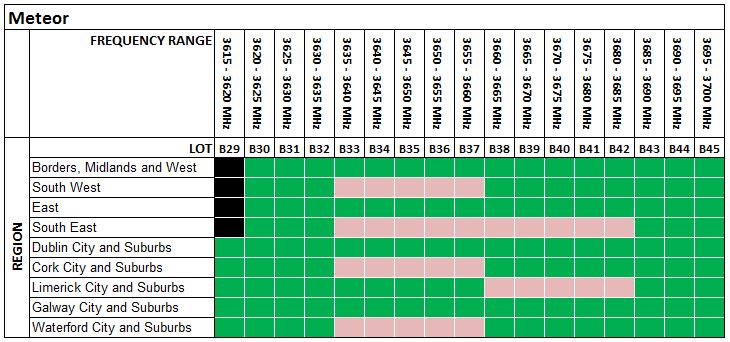

Credit: ComReg

For a deeper dive into eir’s 5G deployments, I’ve summarised key points of information below:

- Eir’s 5G network exploits 80MHz of TDD spectrum within the 3.6GHz frequency band. Given the focus on urban and suburban markets, it is an overlay macrocell deployment atop the existing 1800MHz 4G site grid.

- The non-standalone architecture of 5G (3GPP Option 3) that eir and other mobile operators across the world are commercialising is closely integrated with 4G. This means that eir’s existing Evolved Packet Core (Ericsson) will support its 5G RAN (Huawei) until the move to a standalone architecture in the coming years.

- While there will be very minimal latency enhancements with this initial 5G architecture, enhanced dual connectivity (EN-DC) permits significantly improved peak data rates thanks to the aggregation of 4G and 5G carriers. Both downlink and uplink performance should benefit from EN-DC.

- Thanks to advancements such as beamforming and 64T64R, the higher antenna gain provided by Huawei’s Massive MIMO AAUs enables eir to compensate for higher path loss in the 3.6GHz band. This should result in outdoor coverage that is broadly similar to that provided by the 1800MHz band.

- When combined with the 4G anchor (25MHz), eir’s 5G sites exhibit more than 100MHz of spectrum per sector. In good signal conditions, this will enable downlink speeds in excess of 1Gbps. Fixed backhaul is facilitated by 10 Gigabit Ethernet.

- Ease of access to lattice and pole-type macrocells in suburban markets makes deployment of 5G simpler there. In contrast, the large number of rooftop sites in city centres will delay rollouts in the densest of environments.

- ComReg has clarified that transition delays in vacating incumbent users such as Imagine, Enet and permaNET out of the 3.6GHz band continue to limit access to spectrum in varying degrees of severity across some regions. In the short term, this may inhibit plans to leverage the full amount of contiguous spectrum assigned to each operator in 2017.

Conclusion: Not because it's easy, but because it is hard

An epiphany has infiltrated eir - to unsettle the settled, it first has to unsettle itself. The fruits of this are laid bare in GoMo, a groundbreaking new mobile brand destined to send a chill down the spine of competitors. But Xavier knows that competing solely on price is a game for losers, and that’s why there is a renewed strive to compete for performance supremacy too.

This is, unquestionably, a challenge of monumental proportions. GoMo spawns a new threat of cannibalisation and a race to the bottom, exhibiting potentially adverse impacts for eir, consumers and the wider telecoms industry in Ireland. That’s a terrifying prospect as the 5G journey commences and capital expenditure budgets ramp up.

Despite all the distortion of realities with 5G, it is, however, heralding a new and disruptive era for the mobile market in Ireland. And the radicalised eir wants to be in charge of that era.

This is, unquestionably, a challenge of monumental proportions. GoMo spawns a new threat of cannibalisation and a race to the bottom, exhibiting potentially adverse impacts for eir, consumers and the wider telecoms industry in Ireland. That’s a terrifying prospect as the 5G journey commences and capital expenditure budgets ramp up.

Despite all the distortion of realities with 5G, it is, however, heralding a new and disruptive era for the mobile market in Ireland. And the radicalised eir wants to be in charge of that era.

Your Technical Guide to WiFi Calling in IrelandTo turn the VoIP tide, operators must strive to maintain calling's best feature - simplicity.

|