The Race to 5G

SpecificationThe standalone 5G NR standard was finalised by 3GPP in 2018, paving the way towards the next generation of wireless networks.

|

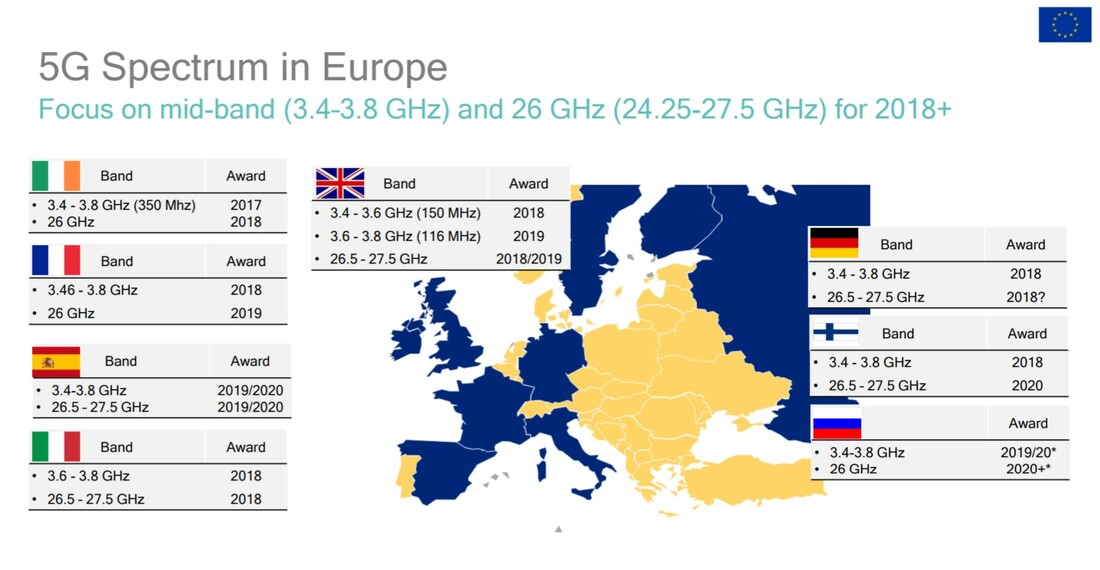

Spectrum DecisionsAcross the world, regulators are auctioning spectrum for 5G use in the sub-6GHz and mmWave range.

|

DeploymentMobile providers are preparing to splash on new infrastructure with the hope of enabling new revenue streams.

|

Ireland's Race to 5G NR

With 350MHz of spectrum in the 3.6GHz band alloacted and network vendors selected, Ireland's telecoms companies hold the necessary keys to unlock the world of 5G, and the imminent flurry of applications that will depend on it.

"5G will have an impact similar to the introduction of electricity or the car, affecting entire economies and benefiting entire societies."

-Steven Mollenkopf

Mapping Ireland and Europe's path to 5G.

Gigabit-Class Wireless networks represent an elusive, but achievable, connectivity goal.

Published 12/02/19

Putting aside the fact that it has become the most prolific buzzword of this era, 5G has a lot going for it, and needless to say, a lot riding on it. For mobile providers, this is an opportunity to reverse the erosion of revenues by offering new services to new consumers. The death of SMS, MMS and roaming charges has ignited fresh fears of indefinite stagnation in the telecoms industry, a result of decades-long complacency and over-regulation.

For consumers, the advent of 5G brings wireless speeds closer to those of fixed connections, expanding the number of locations in which advanced services can be enjoyed, and thereby sparking a renewed drive for innovation in the technology sector, an industry which is fundamentally dependent on telecoms companies to support their operation.

And then there are the crazy ones, or as Steve Jobs once referred to them as the ones who are crazy enough to think that they can change the world, are the ones who do. These are the visionaries that will utilise the potential of 5G to enforce a paradigm shift in the way we live, work and play. Historically, far-reaching revolutions have been triggered by the advancement of mobile networks.

With 2G, voice came to the masses through the medium of mobile phones. The growth of smartphones, as we know them today, was facilitated by the data capabilities of 3G, ground-breaking for its time. Arguably, however, 4G has been the most successful wireless generation to date, connecting communities across the globe with high-quality video calling, enabling the ascension of streaming services and making rapid connectivity to the cloud a reality. We can be certain that 5G will act as the fuel for another revolution in society, but for that to occur, we will need to seriously rethink the telecoms system as we know it today, from top to bottom.

For consumers, the advent of 5G brings wireless speeds closer to those of fixed connections, expanding the number of locations in which advanced services can be enjoyed, and thereby sparking a renewed drive for innovation in the technology sector, an industry which is fundamentally dependent on telecoms companies to support their operation.

And then there are the crazy ones, or as Steve Jobs once referred to them as the ones who are crazy enough to think that they can change the world, are the ones who do. These are the visionaries that will utilise the potential of 5G to enforce a paradigm shift in the way we live, work and play. Historically, far-reaching revolutions have been triggered by the advancement of mobile networks.

With 2G, voice came to the masses through the medium of mobile phones. The growth of smartphones, as we know them today, was facilitated by the data capabilities of 3G, ground-breaking for its time. Arguably, however, 4G has been the most successful wireless generation to date, connecting communities across the globe with high-quality video calling, enabling the ascension of streaming services and making rapid connectivity to the cloud a reality. We can be certain that 5G will act as the fuel for another revolution in society, but for that to occur, we will need to seriously rethink the telecoms system as we know it today, from top to bottom.

Where we stand with 4G, today

Ireland's spectrum position for 4G remains, unapologetically, horrendous. We have found ourselves fumbling to keep up with rocketing capacity demands and crippling congestion issues in urban areas, a direct consequence of the industry's failure to repurpose spectrum that is used for legacy services to mobile use.

Perhaps the most profound embarrassment to us on the global telecoms stage is the nature in which the 2100MHz band has been allocated by ComReg. The use licenses for this band restrict Irish mobile providers to using it for 3G services, with the lack of liberalisation ruling out the possibility of using it has as a mid-band addition to the current 4G spectrum portfolio.

Internationally, the 2100MHz band is used to beef up capacity in urban and suburban environments where existing network deployments fail to meet traffic demands. In particular, the band has been deployed within small cell and distributed antenna systems (DAS) to cater to a high density of customers using the RAN at the same time.

Most importantly, the introduction of 2100MHz in Ireland would permit the implementation of three carrier aggregation, a feature which has earned much praise for its ability to spread traffic across different bands in response to the position of customers inside the coverage footprint of multi-band macrosites. The benefits of carrier-aggregation are far-reaching, and allow customers to enjoy a vastly enhanced QoS, both at the cell edge and where signal quality is ample.

Just to remove any ambiguity or excuses that may be present, virtually every other country that allocates use licenses for the 2100MHz band does not impose limitations on the network technology which can use the spectrum, and certainly not in 2019. This is a ludicrous precedent in Ireland and one that has prevailed in the presence of a dysfunction regulatory regime, stifling investment and competition in the RAN market.

Perhaps the most profound embarrassment to us on the global telecoms stage is the nature in which the 2100MHz band has been allocated by ComReg. The use licenses for this band restrict Irish mobile providers to using it for 3G services, with the lack of liberalisation ruling out the possibility of using it has as a mid-band addition to the current 4G spectrum portfolio.

Internationally, the 2100MHz band is used to beef up capacity in urban and suburban environments where existing network deployments fail to meet traffic demands. In particular, the band has been deployed within small cell and distributed antenna systems (DAS) to cater to a high density of customers using the RAN at the same time.

Most importantly, the introduction of 2100MHz in Ireland would permit the implementation of three carrier aggregation, a feature which has earned much praise for its ability to spread traffic across different bands in response to the position of customers inside the coverage footprint of multi-band macrosites. The benefits of carrier-aggregation are far-reaching, and allow customers to enjoy a vastly enhanced QoS, both at the cell edge and where signal quality is ample.

Just to remove any ambiguity or excuses that may be present, virtually every other country that allocates use licenses for the 2100MHz band does not impose limitations on the network technology which can use the spectrum, and certainly not in 2019. This is a ludicrous precedent in Ireland and one that has prevailed in the presence of a dysfunction regulatory regime, stifling investment and competition in the RAN market.

