The MVNO model is ripe for disruption.

There is a better way to serve mobile consumers, and the broken model of today will be the reflective point of tomorrow.

Published 19/01/18

While those in the industry refrain from denouncing their business model, consumers are becoming increasingly frustrated with the way in which we access a mobile network, and how we pay for that access. Telecoms companies are some of the most hated entities in the world from a consumer stand-point, and that vibrant distaste is the product of a market which inherently thwarts competition.

Think about it. Is there another business model in which consumers are forced to return something that they have paid for on a monthly basis? Why should we settle for access to one network's infrastructure when a converged strategy provides richer coverage and a superior experience on the RAN? Can telecoms companies continue to implement charges wherever they can, sucking consumers' wallets dry?

The answer to all of the above questions is, of course, a resounding no. And it is this viewpoint that has inspired us to embark on a mission that will see the MVNO model radically disrupted, a disruption that will work in the interests of consumers rather than against. Google's Fi has provided a flicker of hope for a better model, and its accelerating momentum proves one thing: consumers are not happy with the solutions that exist today.

Think about it. Is there another business model in which consumers are forced to return something that they have paid for on a monthly basis? Why should we settle for access to one network's infrastructure when a converged strategy provides richer coverage and a superior experience on the RAN? Can telecoms companies continue to implement charges wherever they can, sucking consumers' wallets dry?

The answer to all of the above questions is, of course, a resounding no. And it is this viewpoint that has inspired us to embark on a mission that will see the MVNO model radically disrupted, a disruption that will work in the interests of consumers rather than against. Google's Fi has provided a flicker of hope for a better model, and its accelerating momentum proves one thing: consumers are not happy with the solutions that exist today.

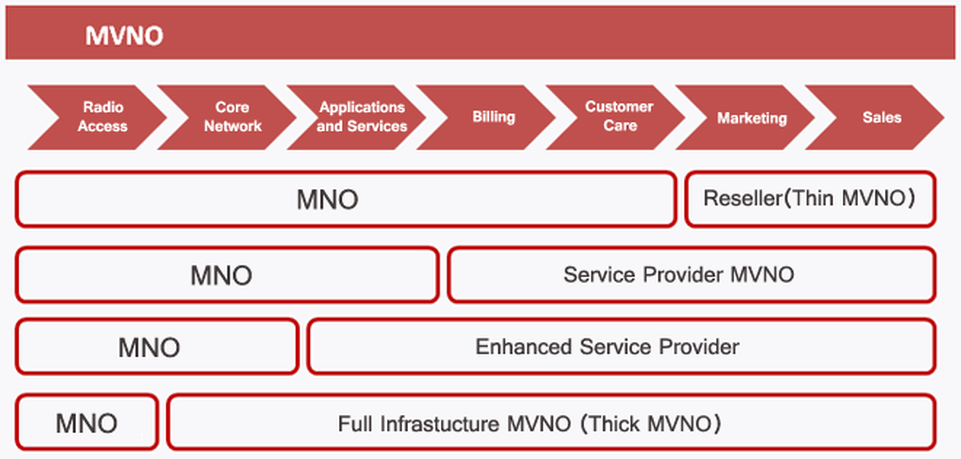

Where MVNOs stand

From the onset, the position of MVNOs in the Irish market has been weak, and these retailers continue to tread on thin ice. Vodafone, for example, managed to bask in the glory of unchallenged market dominance for decades, and if it were not for the ascension of Three following its merger with O2 in 2015, Big Red would still be stifling competition in Ireland to this day.

Under the terms of Three's intensely scrutinised bid for O2, the European Commission ensured that the merged entity would set aside spectrum for the establishment of two new MVNOs, with the view that these providers could eventually deploy their own respective RAN in the future. Frankly, such a view was ridiculous as the CapEx requirements to deploy a nationwide mobile network on an island bearing Ireland's topography is exorbitant, and it just doesn't make sense for a newcomer to splash billions of euro on infrastructure in a saturated market.

