Why ComReg is Vital for a Successful Telecoms Industry in Ireland

Slapping hefty fines on those who cheat, publishing quarterly market results and allocating extremely valuable spectrum: a peek into the importance of ComReg in Ireland.

Published 03/09/18

There are few organisations that I can think of which put the interests of consumers at the forefront of everything they do. ComReg stands out as one such organisation, an organisation that has ensured Irish consumers can access quality broadband and mobile at a reasonable price.

ComReg, or the Commission for Communications Regulation in Ireland, is the telecoms watchdog in this country. The regulator's fundamental task is simple, to maintain a competitive and fair telecoms market in Ireland. But, while the task may seem pretty basic, enforcing it is far from easy.

To fulfil its role as the telecoms watchdog, ComReg has had to flex its muscles over the years, demonstrating the fact that it won't bow down to huge corporations with massive wallets. This flexing of muscles includes imposing mammoth fines on companies whose actions are to the detriment of consumers, providing support to Irish consumers that experience an issue with their service and fairly allocating radio spectrum to ensure a healthy level of competition and innovation.

Over the years, ComReg has slapped hefty fines on virtually all of our telecoms companies: eir, Vodafone, Three and Virgin Media. As well as this, ComReg has played a crucial role in providing information for consumers about pricing, a quarterly report on the state of the Irish telecoms market, overseen and criticised telecoms mergers, and regulated our airwaves.

ComReg, or the Commission for Communications Regulation in Ireland, is the telecoms watchdog in this country. The regulator's fundamental task is simple, to maintain a competitive and fair telecoms market in Ireland. But, while the task may seem pretty basic, enforcing it is far from easy.

To fulfil its role as the telecoms watchdog, ComReg has had to flex its muscles over the years, demonstrating the fact that it won't bow down to huge corporations with massive wallets. This flexing of muscles includes imposing mammoth fines on companies whose actions are to the detriment of consumers, providing support to Irish consumers that experience an issue with their service and fairly allocating radio spectrum to ensure a healthy level of competition and innovation.

Over the years, ComReg has slapped hefty fines on virtually all of our telecoms companies: eir, Vodafone, Three and Virgin Media. As well as this, ComReg has played a crucial role in providing information for consumers about pricing, a quarterly report on the state of the Irish telecoms market, overseen and criticised telecoms mergers, and regulated our airwaves.

The Effects of ComReg's Presence in Mobile

I mean this in the most sincere sense, our telecoms industry has been shaped by ComReg's presence. The fruits of the watchdog's work are obvious. Ireland is regularly reported as having some of the least expensive mobile plans on the continent of Europe. Believe me, that did not happen by accident. It is a direct result of a series of decisions and actions made by ComReg to protect competition in the telecoms market. We are all aware of the fact that healthy competition leads to more innovation and better prices for consumers.