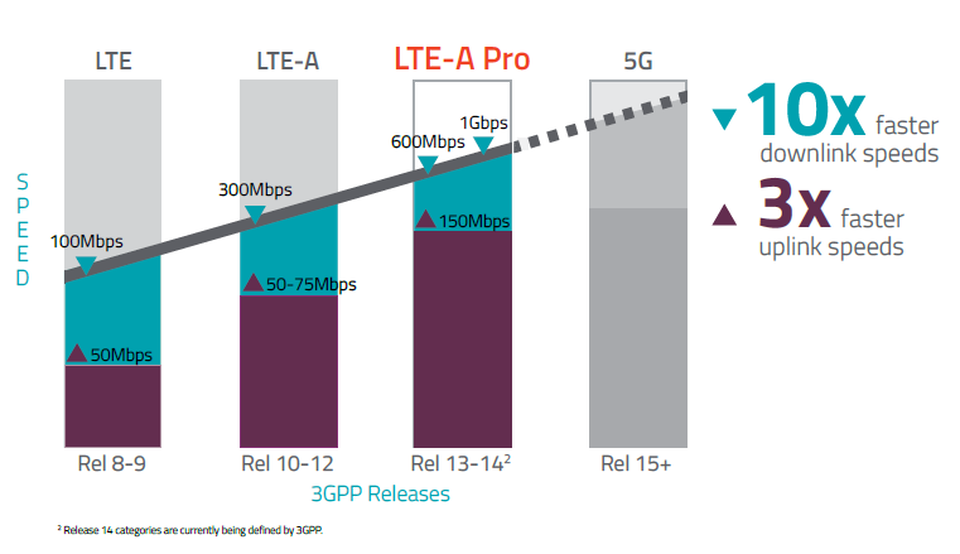

Currently, the dual-carrier aggregation deployments that are present in Ireland are a combination of the 800MHz and 1800MHz bands, with features such as 256QAM and high order MIMO being implemented to bridge the gap that will open between 4G and 5G networks. For example, Vodafone's network provides 30MHz of capacity when the 1800MHz (20MHz) band is paired with the 800MHz (10MHz) band, allowing for throughput of up to 300Mbps.

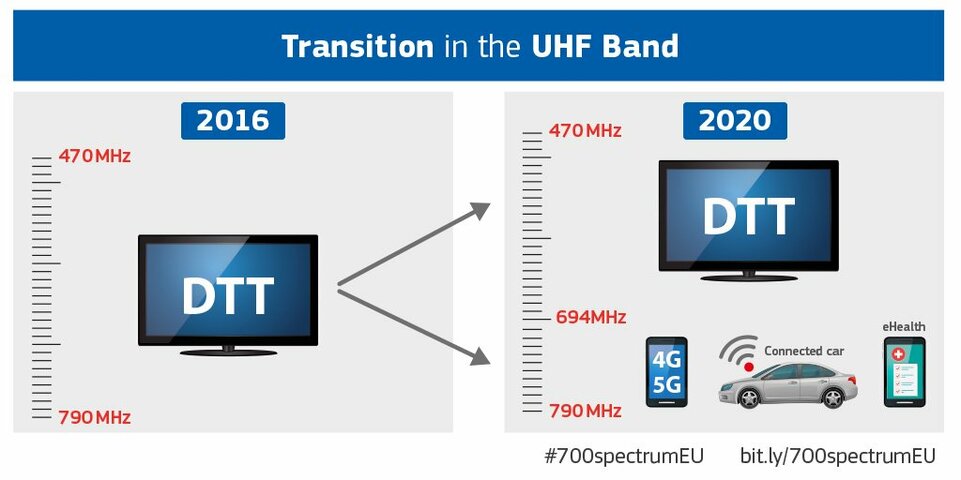

With the liberalisation of the 700MHz band for mobile imminent, we face a dilemma: use the spectrum as a low-band solution for early 5G NR deployments or add it to the existing 4G portfolio as a means to boost capacity and enhance coverage. Both of these strategies will play out across the world over the coming years, and it is important to understand that the allocation and use of spectrum in Ireland must be in harmony with that specified by the EU.

The latter approach is particularly attractive in the case of Ireland because, as explained, we still lack the availability of a third band for 4G services. As this is low-band spectrum, deploying it atop macrosites in rural areas would have the impact of radically improving signal quality where the cell edge exists today with 800MHz coverage footprints, essentially pushing the cell edge further away from macrosites.

With the liberalisation of the 700MHz band for mobile imminent, we face a dilemma: use the spectrum as a low-band solution for early 5G NR deployments or add it to the existing 4G portfolio as a means to boost capacity and enhance coverage. Both of these strategies will play out across the world over the coming years, and it is important to understand that the allocation and use of spectrum in Ireland must be in harmony with that specified by the EU.

The latter approach is particularly attractive in the case of Ireland because, as explained, we still lack the availability of a third band for 4G services. As this is low-band spectrum, deploying it atop macrosites in rural areas would have the impact of radically improving signal quality where the cell edge exists today with 800MHz coverage footprints, essentially pushing the cell edge further away from macrosites.

From a CapEx standpoint, rural deployment of the 700MHz band allows mobile providers to extend the number of areas which can be deemed commercially viable, a result that can only be attributed to the physics of low-frequency spectrum.

The same is true for deploying 700MHz 4G services in urban areas, where its superior penetration of buildings and underground structures mitigates the necessity for intensive network densification work, an incredibly expensive facet of modern mobile network deployments in densely populated urban areas. In addition to the coverage gains that would be incurred with 700MHz 4G proliferation, the potential for capacity improvement is also notable.

To put the capacity improvements into context for you, if Vodafone acquires a portion of the 700MHz band in an upcoming auction and aggregates it with existing 4G bands, the company should be able to provide speeds of up to 600Mbps on its network, provided 256QAM and MIMO is present.

The same is true for deploying 700MHz 4G services in urban areas, where its superior penetration of buildings and underground structures mitigates the necessity for intensive network densification work, an incredibly expensive facet of modern mobile network deployments in densely populated urban areas. In addition to the coverage gains that would be incurred with 700MHz 4G proliferation, the potential for capacity improvement is also notable.

To put the capacity improvements into context for you, if Vodafone acquires a portion of the 700MHz band in an upcoming auction and aggregates it with existing 4G bands, the company should be able to provide speeds of up to 600Mbps on its network, provided 256QAM and MIMO is present.

Looking to 3.6GHz, Mid-Band 5G NR

Spectrum such as that in the aforementioned 700MHz band and 3.6GHz is on course to become the go-to solution for early stage 5G NR deployments across the European Union and on the island of Ireland. Such deployments will put coverage availability as a priority, with intentions to provide pervasive high-capacity (compared to 4G networks today) wireless services an achievable outcome given the minimal uplift in CapEx that would be required.