Under the terms of Three's intensely scrutinised bid for O2, the European Commission ensured that the merged entity would set aside spectrum for the establishment of two new MVNOs, with the view that these providers could eventually deploy their own respective RAN in the future. Frankly, such a view was ridiculous as the CapEx requirements to deploy a nationwide mobile network on an island bearing Ireland's topography is exorbitant, and it just doesn't make sense for a newcomer to splash billions of euro on infrastructure in a saturated market.

iD Mobile, under Dixons Carphone Warehouse, was one of the MVNOs which was a byproduct of the merger, and the retailer ceased its operations in March of 2018. This death serves as a reminder that even a large retail presence, through Carphone Warehouse stores, is insufficient to challenge the might of an oligopoly which is composed of eir, Three and Vodafone.

Excluding Tesco Mobile, which has experienced considerable success as an MVNO on Three's network, the combined mobile subscription market share of retailers such as Lycamobile, Virgin Mobile and 48 Months is 3.6% as of Q3 2018, and this market share has remained level over the past year. Looking at market share by revenue, the combined group of MVNOs holds just 2.3%, highlighting the fact that the big three providers are capturing a significantly higher APRU. ComReg's data also reveals a startling discrepancy between the profile of subscribers on Irish MVNOs compared to those on the primary mobile providers. Pre-paid subscriptions, which are viewed as less valuable from a revenue standpoint, occupy a huge 59.3% of subscriptions on MVNOs. Big Red's profile of subscribers is composed of just 34.1% pre-paid customers.

Based on the above statistics, we can derive some intriguing findings which correlate the failure of MVNOs in Ireland to strategies that focus on a race to the bottom in terms of pricing, and prioritise pre-pay offerings over bill-pay offerings, which can deliver greater customer retention and improved APRU over a period spanning years.

Excluding Tesco Mobile, which has experienced considerable success as an MVNO on Three's network, the combined mobile subscription market share of retailers such as Lycamobile, Virgin Mobile and 48 Months is 3.6% as of Q3 2018, and this market share has remained level over the past year. Looking at market share by revenue, the combined group of MVNOs holds just 2.3%, highlighting the fact that the big three providers are capturing a significantly higher APRU. ComReg's data also reveals a startling discrepancy between the profile of subscribers on Irish MVNOs compared to those on the primary mobile providers. Pre-paid subscriptions, which are viewed as less valuable from a revenue standpoint, occupy a huge 59.3% of subscriptions on MVNOs. Big Red's profile of subscribers is composed of just 34.1% pre-paid customers.

Based on the above statistics, we can derive some intriguing findings which correlate the failure of MVNOs in Ireland to strategies that focus on a race to the bottom in terms of pricing, and prioritise pre-pay offerings over bill-pay offerings, which can deliver greater customer retention and improved APRU over a period spanning years.

The outlier in the Irish MVNO market is Tesco Mobile, thriving where others have failed. The network is now a wholly owned subsidiary of the wider Tesco Group, a result of Three selling its share in the company. A strong retail presence in Ireland, combined with tight integration between Tesco's services such as Clubcard, have been incentives for consumers to join the network.

You see, the only way a company can excel in a saturated market is to develop a unique selling point. For every MVNO operating in Ireland to date, pricing has been the USP, and this approach is fundamentally flawed. Let's examine Vodafone for context: Big Red has touted its network prowess for years, and third-party firms such as Ookla and even ComReg have testified that Vodafone's network is more reliable in more places than any other. In the eyes of Vodafone, quality is their USP, and they can charge a pretty penny for their service as a result.

MVNOs need to find new ways to differentiate themselves from competitors outside the realm of pricing, and those methods can vary from developing loyalty programmes, introducing comprehensive mobile applications that enhance the customer experience to providing access to two RANs in an effort to deliver an enhanced QoS. Whatever strategy is implemented, merely undercutting the oligopoly is not enough to rock an establishment which has been accused of tactical price collusion in the past.