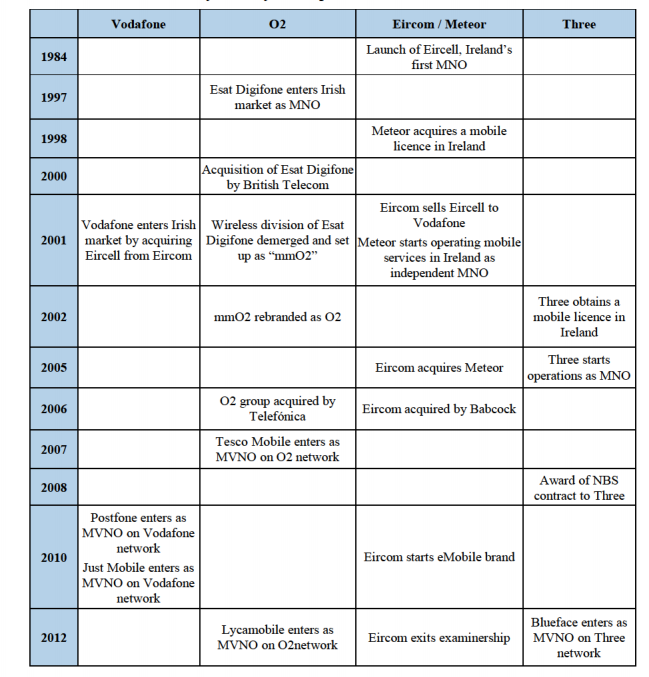

Ireland enjoys a choice of three mobile providers, down from four since 2015 following Three's merger with Telefónica's O2. Before the aforementioned merger occurred, Ireland was one of the most lucrative markets for a mobile network to operate in the world. Seeing this, ComReg stepped in and made efforts to boost competition. The watchdog alleged that Vodafone and O2, the two largest operators in Ireland at the time, "tactically colluded" with one another to "keep competitors out and maintain high prices for their services". Of course, Vodafone and O2 would strongly deny these claims, but the fact that prices for mobile in Ireland were amongst the highest in the developed world was and is a clear indication that the system was not working, something was seriously wrong.

The state of our mobile market was so poor at one point that Vodafone's Average Revenue per User (APRU) figures reached an eye-watering €50.20 every month. In 2018, much to the benefit of consumers, the industry average of APRU had fallen well below €25 monthly. ComReg played a key role in paving a way towards a more competitive market. The watchdog made efforts to end this collusion, which was working wonders for Vodafone's and O2's wallets, by implementing price fixing. This method sets specific prices for services, beyond the control of a mobile network. In this way, the duopoly (Vodafone and O2) could no longer raise or maintain prices based on their own desires. As CK Hutchinson's Three and Meteor (which eir purchased from Western Wireless in 2005) grew, prices began to fall as competition increased.

Three was found by ComReg to be over-reporting its customer base, deceitfully stating it had thousands of more customers than it actually had, leading to a fine from the regulator. More recently, the company was dealt with a record-breaking fine exceeding €500,000 for enforcing contract changes without providing adequate methods for customers to leave. Three's customers were given a once in a lifetime opportunity to abandon the company and forgo the need to pay any remaining contract charges due to a change in terms. However, ComReg discovered that the number provided by Three to contact in the event that you wished to cancel your service didn't work. It is clear that Three predicted thousands of customers would wish to leave and therefore made a substantial effort to prevent it from happening.

In more recent times, ComReg has prosecuted Vodafone, eir and Tesco Mobile for overcharging customers. This is a perfect example of the importance of ComReg, it gives consumer's a voice. As a matter of fact, these issues shouldn't arise in the first place, these companies claim that caring for their customers is a top priority. But, you don't need to be stupid to understand the fact that when there is the choice of earning more profit (whether that means employing aggressive strategies) or looking after the customer, our mobile providers will almost always pursue the first option.

ComReg is in the process of developing an interactive map which will compare network coverage offered by Three, Vodafone and eir. This map, which will be available by the end of this year, will finally create a simple method for consumers to see which network performs best in their own area. As well as this, ComReg recently began to permit the use of signal boosters in areas near the cell edge where the signal available isn't able to facilitate calls, texts or data. The watchdog publishes surveys which it conducts based on the mobile market. These surveys include analysing network performance in drive tests, providing information about the smartphones which manage to achieve the best SINR (the signal-to-interference-plus-noise ratio) and providing an interactive map called "SiteViewer" to locate the precise location of base stations in Ireland.

Finally, I want to touch upon the controversy that was the introduction of free-roaming across Europe. Bewildered by the idea of losing profits, companies such as Three and eir decided that they would ignore the new EU rules and limit customer's domestic data allowances substantially while roaming. At least in this respect, it appears as if these companies somehow believed that they were above the law. Following a scathing backlash from the media and the announcement by ComReg that the regulator was investigating if these actions were illegal, Three and others decided to increase their roaming allowances to a more palatable level. The optics of such actions have stained Three's image of providing great value.