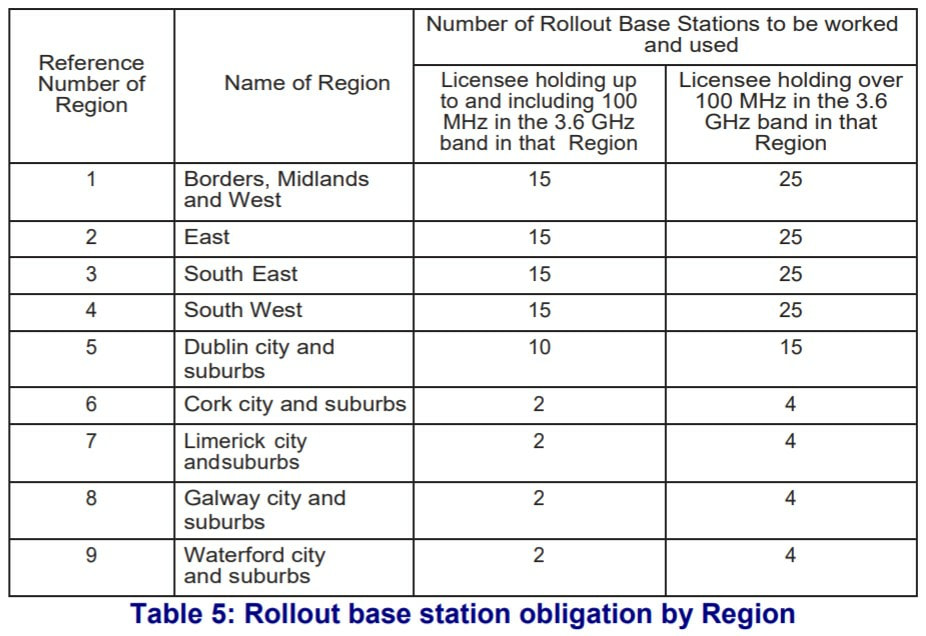

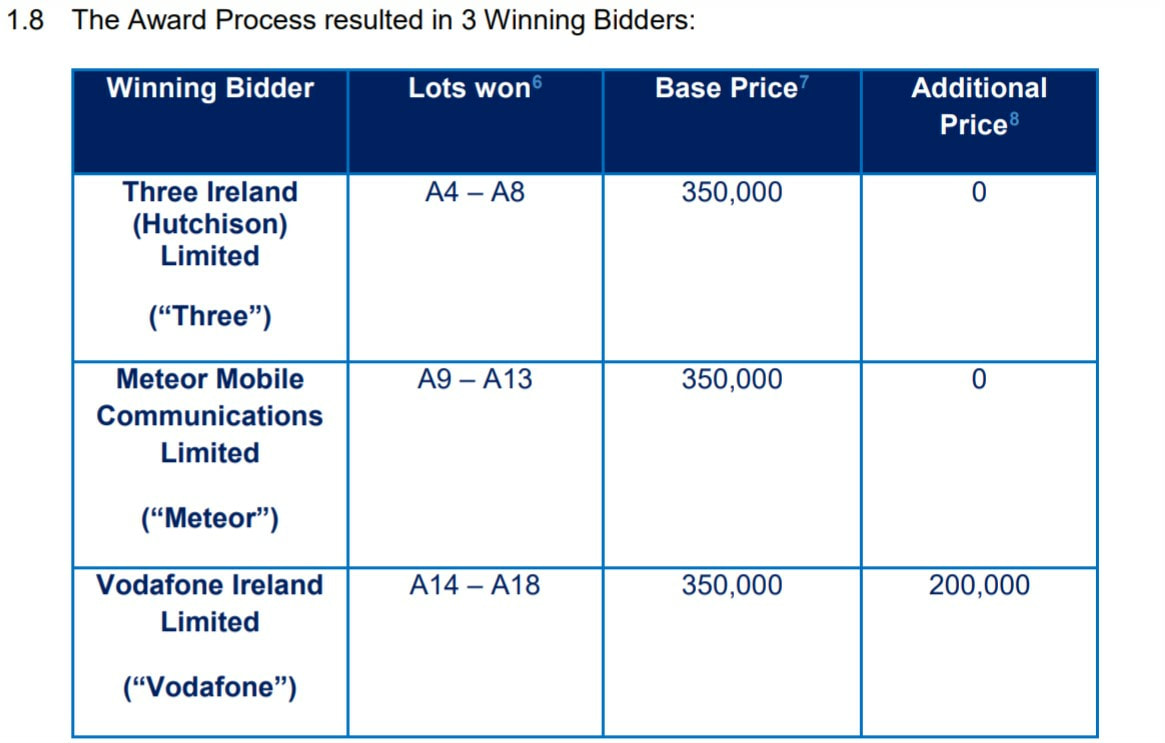

Looking at Ireland specifically, we can anticipate intensive deployment of the 3.6GHz band in urban, suburban and even many rural areas over the coming years by mobile and FWA providers. ComReg has released 350MHz of spectrum in the band across 594 lots over nine geographic regions (four rural and five urban).

Currently, there are over twenty thousand consumers in Ireland accessing broadband through the 3.6GHz band, with the majority of those being customers of Imagine, the largest wireless broadband provider on this island. Imagine has found success in provisioning FWA broadband to rural communities that once lay dark in a digital world which, at its most basic level, requires access to high-speed broadband.

Looking at Ireland specifically, we can anticipate intensive deployment of the 3.6GHz band in urban, suburban and even many rural areas over the coming years by mobile and FWA providers. ComReg has released 350MHz of spectrum in the band across 594 lots over nine geographic regions (four rural and five urban).

Currently, there are over twenty thousand consumers in Ireland accessing broadband through the 3.6GHz band, with the majority of those being customers of Imagine, the largest wireless broadband provider on this island. Imagine has found success in provisioning FWA broadband to rural communities that once lay dark in a digital world which, at its most basic level, requires access to high-speed broadband.

The transition to using the 3.6GHz band for mobile, in addition to FWA, is being made possible by the termination of services that use this spectrum today. ComReg has established a transition plan, in which Imagine has vacated 46 of its 241 transition areas, Lightnet 2 of its 3 transition service areas and Ripplecom 3 of its 4 transition service areas.

Vodafone has worked closely with Imagine to help it move services out of the 3.6GHz band, something that Big Red requires in order to allow it to begin trials of the spectrum in rural areas with Ericsson. For example, the company is set to deploy this band in Roscommon, Gorey, Clonmel and Dungarvan to cover over 20,000 homes with high-capacity FWA coverage capable of speeds up to 500Mbps.

In Dublin's Docklands, Vodafone flaunted its plans for the next generation of wireless networks by demonstrating "Ireland's first international holographic call" supported by spectrum in the 3.6GHz band. During this trial, the company recorded a throughput of 2Gbps, a possibility given the fact that its use license has now commenced in every block of the mid-band spectrum within the Dublin Region.

Looking back to Imagine, ComReg has confirmed that it has now vacated all of the spectrum in the 3680MHz – 3800MHz band, and its 3.6GHz license is live in all blocks within the South East, South, South West and Border, Midlands and West regions. In these peripheral regions, where population distribution is sparse, Imagine will continue to provide FWA services using 60MHz of 3.6GHz band.

Vodafone has worked closely with Imagine to help it move services out of the 3.6GHz band, something that Big Red requires in order to allow it to begin trials of the spectrum in rural areas with Ericsson. For example, the company is set to deploy this band in Roscommon, Gorey, Clonmel and Dungarvan to cover over 20,000 homes with high-capacity FWA coverage capable of speeds up to 500Mbps.

In Dublin's Docklands, Vodafone flaunted its plans for the next generation of wireless networks by demonstrating "Ireland's first international holographic call" supported by spectrum in the 3.6GHz band. During this trial, the company recorded a throughput of 2Gbps, a possibility given the fact that its use license has now commenced in every block of the mid-band spectrum within the Dublin Region.

Looking back to Imagine, ComReg has confirmed that it has now vacated all of the spectrum in the 3680MHz – 3800MHz band, and its 3.6GHz license is live in all blocks within the South East, South, South West and Border, Midlands and West regions. In these peripheral regions, where population distribution is sparse, Imagine will continue to provide FWA services using 60MHz of 3.6GHz band.

For Three, the necessity to move to the 3.6GHz band for 5G NR will be less urgent than it is for eir and Vodafone, both providers which have suffered from the enormous amount of spectrum that their competitor managed to amass following its merger with O2. The company has yet to deploy much of its spectrum portfolio, and the capacity of its carrier-aggregated 4G network remains the greatest on this island, with speeds in excess of 400Mbps possible.

However, Three's 5G strategy will entail greater planning than that of most other providers, given the multi-vendor composition of its network. Exacerbating this is the company's intentions to use Huawei as the sole vendor for its 5G core network and RAN, something that will undoubtedly spook those following the widespread security/smear campaign against the Chinese giant. Putting optics aside, Huawei's 5G NR gear is widely recognised as being years ahead of that offered by rivals such as Ericsson and Nokia, a benefit derived from its Massive MIMO prowess.

While details of Three's partnership with Huawei remain eerily nebulous, chatter suggests that the company also intends to replace 4G Samsung equipment deployed by the South Korean conglomerate over the past number of years with equipment supplied by Huawei. Documents released by ComReg in relation to the 26GHz auction show that equipment from Huawei makes up over 60% of Three's Point to Point microwave links, with the remainder being supplied by Ceragon.