You see, the only way a company can excel in a saturated market is to develop a unique selling point. For every MVNO operating in Ireland to date, pricing has been the USP, and this approach is fundamentally flawed. Let's examine Vodafone for context: Big Red has touted its network prowess for years, and third-party firms such as Ookla and even ComReg have testified that Vodafone's network is more reliable in more places than any other. In the eyes of Vodafone, quality is their USP, and they can charge a pretty penny for their service as a result.

MVNOs need to find new ways to differentiate themselves from competitors outside the realm of pricing, and those methods can vary from developing loyalty programmes, introducing comprehensive mobile applications that enhance the customer experience to providing access to two RANs in an effort to deliver an enhanced QoS. Whatever strategy is implemented, merely undercutting the oligopoly is not enough to rock an establishment which has been accused of tactical price collusion in the past.

A Better Network

If you are an MVNO such as Tesco Mobile, an incredible level of trust is placed in your partner's ability to provide access to a competent core network and RAN. The trust is so great because, without the access, your business will flounder. On top of that, most MVNOs have virtually no control over the QoS that their customers receive, and they are entirely reliant on the mobile provider to pump money into their infrastructure on a constant basis to meet surging capacity demands.

A dependence on one provider for connectivity can go horribly wrong, and I'll place forward an example to put this into context for you. Three is the network for MVNOs in Ireland, and when the merged entity brought both iD Mobile and Virgin Mobile aboard its portfolio, the company's network was a mish-mash of two dysfunctional RANs which were a consequence of severe under-investment on behalf of Telefónica in O2's infrastructure and a lack of scale within the legacy Three 3G network. Let's be honest, the consolidation of the two networks was a mess of unparalleled magnitude in Irish telecoms, and constant outages, capacity shortages and sloppy voice hand-off between the separate core networks ensued for weeks, months and even years after the merger.

A dependence on one provider for connectivity can go horribly wrong, and I'll place forward an example to put this into context for you. Three is the network for MVNOs in Ireland, and when the merged entity brought both iD Mobile and Virgin Mobile aboard its portfolio, the company's network was a mish-mash of two dysfunctional RANs which were a consequence of severe under-investment on behalf of Telefónica in O2's infrastructure and a lack of scale within the legacy Three 3G network. Let's be honest, the consolidation of the two networks was a mess of unparalleled magnitude in Irish telecoms, and constant outages, capacity shortages and sloppy voice hand-off between the separate core networks ensued for weeks, months and even years after the merger.

The poor state of Three's network from 2015 up to 2018 presented insurmountable challenges for its MVNOs, all of whom shed customers due to the network issues. Unfortunately, these MVNOs were trapped on Three's network, essentially stifling their own growth. You see, consumers perceive network quality to be an essential factor when switching between providers, and at the time, no MVNO in Ireland could boast about the prowess of a network that was, quite visibly, choking.

Three's network has advanced to an exceptional level as of today, and its MVNOs are no longer restricted by crippled infrastructure. Nonetheless, the above is a fundamental lesson for anyone in the telecoms industry that thinks network quality is not an important aspect of an MVNO.