Ireland enjoys a choice of three mobile providers, down from four since 2015 following Three's merger with Telefónica's O2. Before the aforementioned merger occurred, Ireland was one of the most lucrative markets for a mobile network to operate in the world. Seeing this, ComReg stepped in and made efforts to boost competition. The watchdog alleged that Vodafone and O2, the two largest operators in Ireland at the time, "tactically colluded" with one another to "keep competitors out and maintain high prices for their services". Of course, Vodafone and O2 would strongly deny these claims, but the fact that prices for mobile in Ireland were amongst the highest in the developed world was and is a clear indication that the system was not working, something was seriously wrong.

The state of our mobile market was so poor at one point that Vodafone's Average Revenue per User (APRU) figures reached an eye-watering €50.20 every month. In 2018, much to the benefit of consumers, the industry average of APRU had fallen well below €25 monthly. ComReg played a key role in paving a way towards a more competitive market. The watchdog made efforts to end this collusion, which was working wonders for Vodafone's and O2's wallets, by implementing price fixing. This method sets specific prices for services, beyond the control of a mobile network. In this way, the duopoly (Vodafone and O2) could no longer raise or maintain prices based on their own desires. As CK Hutchinson's Three and Meteor (which eir purchased from Western Wireless in 2005) grew, prices began to fall as competition increased.

Three was found by ComReg to be over-reporting its customer base, deceitfully stating it had thousands of more customers than it actually had, leading to a fine from the regulator. More recently, the company was dealt with a record-breaking fine exceeding €500,000 for enforcing contract changes without providing adequate methods for customers to leave. Three's customers were given a once in a lifetime opportunity to abandon the company and forgo the need to pay any remaining contract charges due to a change in terms. However, ComReg discovered that the number provided by Three to contact in the event that you wished to cancel your service didn't work. It is clear that Three predicted thousands of customers would wish to leave and therefore made a substantial effort to prevent it from happening.

In more recent times, ComReg has prosecuted Vodafone, eir and Tesco Mobile for overcharging customers. This is a perfect example of the importance of ComReg, it gives consumer's a voice. As a matter of fact, these issues shouldn't arise in the first place, these companies claim that caring for their customers is a top priority. But, you don't need to be stupid to understand the fact that when there is the choice of earning more profit (whether that means employing aggressive strategies) or looking after the customer, our mobile providers will almost always pursue the first option.

ComReg is in the process of developing an interactive map which will compare network coverage offered by Three, Vodafone and eir. This map, which will be available by the end of this year, will finally create a simple method for consumers to see which network performs best in their own area. As well as this, ComReg recently began to permit the use of signal boosters in areas near the cell edge where the signal available isn't able to facilitate calls, texts or data. The watchdog publishes surveys which it conducts based on the mobile market. These surveys include analysing network performance in drive tests, providing information about the smartphones which manage to achieve the best SINR (the signal-to-interference-plus-noise ratio) and providing an interactive map called "SiteViewer" to locate the precise location of base stations in Ireland.

Finally, I want to touch upon the controversy that was the introduction of free-roaming across Europe. Bewildered by the idea of losing profits, companies such as Three and eir decided that they would ignore the new EU rules and limit customer's domestic data allowances substantially while roaming. At least in this respect, it appears as if these companies somehow believed that they were above the law. Following a scathing backlash from the media and the announcement by ComReg that the regulator was investigating if these actions were illegal, Three and others decided to increase their roaming allowances to a more palatable level. The optics of such actions have stained Three's image of providing great value.

The Failures of ComReg in Mobile

For every success, there are many more failures. ComReg has experienced its own fair share of failures, which predominately preside in the broadband market. However, I want to discuss the failures in mobile first.

From a spectrum standpoint, allowing the Three and O2 merger to be accepted without hindrance was a disastrous failure. Upon the consolidation of the two networks, Three holds significantly more spectrum (45% of all spectrum) than Vodafone and eir. This will hurt competition and innovation in the mobile market in the future. In fact, Three still has a huge amount of idle spectrum which it has yet to deploy. The company should have been forced to divest some of its spectrum upon completion of the merger. Just as an example of what I'm speaking about, look at the eir's mobile network, a network approaching a state of tatters. The company is restricted by its limited spectrum portfolio, leading to congestion and subsequently slower speeds for consumers.