This makes Three's network a messy mishmash of Nokia for 2G and 3G, Samsung for 4G and Huawei for 4G and 5G. As a consequence of this, the network hand-off experience will continue to fair worse with Three than that with Vodafone, who has thrived with its long-standing Ericsson partnership.

However, Three's 5G strategy will entail greater planning than that of most other providers, given the multi-vendor composition of its network. Exacerbating this is the company's intentions to use Huawei as the sole vendor for its 5G core network and RAN, something that will undoubtedly spook those following the widespread security/smear campaign against the Chinese giant. Putting optics aside, Huawei's 5G NR gear is widely recognised as being years ahead of that offered by rivals such as Ericsson and Nokia, a benefit derived from its Massive MIMO prowess.

While details of Three's partnership with Huawei remain eerily nebulous, chatter suggests that the company also intends to replace 4G Samsung equipment deployed by the South Korean conglomerate over the past number of years with equipment supplied by Huawei. Documents released by ComReg in relation to the 26GHz auction show that equipment from Huawei makes up over 60% of Three's Point to Point microwave links, with the remainder being supplied by Ceragon.

This makes Three's network a messy mishmash of Nokia for 2G and 3G, Samsung for 4G and Huawei for 4G and 5G. As a consequence of this, the network hand-off experience will continue to fair worse with Three than that with Vodafone, who has thrived with its long-standing Ericsson partnership.

Vodafone's 3.6GHz portfolio includes 105MHz in cities and their suburbs and 85MHz in other regions. While Three has claimed that its 3.6GHz allotment of 100MHz nationally puts them in the best position to deploy low-band 5G NR, when you cut through the waffling the reality is that the most successful network rollouts are a product of strategic network planning and design, not just the sheer amount of spectrum at disposal.

At Ireland's smallest mobile provider, the urgency to deploy pervasive 5G NR coverage is high, given the substandard network it finds itself operating today. Eir holds 85MHz of the 3.6GHz band in five cities and their suburbs, with rural counties being covered with 80MHz. Again, while many would view eir's spectrum portfolio as inferior to that of its competitors, other factors such as backhaul (an area in which the company can excel) and the density/distribution of subscribers play an equally important role to influence the performance of networks. Moreover, eir's partnership with Huawei for its 4G/5G RAN, and selection of Ericsson for the core network puts them in a capable position to fulfil network deployment goals, which include extending 4G coverage to 99% of the Irish population within two years.

At Ireland's smallest mobile provider, the urgency to deploy pervasive 5G NR coverage is high, given the substandard network it finds itself operating today. Eir holds 85MHz of the 3.6GHz band in five cities and their suburbs, with rural counties being covered with 80MHz. Again, while many would view eir's spectrum portfolio as inferior to that of its competitors, other factors such as backhaul (an area in which the company can excel) and the density/distribution of subscribers play an equally important role to influence the performance of networks. Moreover, eir's partnership with Huawei for its 4G/5G RAN, and selection of Ericsson for the core network puts them in a capable position to fulfil network deployment goals, which include extending 4G coverage to 99% of the Irish population within two years.

High-Bands welcome Gigabit-Class Wireless

If we intend to establish gigabit-class wireless networks that stand up to their title, delivering world-class connectivity from off-peak to peak traffics hours and managing to withstand sudden surges in traffic, utilisation of high-band spectrum is critical.

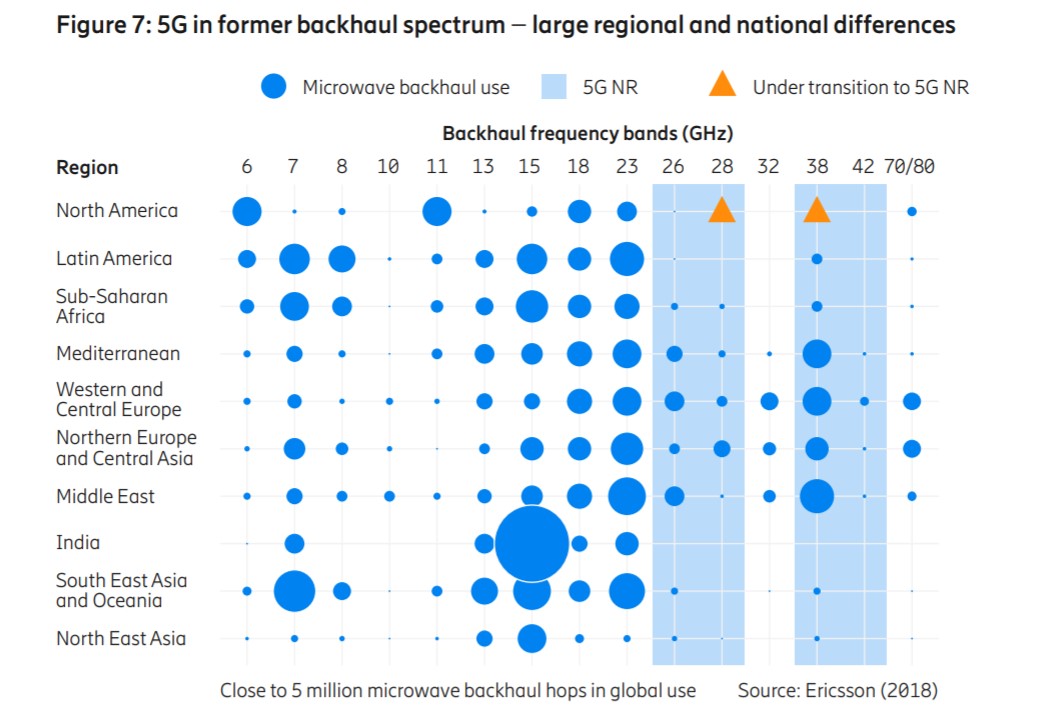

The pioneering spectrum for high-band or mmWave 5G NR in Europe is 26GHz, which also happens to be used as a method of microwave backhaul from radio sites in areas where fixed infrastructure is lacking. Here, the licenses for this band remain restricted to use for Point to Point links, with the regulator explaining that over 3,000 hops utilise it. For some interesting insight, data from Ericsson reveals that Ireland is one of the countries with the highest number of microwave links in the 26GHz band anywhere on the continent of Europe.

Sighting documents released by ComReg, Vodafone operates over 1,000 microwave links in the 26GHz band, with Three accounting for the vast majority of the remaining 2,000. Notably, eir's network is significantly less dependent on this band than its competitors, something that is likely linked to the scale of its fibre network.

The pioneering spectrum for high-band or mmWave 5G NR in Europe is 26GHz, which also happens to be used as a method of microwave backhaul from radio sites in areas where fixed infrastructure is lacking. Here, the licenses for this band remain restricted to use for Point to Point links, with the regulator explaining that over 3,000 hops utilise it. For some interesting insight, data from Ericsson reveals that Ireland is one of the countries with the highest number of microwave links in the 26GHz band anywhere on the continent of Europe.

Sighting documents released by ComReg, Vodafone operates over 1,000 microwave links in the 26GHz band, with Three accounting for the vast majority of the remaining 2,000. Notably, eir's network is significantly less dependent on this band than its competitors, something that is likely linked to the scale of its fibre network.

In June of last year, ComReg allocated a further 840MHz within the 26GHz band (15 of 19 Lots of 2 × 28 MHz in the range 24.745 – 25.277 GHz paired with 25.753 GHz – 26.285). This release, which represented a 25% increase in the overall capacity of the band, leaves little wiggle-room for a quick transition to 5G NR access use in Ireland, something that mobile providers including Three and Vodafone brought to the attention of the regulator during the consultation period preceding the auction.

The issue, though, as you probably can probably extract from the data mentioned, is that the intensive use of this band means we will need to undergo a massive spectrum repurposing process in a very short space of time if liberalisation opens up the path to access use. From a rural perspective, a hasty transition is not viable, and the criticality of microwave as the most prolific backhaul type in Ireland must be understood.