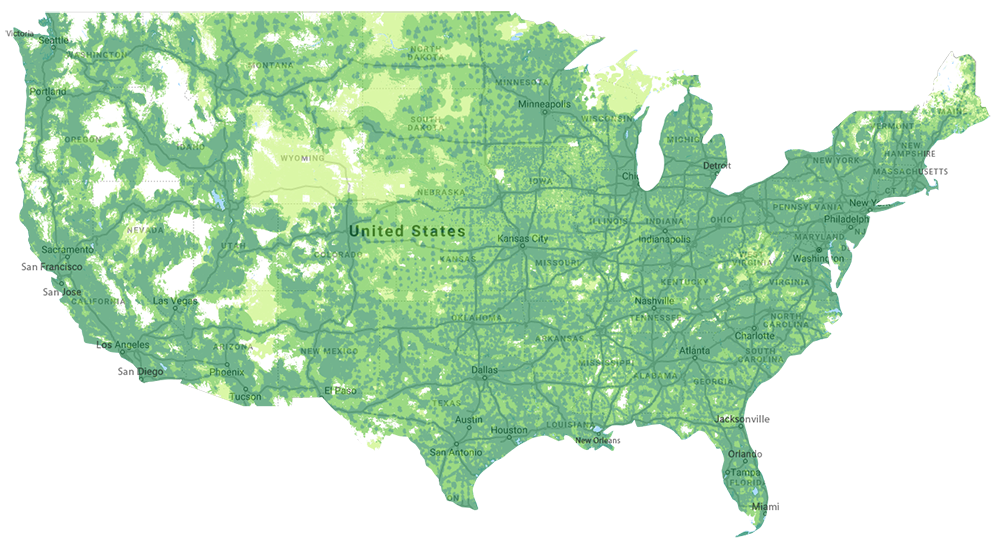

A dual-network approach, in which an MVNO can intelligently shift its customers between the infrastructure of at least two separate mobile providers to maximise the availability of coverage and minimise the level of congestion is the next step for MVNOs. In the US, Google Fi allows its customers with compatible devices to access Sprint, T-Mobile and US Cellular in the one mobile plan. At its most basic level, this means that Fi provides customers with the best possible coverage and speed at any particular location. If one network goes down, there is another. If one network is congested, there is another.

Implementing such an advanced system is more complex in the US than it would be in Ireland, where T-Mobile utilises GSM and Sprint utilises CDMA. There are only a limited number of devices which embed the ability to switch between GSM and CDMA networks, however, this is changing with the launch of new chipsets from Intel and Qualcomm. All three networks in Ireland utilise GSM, as does the vast majority of the world.

Three's network has advanced to an exceptional level as of today, and its MVNOs are no longer restricted by crippled infrastructure. Nonetheless, the above is a fundamental lesson for anyone in the telecoms industry that thinks network quality is not an important aspect of an MVNO.

A dual-network approach, in which an MVNO can intelligently shift its customers between the infrastructure of at least two separate mobile providers to maximise the availability of coverage and minimise the level of congestion is the next step for MVNOs. In the US, Google Fi allows its customers with compatible devices to access Sprint, T-Mobile and US Cellular in the one mobile plan. At its most basic level, this means that Fi provides customers with the best possible coverage and speed at any particular location. If one network goes down, there is another. If one network is congested, there is another.

Implementing such an advanced system is more complex in the US than it would be in Ireland, where T-Mobile utilises GSM and Sprint utilises CDMA. There are only a limited number of devices which embed the ability to switch between GSM and CDMA networks, however, this is changing with the launch of new chipsets from Intel and Qualcomm. All three networks in Ireland utilise GSM, as does the vast majority of the world.

Imagine being a customer of an MVNO which allows you to shift between the Three and Vodafone network for connectivity. This would be a game-changer, and it is something that is now in operation throughout many countries in Europe and Asia, not just with Google Fi in the US.

Of course, from the viewpoint of an MVNO, maintaining access to two networks would be expensive and there are many mobile providers that don't sit well knowing a competitor can provide an enhanced network experience without the need to deploy any new infrastructure. However, this is a huge USP for an MVNO, and it could allow them to generate greater APRU with the enforcement of prices that are higher than other MVNOs, many of which target aggressive cost-cutting.

There are other benefits of this dual-connectivity model too, and they fall into the space of SDN-WANs. Traffic shaping could be implemented to alleviate congestion on the Vodafone network and shift heavier users to Three's high capacity data network. Furthermore, think of the savings that could be delivered during off-peak times, when customers of the MVNO are encouraged to carry out the majority of their downloading and uploading late at night and the early hours of the morning.

There are ample technologies and solutions available today to make this a reality, and it is a process which leverages our existing infrastructure in a more effective way than ever before.

Of course, from the viewpoint of an MVNO, maintaining access to two networks would be expensive and there are many mobile providers that don't sit well knowing a competitor can provide an enhanced network experience without the need to deploy any new infrastructure. However, this is a huge USP for an MVNO, and it could allow them to generate greater APRU with the enforcement of prices that are higher than other MVNOs, many of which target aggressive cost-cutting.

