The Shift from Growth to Retention in the Irish Telecoms Market

In a saturated market, retaining existing customers becomes more lucrative than attracting new ones.

With over six million active mobile subscriptions in Ireland and climbing, it is fair to say that we are well into the mature stages of a mobile market. For our mobile providers, the lucrativeness presented by the opportunity to attract new customers has soured, giving way to a more sustainable business model that puts customer retention at the front of all activities.

As a market becomes more saturated, it becomes exponentially more difficult for companies to attract new customers. Because of this very reason, maintaining strong customer growth becomes an uphill battle, a battle that will ultimately be lost as the nature of the market changes.

The times of double-digit subscriber growth are well and truly over for Vodafone and Three, Ireland's two largest mobile networks. For these players, subscriber numbers have fluctuated from quarter to quarter, and there is no strong trend of growth or decline. Should that worry these established players?

The answer to the above question is an astounding no. Vodafone, being the oldest mobile network on this island, has enjoyed unchallenged market dominance for a period spanning over a decade. In that time, the company has raked in enormous profits, even as players such as Three and Meteor (now eir) enjoyed rapid growth. In fact, Three is on the verge of surpassing Vodafone to become the largest mobile network in Ireland, but that shouldn't worry big red.

As a market becomes more saturated, it becomes exponentially more difficult for companies to attract new customers. Because of this very reason, maintaining strong customer growth becomes an uphill battle, a battle that will ultimately be lost as the nature of the market changes.

The times of double-digit subscriber growth are well and truly over for Vodafone and Three, Ireland's two largest mobile networks. For these players, subscriber numbers have fluctuated from quarter to quarter, and there is no strong trend of growth or decline. Should that worry these established players?

The answer to the above question is an astounding no. Vodafone, being the oldest mobile network on this island, has enjoyed unchallenged market dominance for a period spanning over a decade. In that time, the company has raked in enormous profits, even as players such as Three and Meteor (now eir) enjoyed rapid growth. In fact, Three is on the verge of surpassing Vodafone to become the largest mobile network in Ireland, but that shouldn't worry big red.

APRU is the Name of the Game

If you're a mobile provider, the APRU (Average-Revenue-Per-User) is an extremely important metric that basically summarises how much average revenue the company earns from each subscriber on a month to month basis. As you would guess, the higher your APRU is, the better the company is performing.

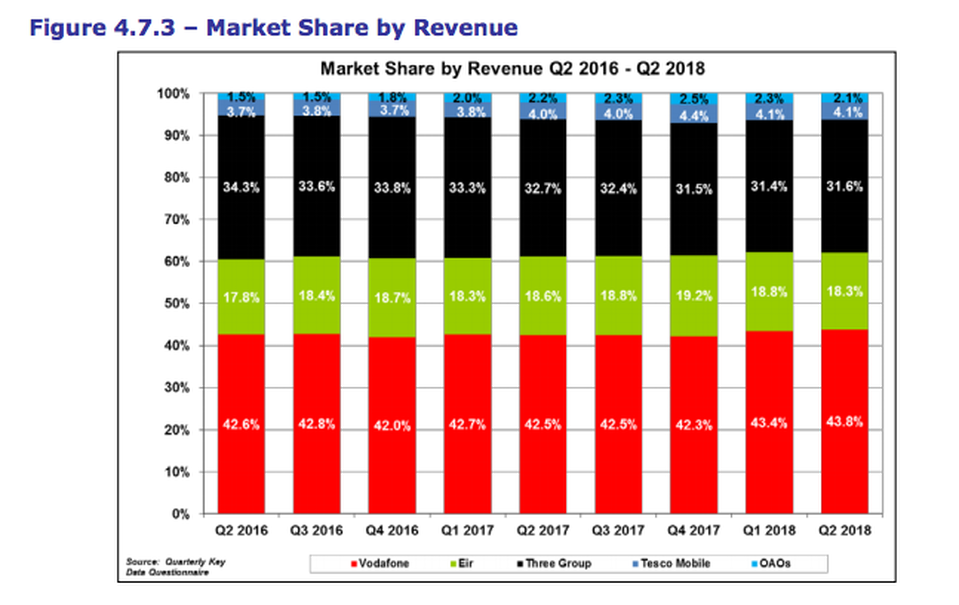

In Ireland, there is quite a large disparity in the ARPU figures between mobile providers. The industry APRU is €25, according to ComReg's most recent report on the Irish market. On a more specific level, Vodafone is the clear winner when it comes to APRU, holding 43.4% of all revenue (with a subscription market share of 36.3%). This is thanks in part to Vodafone's business plan, which prioritises customer retention over customer growth. Essentially, this means Vodafone can charge a pretty penny for access to its service because the goal is not to attract new customers, rather, to maintain existing ones.