We do have other options at our disposal, thankfully, and those primarily concern the release of further spectrum in the mmWave bands, solely for microwave use. Nonetheless, there is a very lucid message that I want to convey on the matter of backhaul for 5G services: if we do not support initiatives which set out to increase the availability of high-speed broadband in Ireland, and by that measure, the deployment of future-proof fixed fibre networks, the next generation of wireless standards will have no backbone.

The issue, though, as you probably can probably extract from the data mentioned, is that the intensive use of this band means we will need to undergo a massive spectrum repurposing process in a very short space of time if liberalisation opens up the path to access use. From a rural perspective, a hasty transition is not viable, and the criticality of microwave as the most prolific backhaul type in Ireland must be understood.

We do have other options at our disposal, thankfully, and those primarily concern the release of further spectrum in the mmWave bands, solely for microwave use. Nonetheless, there is a very lucid message that I want to convey on the matter of backhaul for 5G services: if we do not support initiatives which set out to increase the availability of high-speed broadband in Ireland, and by that measure, the deployment of future-proof fixed fibre networks, the next generation of wireless standards will have no backbone.

Leaving the doom and gloom behind, I should stress that the locations in which the 26GHz band will be deployed most extensively for access use also happen to be the locations in which use of the band for backhaul is lowest due to the availability of superior, low-cost dark fibres MANs operated by companies such as eNet in urban and suburban regions.

The beauty of 5G NR is the vast widening in the breadth of how much spectrum can be targeted for commercial utilisation. Diversity is important to address different use cases, and Europe is pursuing this vision by preparing to introduce further spectrum in high-bands, such as 42GHz (40.5–43.5GHz), and at a later time, 66–71GHz. In particular, the 42GHz band is attractive because of its excellent capacity and due to the fact that the 38GHz band is heavily utilised for microwave backhaul on this continent.

Regardless of specific bands, the complexity of mmWave deployments will be unprecedented, falling upon numerous parties involved in the connectivity experience, from mobile providers to smartphone manufactures. With signal attenuation becoming a major stumbling block for consistent coverage, devices will need to incorporate multiple antennas that use techniques such as beamforming to maintain the strongest possible link with small cells, the defacto cell deployment strategy for spectrum with wavelengths measured in millimetres. As such, these challenges will likely push high-band 5G NR to be perceived as a second-stage solution, rather than acting as the logical building block atop existing 4G networks.

The beauty of 5G NR is the vast widening in the breadth of how much spectrum can be targeted for commercial utilisation. Diversity is important to address different use cases, and Europe is pursuing this vision by preparing to introduce further spectrum in high-bands, such as 42GHz (40.5–43.5GHz), and at a later time, 66–71GHz. In particular, the 42GHz band is attractive because of its excellent capacity and due to the fact that the 38GHz band is heavily utilised for microwave backhaul on this continent.

Regardless of specific bands, the complexity of mmWave deployments will be unprecedented, falling upon numerous parties involved in the connectivity experience, from mobile providers to smartphone manufactures. With signal attenuation becoming a major stumbling block for consistent coverage, devices will need to incorporate multiple antennas that use techniques such as beamforming to maintain the strongest possible link with small cells, the defacto cell deployment strategy for spectrum with wavelengths measured in millimetres. As such, these challenges will likely push high-band 5G NR to be perceived as a second-stage solution, rather than acting as the logical building block atop existing 4G networks.

A Backhaul Revolution Awaits

I've alluded to the different forms of backhaul throughout this article, from detailing the changes occurring in microwave technology to explaining the challenges of FTTA. While this topic often falls under the radar, we need to understand that without future-proof and resilient backhaul solutions, our wireless networks are nothing. Quite literally, backhaul is the lifeblood of access networks.

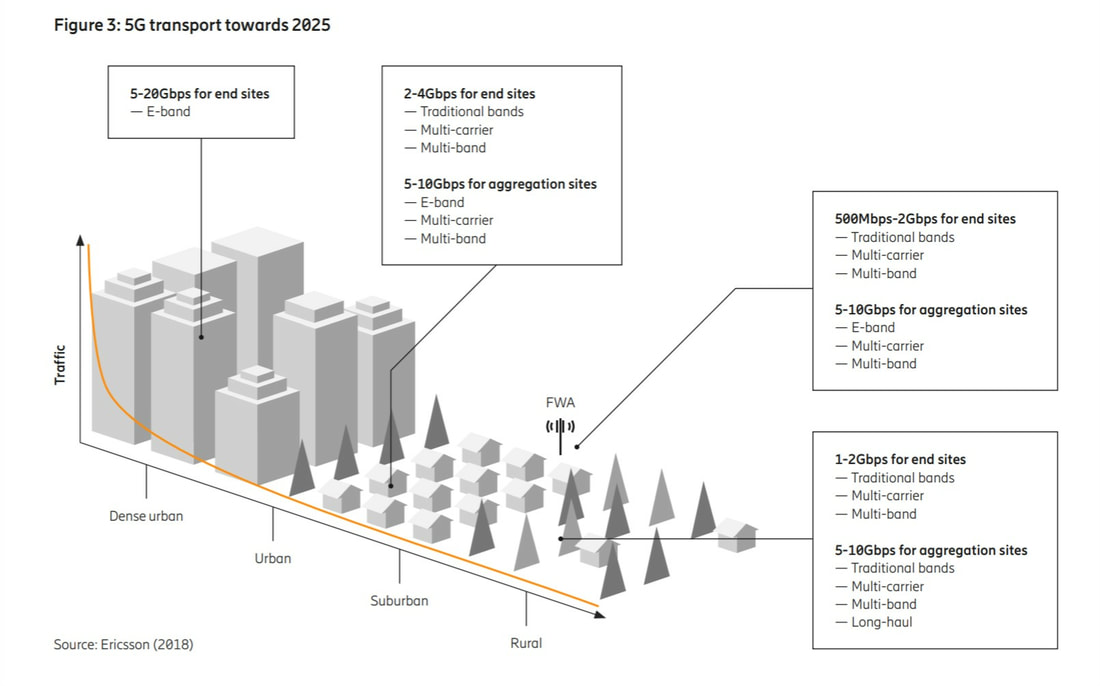

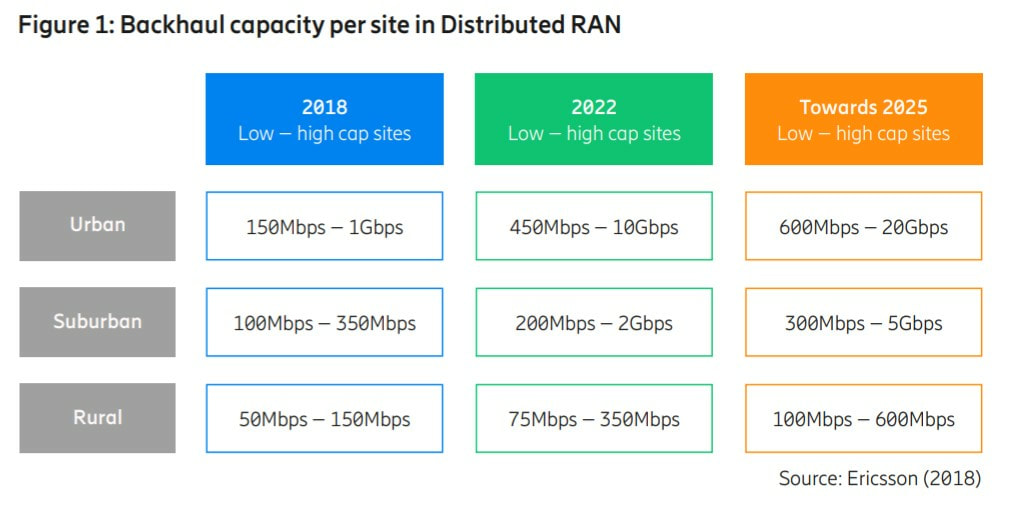

For microwave backhaul, frequencies above 6GHz will be required to support 5G NR networks which require a high level of capacity in order to deliver on their many promises, such as consistent, ultra-high throughput and extremely low latency. Unsurprisingly, a major revolution is on the cusp of occurring in the microwave industry, with the 32GHz and E-Band poised to become the preferred spectrum choices for next-generation transport networks.