There are other benefits of this dual-connectivity model too, and they fall into the space of SDN-WANs. Traffic shaping could be implemented to alleviate congestion on the Vodafone network and shift heavier users to Three's high capacity data network. Furthermore, think of the savings that could be delivered during off-peak times, when customers of the MVNO are encouraged to carry out the majority of their downloading and uploading late at night and the early hours of the morning.

There are ample technologies and solutions available today to make this a reality, and it is a process which leverages our existing infrastructure in a more effective way than ever before.

A Better Pricing Strategy

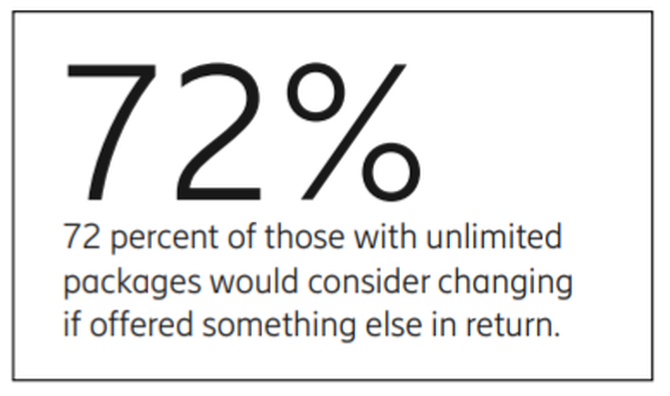

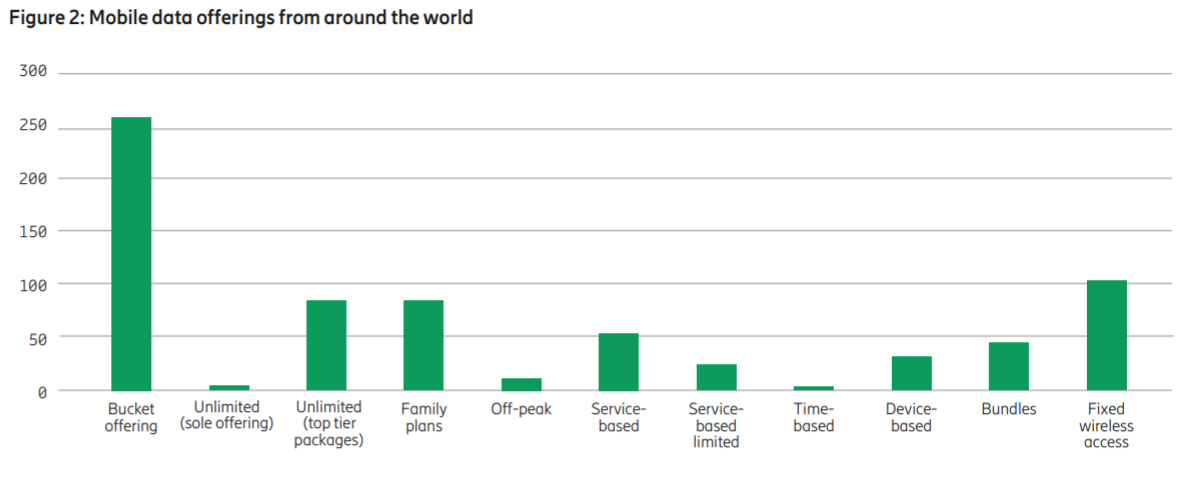

Offering inexpensive unlimited plans as an MVNO is not a sustainable model, especially considering the fact that mobile APRU has reached an all-time low in many markets across the world. Instead, the implementation of a simple and intuitive bucket pricing strategy which provides a robust path of growth and wiggle-room for adaptation in the future is the best approach to pinpoint a balance between customer and investor satisfaction.