For example, Three holds seven blocks of 1800MHz, compared to three blocks held by eir and five blocks held by Vodafone. Three owns three blocks of 900MHz, whereas Vodafone and eir both hold two individually. In terms of 2100MHz, Three holds six blocks of spectrum. Vodafone and eir hold each hold three blocks of 2100MHz spectrum. There is an obvious and worrying spectrum disparity.

Now, there is the argument that ComReg was not in support of the merger in the first place, stating "significant negative consequences for Irish consumer welfare may result". And for the most part, ComReg had no say in the final decision made by the European Commission on whether to permit the merger. It may not surprise you that Vodafone, the company which enjoyed unchallenged market dominance for a period spanning over a decade, was spooked by the prospects of the merger and a significantly stronger competitor. The company raised concerns with the watchdog before and after the combined Three became the second largest Irish mobile network. In fact, the company complained to ComReg about Three's intentions to amend its 2100MHz licenses. Below, I have attached images which include a response to ComReg from Three on the matter and detail Vodafone's intentions to prevent the amendments from occurring.

Finally, on the topic of mobile, ComReg has yet to allocate spectrum in the 2600MHz band for use by Ireland's mobile networks. This is a clear missed opportunity by the watchdog, which if pursued, would allow for higher capacity 4G networks and mitigate issues of congestion in urban areas. Unfortunately, this spectrum is allocated to MMDS at present (Multichannel Multipoint Distribution Service).

From a spectrum standpoint, allowing the Three and O2 merger to be accepted without hindrance was a disastrous failure. Upon the consolidation of the two networks, Three holds significantly more spectrum (45% of all spectrum) than Vodafone and eir. This will hurt competition and innovation in the mobile market in the future. In fact, Three still has a huge amount of idle spectrum which it has yet to deploy. The company should have been forced to divest some of its spectrum upon completion of the merger. Just as an example of what I'm speaking about, look at the eir's mobile network, a network approaching a state of tatters. The company is restricted by its limited spectrum portfolio, leading to congestion and subsequently slower speeds for consumers.

For example, Three holds seven blocks of 1800MHz, compared to three blocks held by eir and five blocks held by Vodafone. Three owns three blocks of 900MHz, whereas Vodafone and eir both hold two individually. In terms of 2100MHz, Three holds six blocks of spectrum. Vodafone and eir hold each hold three blocks of 2100MHz spectrum. There is an obvious and worrying spectrum disparity.

Now, there is the argument that ComReg was not in support of the merger in the first place, stating "significant negative consequences for Irish consumer welfare may result". And for the most part, ComReg had no say in the final decision made by the European Commission on whether to permit the merger. It may not surprise you that Vodafone, the company which enjoyed unchallenged market dominance for a period spanning over a decade, was spooked by the prospects of the merger and a significantly stronger competitor. The company raised concerns with the watchdog before and after the combined Three became the second largest Irish mobile network. In fact, the company complained to ComReg about Three's intentions to amend its 2100MHz licenses. Below, I have attached images which include a response to ComReg from Three on the matter and detail Vodafone's intentions to prevent the amendments from occurring.

Finally, on the topic of mobile, ComReg has yet to allocate spectrum in the 2600MHz band for use by Ireland's mobile networks. This is a clear missed opportunity by the watchdog, which if pursued, would allow for higher capacity 4G networks and mitigate issues of congestion in urban areas. Unfortunately, this spectrum is allocated to MMDS at present (Multichannel Multipoint Distribution Service).

The Effects of ComReg in Broadband

The watchdog has also played a critical role in ensuring our broadband providers operate fairly. This means ensuring that companies such as eir, which hold a Universal Service Obligation (USO), fulfil their service agreements. For example, as the incumbent broadband operator, eir is required to deal with complaints from its wholesale customers just as it would from its own customers. However, following an investigation, ComReg discovered that eir failed to repair 95% of reported faults within four working days and 100% within ten working days, resulting in a fine of €1.5 million.