To support the repurposing of the 26GHz band for 5G NR, something that Vodafone estimates would take four years in a report it submitted to ComReg, mobile and FWA providers will need to shift microwave links to spectrum that can guarantee long-term usability. On this island, and further afield, the 32GHz band will likely act as the replacement for spectrum in the 26 and 28GHz bands that will be needed for access use. The spectrum is being positioned as a band dedicated to microwave use because it is less suitable for 5G NR access services and offers enhanced capacity over most of today's wireless links without reducing the potential link distance by a significant amount. To put these words into numbers, throughput of up to 4Gbps and an availibility of 99.99% is achieavle with the 32GHz band.

For microwave backhaul, frequencies above 6GHz will be required to support 5G NR networks which require a high level of capacity in order to deliver on their many promises, such as consistent, ultra-high throughput and extremely low latency. Unsurprisingly, a major revolution is on the cusp of occurring in the microwave industry, with the 32GHz and E-Band poised to become the preferred spectrum choices for next-generation transport networks.

To support the repurposing of the 26GHz band for 5G NR, something that Vodafone estimates would take four years in a report it submitted to ComReg, mobile and FWA providers will need to shift microwave links to spectrum that can guarantee long-term usability. On this island, and further afield, the 32GHz band will likely act as the replacement for spectrum in the 26 and 28GHz bands that will be needed for access use. The spectrum is being positioned as a band dedicated to microwave use because it is less suitable for 5G NR access services and offers enhanced capacity over most of today's wireless links without reducing the potential link distance by a significant amount. To put these words into numbers, throughput of up to 4Gbps and an availibility of 99.99% is achieavle with the 32GHz band.

Investigating spur network deployments, a type traditionally found in rural areas, the 32GHz band will play the pivotal role of linking macrosites which provide coverage to large swathes of sparsely populated lands served by low-band access spectrum such as 700MHz. Demand for capacity is less intense in these regions, allowing for the implementation of long-distance microwave links, with bands as low as 6–13GHz being applicable in cases where fixed networks are non-existent. These low-band microwave solutions offer throughput of up to 2Gbps with an availability of 99.999% at link distances beyond 10km.

Perhaps the most intriguing demonstration of how far we've come connectivity-wise is the E-Band, the most capable microwave spectrum to date, and the one that supports our collective vision to create a Gigabit Society in Ireland. Standalone, the E-Band (71–76GHz paired with 81–86GHz) reaches the 10Gbps threshold that wireless backhaul solutions have failed to achieve in the past.

This band offers mobile providers something that they have been craving for decades: fibre-like capacity in the form of electromagnetic waves zooming through the atmosphere between point to point links. Those links, by the way, will be confined to urban and suburban centres due to the restrictive hop distances of up to 3km.

Perhaps the most intriguing demonstration of how far we've come connectivity-wise is the E-Band, the most capable microwave spectrum to date, and the one that supports our collective vision to create a Gigabit Society in Ireland. Standalone, the E-Band (71–76GHz paired with 81–86GHz) reaches the 10Gbps threshold that wireless backhaul solutions have failed to achieve in the past.

This band offers mobile providers something that they have been craving for decades: fibre-like capacity in the form of electromagnetic waves zooming through the atmosphere between point to point links. Those links, by the way, will be confined to urban and suburban centres due to the restrictive hop distances of up to 3km.

However, combining the E-Band with mid-band spectrum (15–23GHz) that is already used for microwave backhaul in a technique known as radio link bonding provides substantial advantages: a boost in capacity to 11Gbps and an increase in the potential hop distances to 5km. This is the spectrum that will enable mmWave 5G NR access networks to flourish.

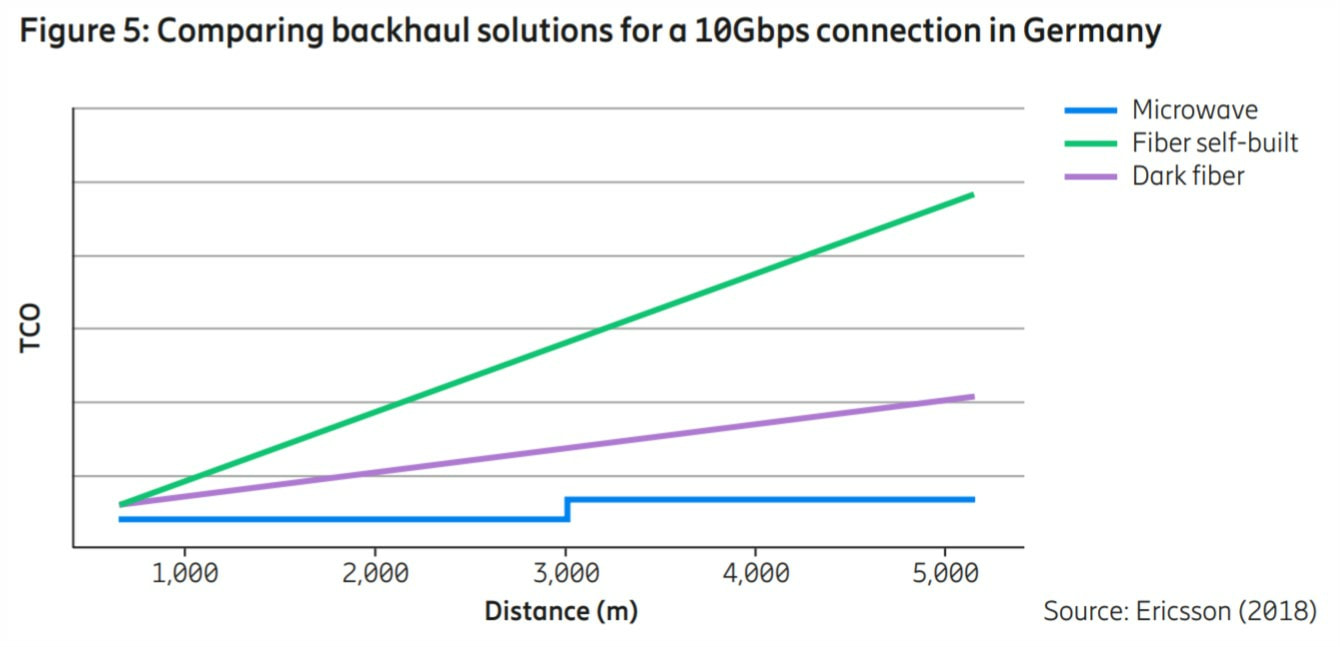

As the TCO of microwave backhaul is lower than that of fibre, wireless solutions will continue to win out in cost sensitive and rural regions, preempting us to continue pushing for innovation in the space. On that front, we can expect to witness further deployment of multi-carrier backhaul links which aggregate at least two bands to increase peak capacity and to enhance availability. The specifications of the W-band (92–115GHz) and D-band (130–175GHz) have been finalised in Europe, and this is spectrum that will be dedicated for future microwave deployments exceeding peak capacity of 100Gbps, wirelessly.

As the TCO of microwave backhaul is lower than that of fibre, wireless solutions will continue to win out in cost sensitive and rural regions, preempting us to continue pushing for innovation in the space. On that front, we can expect to witness further deployment of multi-carrier backhaul links which aggregate at least two bands to increase peak capacity and to enhance availability. The specifications of the W-band (92–115GHz) and D-band (130–175GHz) have been finalised in Europe, and this is spectrum that will be dedicated for future microwave deployments exceeding peak capacity of 100Gbps, wirelessly.

Talking about backhaul without referring to fibre would be ridiculous, because this is, unequivocally, the future of transport networks. No microwave spectrum can match the sheer peak capacity, reliability and rock-bottom response times that fibre boasts, today, tomorrow and the next day. Lucky for us, the rapid growth in penetration of fibre across Ireland, and most notably, in the realm of access networks, coincides with the ever-evolving requirements of 5G NR.

As wholesale providers such as Aurora Telecom, BT, eNet, open eir and SIRO ramp up the pace of fibre deployment on this island, it gives mobile operators greater head-room and versatility with 5G NR, alleviating pressure on spectrum assets that would be tied in the event of high microwave usage. In particular, fibre will solidify its position as the dominant backhaul solution for core and intercity transport networks, delivering future-proof and scalable connectivity to mobile providers.