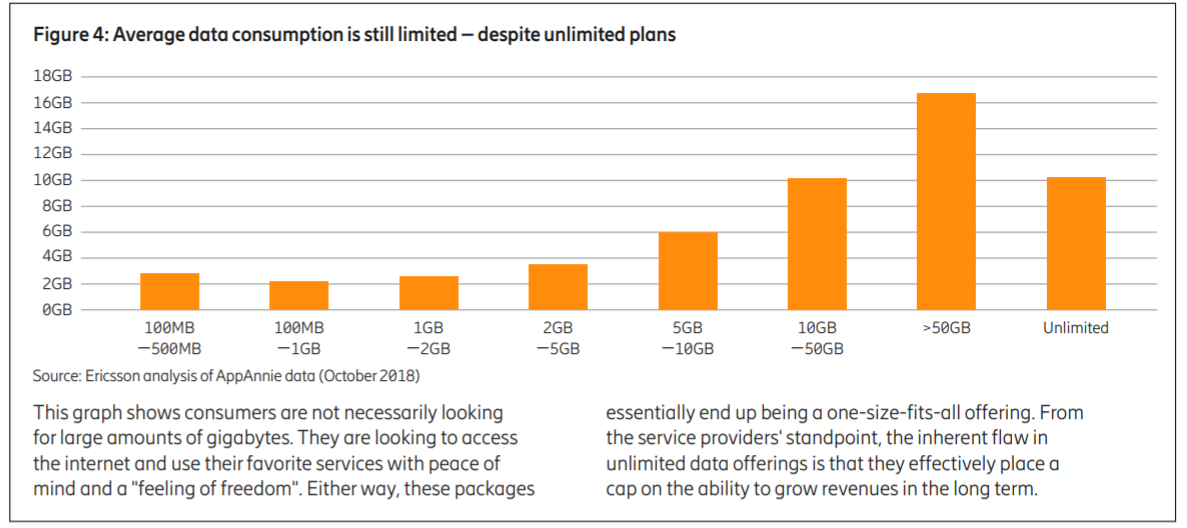

Service-based pricing strategies have risen to prominence as a way for mobile providers to deliver the "feel free" factor associated with unlimited data plans without actually offering an unlimited allowance. This isn't some elaborate trick of the mind, you see, the vast majority of those that pay for an unlimited allowance don't actually require one. For example, Ericsson has indicated that customers who opt for an unlimited data plan actually consume less data on a monthly basis than those who opt for a plan with a hard limit above 50GB.

The other issue with unlimited and the one that service-based plans can solve is the cannibalisation of revenues which would traditionally be generated from bucket pricing plans. There are no overage tariffs with truly unlimited plans, and this forces mobile providers to hike fees in another area of the business to recuperate their losses. In many cases, service-based plans come in the form of an optional add-on to an existing plan that enforces a data usage limit.

For the above reasons, service-based models offer providers room to grow their APRU by applying a separate monthly fee to existing plans.

Service-based pricing strategies have risen to prominence as a way for mobile providers to deliver the "feel free" factor associated with unlimited data plans without actually offering an unlimited allowance. This isn't some elaborate trick of the mind, you see, the vast majority of those that pay for an unlimited allowance don't actually require one. For example, Ericsson has indicated that customers who opt for an unlimited data plan actually consume less data on a monthly basis than those who opt for a plan with a hard limit above 50GB.

The other issue with unlimited and the one that service-based plans can solve is the cannibalisation of revenues which would traditionally be generated from bucket pricing plans. There are no overage tariffs with truly unlimited plans, and this forces mobile providers to hike fees in another area of the business to recuperate their losses. In many cases, service-based plans come in the form of an optional add-on to an existing plan that enforces a data usage limit.

For the above reasons, service-based models offer providers room to grow their APRU by applying a separate monthly fee to existing plans.

An example of this model in practice would be for an MVNO to provide a data allowance of 15GB on the standard plan, at a cost of €25 per month. Beyond this limit, customers will incur the cost per megabyte charges that we love to hate today. However, there is a service-based add-on available for €10 per month which zero-rates video streaming on the customer's mobile device, up to a fair usage allowance. In this way, customers can enjoy the benefits of unlimited data on a limited plan, setting categories of segmentation and differentiation for mobile providers.