As the telecoms regulator, ComReg has great power over the costs associated with connecting to open eir's monopolistic wholesale network. For example, a heated debate arose during the planning of the National Broadband Plan. This debate revolved around the fact that the remaining bidder, Enet, would need to access eir's poles and ducts at a discounted price. However, as you would expect, eir maintained its position and firmly rejected any suggestions that it should provide discounts for the government. In fact, ComReg regulates the prices for access to eir's poles and ducts, not eir. The company argues that providing discounts would give its rivals a competitive advantage as they do not have to cough out the money required to maintain the network.

ComReg's issuing of reports has also been vital to inform consumers about the state of the broadband market. For example, in Q2 of 2018, the regulator received more than quadruple the number of complaints relating to service issues with eir broadband (59) compared to Sky broadband (10). These figures are derived from complaints made by Irish consumers to ComReg's help channels. If consumers experience an issue with their service, whether that's a billing or service issue, the watchdog will investigate and make the necessary actions required to resolve the issue. In some cases, ComReg will force a company such as eir to terminate a contract with an unhappy customer without any surplus charge if they continue to experience issues.

ComReg's quarterly market reports also paint a picture of the state of the Irish broadband market. These reports include the number of broadband connections in Ireland, their type (FTTH, FTTC, etc.), and the market share of each company. In this way, we can understand how our country fairs in terms of broadband availability, a hot topic as we await the initiation of the National Broadband Plan.

Finally, ComReg provides a comprehensive price comparison tool on its website. This can be used as a non-biased method of locating the best broadband deal that suits your needs. The tool compares broadband from a plethora of different companies, including those that provide fixed and fixed wireless broadband.

As the telecoms regulator, ComReg has great power over the costs associated with connecting to open eir's monopolistic wholesale network. For example, a heated debate arose during the planning of the National Broadband Plan. This debate revolved around the fact that the remaining bidder, Enet, would need to access eir's poles and ducts at a discounted price. However, as you would expect, eir maintained its position and firmly rejected any suggestions that it should provide discounts for the government. In fact, ComReg regulates the prices for access to eir's poles and ducts, not eir. The company argues that providing discounts would give its rivals a competitive advantage as they do not have to cough out the money required to maintain the network.

ComReg's issuing of reports has also been vital to inform consumers about the state of the broadband market. For example, in Q2 of 2018, the regulator received more than quadruple the number of complaints relating to service issues with eir broadband (59) compared to Sky broadband (10). These figures are derived from complaints made by Irish consumers to ComReg's help channels. If consumers experience an issue with their service, whether that's a billing or service issue, the watchdog will investigate and make the necessary actions required to resolve the issue. In some cases, ComReg will force a company such as eir to terminate a contract with an unhappy customer without any surplus charge if they continue to experience issues.

ComReg's quarterly market reports also paint a picture of the state of the Irish broadband market. These reports include the number of broadband connections in Ireland, their type (FTTH, FTTC, etc.), and the market share of each company. In this way, we can understand how our country fairs in terms of broadband availability, a hot topic as we await the initiation of the National Broadband Plan.

Finally, ComReg provides a comprehensive price comparison tool on its website. This can be used as a non-biased method of locating the best broadband deal that suits your needs. The tool compares broadband from a plethora of different companies, including those that provide fixed and fixed wireless broadband.

ComReg has failed to maintain a Competitive Broadband Market

Without any doubt, ComReg's greatest failure has been its inability to breathe competition into a broken broadband market controlled by a monopolistic incumbent operator, eir. Statistics from ComReg itself show that Irish consumers pay more for broadband than virtually anywhere else in Europe. The root cause of this is a serious lack of competition in the broadband market. eir owns and controls the vast majority of poles and ducts throughout the country and this has given the former state-owned monopoly tremendous leverage over pricing.

eir's wholesale division, open eir, charges companies such as Sky and Vodafone exorbitant sums of money to access its network. The access charges to its FTTH network are so high that all of eir's competitors have boycotted the company and refused to pay the charge which breaches €200. For some perspective, SIRO charges its customers around €80 to access its next generation 100% fibre-optic network. The failure of ComReg to step in has exacerbated these issues, leading to higher prices for consumers.