Studies conducted by companies such as Ericsson paint an auspicious picture of FTTA, fuelled by the trend of diving deployment and operational costs. In fact, the TCO associated with dark fibre offerings has fallen to such an extent that it is now on par with microwave links which utilise high-bands for backhaul in many regions. Self-built fibre, however, will continue to be a major sting to the wallet in terms of CapEx, rendering it wholly unsuitable for deployment in rural counties along the western seaboard.

Ultra-high frequency 5G NR access deployments incorporating mmWave spectrum and dense networks of small cells will require fibre backhaul to virtually every node because microwave is just not feasible in the presence of interference. As such, there will be a need for an unprecedented level of collaboration between mobile providers and their fibre backhaul partners in the design and deployment process of next-generation wireless networks.

As wholesale providers such as Aurora Telecom, BT, eNet, open eir and SIRO ramp up the pace of fibre deployment on this island, it gives mobile operators greater head-room and versatility with 5G NR, alleviating pressure on spectrum assets that would be tied in the event of high microwave usage. In particular, fibre will solidify its position as the dominant backhaul solution for core and intercity transport networks, delivering future-proof and scalable connectivity to mobile providers.

Studies conducted by companies such as Ericsson paint an auspicious picture of FTTA, fuelled by the trend of diving deployment and operational costs. In fact, the TCO associated with dark fibre offerings has fallen to such an extent that it is now on par with microwave links which utilise high-bands for backhaul in many regions. Self-built fibre, however, will continue to be a major sting to the wallet in terms of CapEx, rendering it wholly unsuitable for deployment in rural counties along the western seaboard.

Ultra-high frequency 5G NR access deployments incorporating mmWave spectrum and dense networks of small cells will require fibre backhaul to virtually every node because microwave is just not feasible in the presence of interference. As such, there will be a need for an unprecedented level of collaboration between mobile providers and their fibre backhaul partners in the design and deployment process of next-generation wireless networks.

Striking Gold with Shared and Unlicensed Spectrum

Leveraging spectrum in unlicensed bands, combined with implementing shared spectrum strategies, allows us to radically redefine our approach to access networks, and adding to that, reach extraordinary levels of spectral efficiency with 5G NR. The unlicensed bands are of deep interest because they liberate access to spectrum, allowing anyone or any company to deploy their own private network, scaling back the overarching power which mobile providers wield over markets today.