An extension of the service-based model is one that utilises time to gauge customer usage of the network. With this model, just as the proverbial term states, time is money. Music or video streaming add-ons, commonly referred to as passes, can be purchased and applied to a customer's account. These passes vary in terms of their time limit, with some having the ability to last up to twenty-four hours before expiration. This could be a momentous breakthrough in the quest to end declining revenues for mobile providers as the volume of data consumed is not the metric for costing, rather, the time spent using data is. For consumers, such a time-based model eradicates the fear that they are overpaying for a data allowance that they will not use and represents an opportunity for on-demand access to a network.

An extension of the service-based model is one that utilises time to gauge customer usage of the network. With this model, just as the proverbial term states, time is money. Music or video streaming add-ons, commonly referred to as passes, can be purchased and applied to a customer's account. These passes vary in terms of their time limit, with some having the ability to last up to twenty-four hours before expiration. This could be a momentous breakthrough in the quest to end declining revenues for mobile providers as the volume of data consumed is not the metric for costing, rather, the time spent using data is. For consumers, such a time-based model eradicates the fear that they are overpaying for a data allowance that they will not use and represents an opportunity for on-demand access to a network.

Finally, an MVNO could implement a dynamic pricing strategy which fluctuates based on the constraints being placed on their partner's network at any one time. When network traffic is high, such as during rush hour, the usage of data becomes more expensive. As the cost of accessing data rises, it directly disincentivises customers from using data heavily during peak usage times, consequently alleviating network congestion. During the night, when network traffic is low, the usage of data could be encouraged through the introduction of less expensive data tariffs. Plotted on a graph, a peak and off-peak pricing model could reduce the extreme variations between data usage at different times of the day.

Finally, the development of a device or family pricing strategies, similar to those offered by mobile providers throughout the world today, could be an opportunity to pursue for MVNOs. Family pricing plans are an excellent combatant to churn on a network, and they boost customer retention thanks to the bundling of multiple users on the same provider, under the same bill.

Device-specific pricing strategies can cater to the different use cases of an ever-evolving plethora of devices which require connectivity, from smartphones, cellular-enabled laptops and smartwatches to asset trackers and further afield.

The growth of the IoT should be looked upon as the emergence of a gold mine by the telecoms industry, and MVNOs can exploit this by targeting the needs of simple devices with simple connectivity requirements.

Finally, the development of a device or family pricing strategies, similar to those offered by mobile providers throughout the world today, could be an opportunity to pursue for MVNOs. Family pricing plans are an excellent combatant to churn on a network, and they boost customer retention thanks to the bundling of multiple users on the same provider, under the same bill.

Device-specific pricing strategies can cater to the different use cases of an ever-evolving plethora of devices which require connectivity, from smartphones, cellular-enabled laptops and smartwatches to asset trackers and further afield.

The growth of the IoT should be looked upon as the emergence of a gold mine by the telecoms industry, and MVNOs can exploit this by targeting the needs of simple devices with simple connectivity requirements.

A Better Customer Relationship

Customer satisfaction is the metric which every company should swear by, and this must be applied rigidly to MVNOs. Maintaining a quality relationship between a company and their customers is a fundamental component of success in telecoms because a dissatisfied customer will always desert you, regardless of the magnitude of discounts that you pass on to them.

However, to be frank, customer care in the telecoms industry is a broken and miserable system akin to running in a hamster wheel. The big providers won't change their ways without someone stepping on their toes, and it will take serious innovation from MVNOs to force a sea change in the wider industry.

As we've seen with T-Mobile in the US, over-reliance on bots for customer interaction with a company has a hugely negative impact on the support experience. In fact, T-Mobile recognised the deficit of humans in this process and radically changed its customer care channels to provide a human representative to its customers as soon as they dial a care number, bypassing frustrating IVR systems, call bouncing and lengthy phone menus.