More than this, however, is the regulator's failure to break up open eir and eir into two separate entities. Combined, open eir gives eir a competitive advantage in the broadband market.

eir's wholesale division, open eir, charges companies such as Sky and Vodafone exorbitant sums of money to access its network. The access charges to its FTTH network are so high that all of eir's competitors have boycotted the company and refused to pay the charge which breaches €200. For some perspective, SIRO charges its customers around €80 to access its next generation 100% fibre-optic network. The failure of ComReg to step in has exacerbated these issues, leading to higher prices for consumers.

More than this, however, is the regulator's failure to break up open eir and eir into two separate entities. Combined, open eir gives eir a competitive advantage in the broadband market.

Conclusion: Protecting an Industry of Pinnacle Importance

Protecting something as important as access to the Internet is a damn difficult task, a task that requires serious knowledge and experience. Unfortunately, the difficulties associated which such a task have been amplified by companies such as eir, Vodafone, Three and Virgin Media, companies which provide the services that ComReg regulates.

The telecoms industry is a brilliant industry, fuelled by a passion to deliver cutting-edge technologies and provide meaningful innovations for consumers. So much has changed in so little time. Before 2010, the duopoly (Vodafone and O2) stifled innovation and hurt consumers in mobile due to a chronic lack of competition. But, ComReg implemented many remedies to ease this issue, and we now enjoy one of the most competitive mobile markets anywhere on this continent. Going forward, Three's large spectrum portfolio will put competition in jeopardy, so we need to see some concrete divestment actions on this matter sooner rather than later.

The watchdog has safeguarded our broadband networks against illegal actions by Internet Service Providers, prosecuting those whose actions breach the agreements they have made. However, with a broadband market where prices are the third highest in Europe, it is clear that ComReg still has some serious work ahead of it. The primary cause of this lack of competition is the crippling effect which eir's monopolistic wholesale division, open eir, has cast on our country.

We are eagerly awaiting the arrival of 5G, a technology set to revolutionise how we work, play and relax. In fact, ComReg has already done its bit in fulfilling the 5G dream, allocating spectrum in the 3.6GHz and 26GHz bands to Ireland's mobile networks for use with 5G. In the most basic sense, ComReg has shaped the telecoms industry in Ireland, ensuring that the magic which is access to the Internet is available to everyone at a reasonable rate.

The telecoms industry is a brilliant industry, fuelled by a passion to deliver cutting-edge technologies and provide meaningful innovations for consumers. So much has changed in so little time. Before 2010, the duopoly (Vodafone and O2) stifled innovation and hurt consumers in mobile due to a chronic lack of competition. But, ComReg implemented many remedies to ease this issue, and we now enjoy one of the most competitive mobile markets anywhere on this continent. Going forward, Three's large spectrum portfolio will put competition in jeopardy, so we need to see some concrete divestment actions on this matter sooner rather than later.

The watchdog has safeguarded our broadband networks against illegal actions by Internet Service Providers, prosecuting those whose actions breach the agreements they have made. However, with a broadband market where prices are the third highest in Europe, it is clear that ComReg still has some serious work ahead of it. The primary cause of this lack of competition is the crippling effect which eir's monopolistic wholesale division, open eir, has cast on our country.

We are eagerly awaiting the arrival of 5G, a technology set to revolutionise how we work, play and relax. In fact, ComReg has already done its bit in fulfilling the 5G dream, allocating spectrum in the 3.6GHz and 26GHz bands to Ireland's mobile networks for use with 5G. In the most basic sense, ComReg has shaped the telecoms industry in Ireland, ensuring that the magic which is access to the Internet is available to everyone at a reasonable rate.