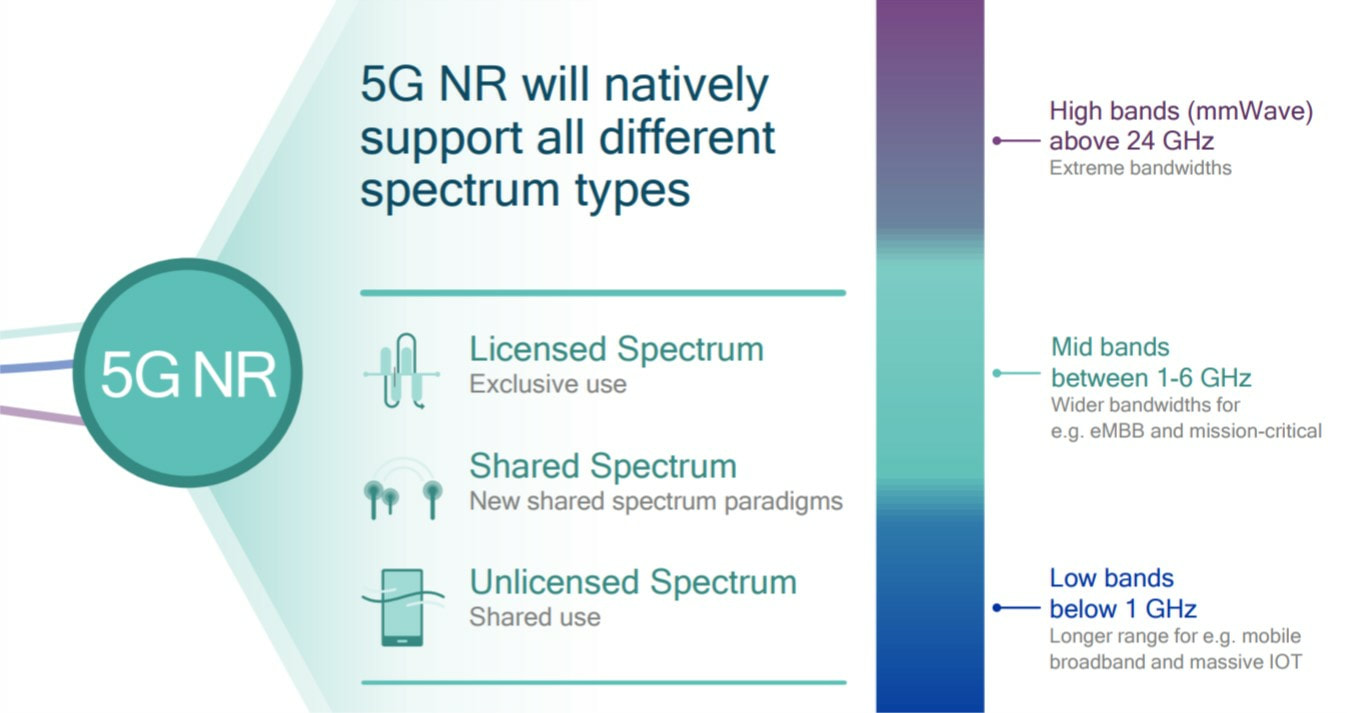

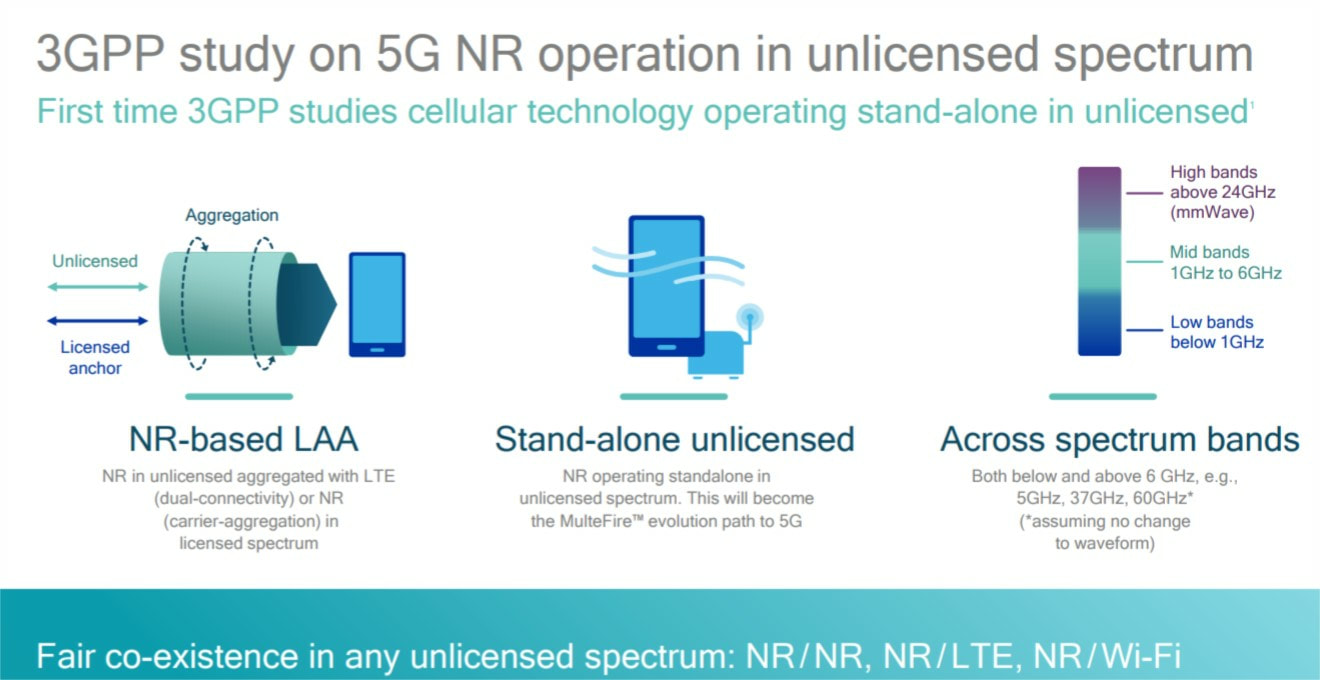

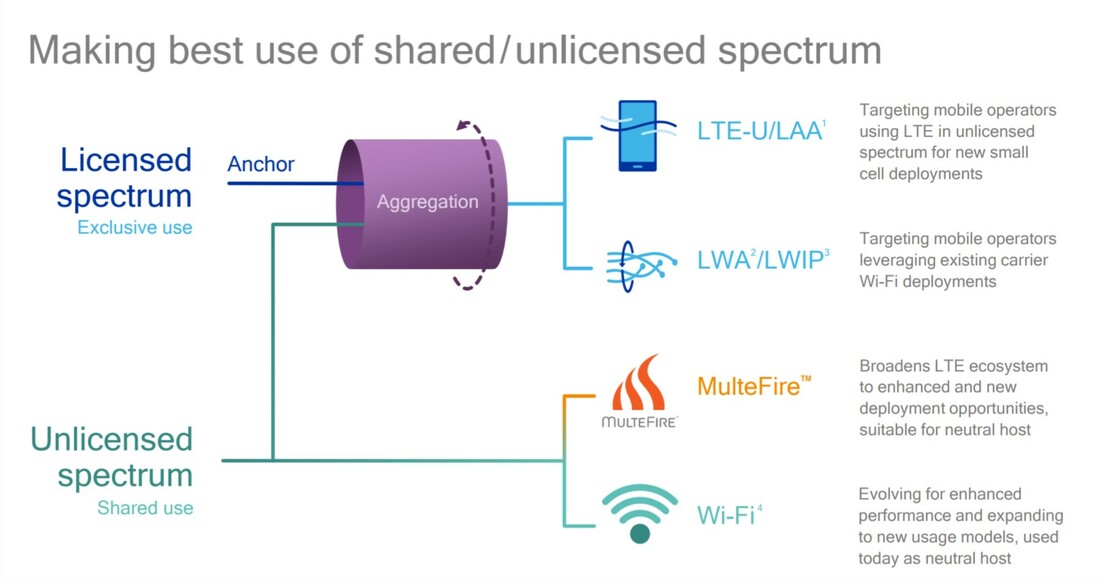

Intrinsically, 5G NR was designed by 3GPP to support virtually every spectrum type spanning dozens of diverse bands. As we've come to understand with deployments of 4G U/LAA in recent years, strategies which categorically reduce dependence on licensed spectrum have the potential to increase the number of areas in which gigabit-class wireless networks are available.

In Europe and Ireland, unlicensed spectrum in the 2.4GHz, 5-7GHz and 57-71GHz bands will form a significant aspect of 5G NR-LAA and standalone 5G NR-U. The first approach, Licensed Assisted Access, aggregates spectrum in licensed bands with that in unlicensed bands to improve availability and capacity. The licensed band assumes the role of backbone spectrum, ensuring a high level of reliability, with the unlicensed band acting as another layer enhancing the backbone.

Intrinsically, 5G NR was designed by 3GPP to support virtually every spectrum type spanning dozens of diverse bands. As we've come to understand with deployments of 4G U/LAA in recent years, strategies which categorically reduce dependence on licensed spectrum have the potential to increase the number of areas in which gigabit-class wireless networks are available.

In Europe and Ireland, unlicensed spectrum in the 2.4GHz, 5-7GHz and 57-71GHz bands will form a significant aspect of 5G NR-LAA and standalone 5G NR-U. The first approach, Licensed Assisted Access, aggregates spectrum in licensed bands with that in unlicensed bands to improve availability and capacity. The licensed band assumes the role of backbone spectrum, ensuring a high level of reliability, with the unlicensed band acting as another layer enhancing the backbone.

With standalone 5G NR-U, it brings forth a new paradigm for mobile access networks, eradicating the utilisation of licensed spectrum. This is the case with WiFi at present, one of the most successful technologies in history. Access to licensed spectrum in dense urban areas may be limited or even non-existent, and so, exploiting unlicensed bands offers mobile providers a new, more cost-effective way to serve customers.

Spectrum sharing, an opportunity to enable new applications such as private 5G NR networks custom-built to support mission-critical Industrial-IoT, is an incredibly exciting development that will kick start an epidemic of wireless innovation over the coming years. With the sharing of spectrum assets imminent, the power of wireless connectivity will be put in the hands of companies, small and large.

Spectrum sharing, an opportunity to enable new applications such as private 5G NR networks custom-built to support mission-critical Industrial-IoT, is an incredibly exciting development that will kick start an epidemic of wireless innovation over the coming years. With the sharing of spectrum assets imminent, the power of wireless connectivity will be put in the hands of companies, small and large.

Private 5G NR-SS will be particularly attractive to large enterprises who seek to take advantage of automation and IoT, bringing their connectivity in-house as a result. For these scenarios and others such as local broadband with neutral hosts, spectrum sharing increases utilisation of assets held by incumbent providers, levelling the playing field and acting as a catalyst for greater competition in wireless markets.

Aggregation of 4G LTE and WiFi networks (LWA) is a feature that has been used to split data flows in such a way that channels of both LTE and WiFi are leveraged simultaneously to lessen strain on the RAN, bolster capacity, and provide a higher QoS. A similar technique to this will find its way to 5G NR and WiFi 6, and it is distinctive in the fact that hardware-level changes are not required for execution, both in the form of mobile devices and network equipment. This highlights an important point that I want to make clear: 5G NR and further advancements in cellular-based protocols will only serve to elevate our usage of WiFi, not replace it.

Aggregation of 4G LTE and WiFi networks (LWA) is a feature that has been used to split data flows in such a way that channels of both LTE and WiFi are leveraged simultaneously to lessen strain on the RAN, bolster capacity, and provide a higher QoS. A similar technique to this will find its way to 5G NR and WiFi 6, and it is distinctive in the fact that hardware-level changes are not required for execution, both in the form of mobile devices and network equipment. This highlights an important point that I want to make clear: 5G NR and further advancements in cellular-based protocols will only serve to elevate our usage of WiFi, not replace it.

A Continent of Connectivity

The impending socio-economic impact of 5G and the ecosystem of services spawning in its wake will be tremendous, just as it was for 2G, 3G and 4G. Maintaining a unique ability to transcend regional differences, wireless standards set by 3GPP represent a global effort to create continents of connectivity, and as a consequence, bring the human race closer together by empowering breakthroughs in technology.

Unlike its predecessors, which were confined to slivers of spectrum within low-frequency bands, 5G introduces a new level of diversity in the realms of spectrum allocation and implementation. With intrinsic support for transformative features such as spectrum sharing, and the ability to harness the liberty of unlicensed bands, the next generation of wireless networks will create a fairer competition ground for mobile providers.

Culminating these characteristics is the exponential expansion of use cases that 5G permits in the presence of gigabit access capacity, ultra-low latency and extreme reliability. From supporting technologies that are unknown to us today, to aiding the expansion of the cloud, 5G is and will be more than a buzzword: it will be a new, revolutionary means of wireless connectivity.

Unlike its predecessors, which were confined to slivers of spectrum within low-frequency bands, 5G introduces a new level of diversity in the realms of spectrum allocation and implementation. With intrinsic support for transformative features such as spectrum sharing, and the ability to harness the liberty of unlicensed bands, the next generation of wireless networks will create a fairer competition ground for mobile providers.

Culminating these characteristics is the exponential expansion of use cases that 5G permits in the presence of gigabit access capacity, ultra-low latency and extreme reliability. From supporting technologies that are unknown to us today, to aiding the expansion of the cloud, 5G is and will be more than a buzzword: it will be a new, revolutionary means of wireless connectivity.

5G and the Digital Divide Haunting IrelandThe stark reality is that 5G will exacerbate connectivity disparity, not reverse it.

|