Sure, putting more people in the customer care process raises operational expenses for providers, but those costs can be recovered with greater customer retention that results from enhanced care. For example, a new approach in the form of callbacks is being implemented by many providers, abolishing the occurrence of long periods waiting on hold or in a queue. This is a small change that adapts the process to the requirements of individual customers, and it can drastically improve their experience without the need to invest heavily in new solutions.

However, to be frank, customer care in the telecoms industry is a broken and miserable system akin to running in a hamster wheel. The big providers won't change their ways without someone stepping on their toes, and it will take serious innovation from MVNOs to force a sea change in the wider industry.

As we've seen with T-Mobile in the US, over-reliance on bots for customer interaction with a company has a hugely negative impact on the support experience. In fact, T-Mobile recognised the deficit of humans in this process and radically changed its customer care channels to provide a human representative to its customers as soon as they dial a care number, bypassing frustrating IVR systems, call bouncing and lengthy phone menus.

Sure, putting more people in the customer care process raises operational expenses for providers, but those costs can be recovered with greater customer retention that results from enhanced care. For example, a new approach in the form of callbacks is being implemented by many providers, abolishing the occurrence of long periods waiting on hold or in a queue. This is a small change that adapts the process to the requirements of individual customers, and it can drastically improve their experience without the need to invest heavily in new solutions.

Moving away from customer care, and into the polarising issue of customer appreciation, it becomes obvious that the two are tightly linked - both will be scrutinised by customers and play an important role in forming their perception of the company. Loyalty programmes such as that implemented by Three, 3Plus, offer customers a sense of appreciation through the gifting of discounts and freebies in different shops and services.

I selectively use the word polarising to describe these loyalty programmes because many in the telecoms industry will dispute their purpose. Is it worth the resource investment, and more importantly, how can you measure the impacts of such programmes in a market where there are so many different variables present at any one time? However, the fact stands that the availability of a comprehensive loyalty programme for customers of an MVNO can work to improve satisfaction, retention and APRU.

One last point that I think needs to be afforded more attention in the telecoms industry is the development of high-quality and intuitive mobile applications for Android and iOS devices which allow customers to view their bill and interact with their account. Furthermore, other features such as the ability to contact live support, view real-time usage statistics and alter plans should be present. There are too many applications offered by mobile providers that are dysfunctional, outdated and difficult to use.

I selectively use the word polarising to describe these loyalty programmes because many in the telecoms industry will dispute their purpose. Is it worth the resource investment, and more importantly, how can you measure the impacts of such programmes in a market where there are so many different variables present at any one time? However, the fact stands that the availability of a comprehensive loyalty programme for customers of an MVNO can work to improve satisfaction, retention and APRU.

One last point that I think needs to be afforded more attention in the telecoms industry is the development of high-quality and intuitive mobile applications for Android and iOS devices which allow customers to view their bill and interact with their account. Furthermore, other features such as the ability to contact live support, view real-time usage statistics and alter plans should be present. There are too many applications offered by mobile providers that are dysfunctional, outdated and difficult to use.

Conclusion: Adaptation is key to survival

The telecoms industry is dominated by a limited number of vast monopolies reigning over consumers, resulting in the unnecessary stagnation of innovation in areas such as pricing and care. While not a significant threat in Ireland, MVNOs have fledged the dark horse title in numerous countries around the world, spurring positive change in the greater market.

Adaptation is the key to survival. MVNOs need to dump the idea that cost-cutting is the only solution to thrive. Developing profound unique selling points which are attractive to the customer, and to investors, is the path that we should follow.

The more you give to customers, the more they will give you back. It can be a directly proportionate relationship.

Adaptation is the key to survival. MVNOs need to dump the idea that cost-cutting is the only solution to thrive. Developing profound unique selling points which are attractive to the customer, and to investors, is the path that we should follow.

The more you give to customers, the more they will give you back. It can be a directly proportionate relationship.

Pest Pulse is using the IoT to tackle an old problem in a new wayTraversing the ups and downs of an IoT industry on the brink of explosion, Brian Monaghan explains where his company fits in.

|