On the other hand, Three holds 31.4% of revenues (with a subscription market share of 32%) and eir trails further with a revenue share of 18.8% (and a subscription share of 20.2%). These figures tell a lot about the state of the Irish mobile market. For one, we can explain Three's considerably lower APRU to Vodafone's figures because the company is still in a transition from growth mode to retention. Three's plans remain some of the best value on the Irish market, offering huge data allowances at low prices, but this trend has dissipated to an extent. You see, last year, Three hiked the prices across its portfolio of bill pay plans and removed some perks from its pay as you go plans. This can be seen as a precursor to transitioning from an aggressive competitor to a more mature company. By employing this strategy, Three believes that boosting ARPU is more important than attracting new customers.

When it comes to eir, the smallest of Ireland's three mobile networks, a desire to add subscribers still exists. This makes eir an outlier, based on the fact that its smaller subscriber base still cannot maintain sufficient revenue growth without adding customers. A major cause of this is the network which eir has found itself with, one associated with poorer coverage and speeds than Three or Vodafone. This makes it more difficult for eir to retain customers. Factor in the fact that Xavier Niel, the new owner of eir, has historically embarked on a price war in all of the countries to which he has entered, and it appears that eir remains a seeker of growth. This means that adding subscribers will be of greater importance to eir than it is to Vodafone and Three. Hence, the reason we've seen the company splash out on extensive marketing campaigns for its mobile network.

In Ireland, there is quite a large disparity in the ARPU figures between mobile providers. The industry APRU is €25, according to ComReg's most recent report on the Irish market. On a more specific level, Vodafone is the clear winner when it comes to APRU, holding 43.4% of all revenue (with a subscription market share of 36.3%). This is thanks in part to Vodafone's business plan, which prioritises customer retention over customer growth. Essentially, this means Vodafone can charge a pretty penny for access to its service because the goal is not to attract new customers, rather, to maintain existing ones.

On the other hand, Three holds 31.4% of revenues (with a subscription market share of 32%) and eir trails further with a revenue share of 18.8% (and a subscription share of 20.2%). These figures tell a lot about the state of the Irish mobile market. For one, we can explain Three's considerably lower APRU to Vodafone's figures because the company is still in a transition from growth mode to retention. Three's plans remain some of the best value on the Irish market, offering huge data allowances at low prices, but this trend has dissipated to an extent. You see, last year, Three hiked the prices across its portfolio of bill pay plans and removed some perks from its pay as you go plans. This can be seen as a precursor to transitioning from an aggressive competitor to a more mature company. By employing this strategy, Three believes that boosting ARPU is more important than attracting new customers.

When it comes to eir, the smallest of Ireland's three mobile networks, a desire to add subscribers still exists. This makes eir an outlier, based on the fact that its smaller subscriber base still cannot maintain sufficient revenue growth without adding customers. A major cause of this is the network which eir has found itself with, one associated with poorer coverage and speeds than Three or Vodafone. This makes it more difficult for eir to retain customers. Factor in the fact that Xavier Niel, the new owner of eir, has historically embarked on a price war in all of the countries to which he has entered, and it appears that eir remains a seeker of growth. This means that adding subscribers will be of greater importance to eir than it is to Vodafone and Three. Hence, the reason we've seen the company splash out on extensive marketing campaigns for its mobile network.

How Retention Works?

Retaining customers can be an expensive and complex task, one that involves enhancing existing services and developing new ones designed to create a rich ecosystem where each service complements one another in a seamless manner. The churn rate, or the rate at which customers move from your network to another, is a telling sign of just how effective your retention efforts are. If you are Vodafone, Three or eir, maintaining a low churn rate is an excellent formula for success because it basically means that fewer customers are leaving and more customers are staying, usually due to higher customer satisfaction.

How might a mobile provider endeavor to improve its churn rate, and in turn, switch from a growth model to retention? First and foremost, developing unique and valuable services that enhance the customer experience without adding to the price is a good place to start. A loyalty programme, in which customers are rewarded for staying with the company for an extended period of time, is an extremely effective method when implemented correctly. Three's 3Plus loyalty programme is a perfect example, offering discounts in various shops, restaurants, and cinemas. With 3Plus, the company has found a way to add value to customers plans.

On Vodafone's part, evolving and extending its "Fantastic Days" loyalty programme has allowed it to offer more value, providing free allowances, competitions, and food items. More than adding value to plans, these loyalty programmes work to improve customer's perception of a particular brand, a very important step to improve satisfaction with a service. Then there's eir, whose efforts to blur the lines between telecoms and media has led to the development of a sports channel exclusive to eir customers. eir Sport has been a major success, opening up a new unique selling point for the company, and expanding eir's brand into more places than ever before. For eir, the struggle to retain customers is made so much easier by its sports channel, which is hailed by many to add unparalleled value to plans.

Beyond the issue of loyalty programmes, there is the quality of a network. Vodafone has done an outstanding job of morphing a premium image around its brand in Ireland. The quality of its network is the sole contributor to this, the company is rightly perceived as having the best network in this country. Having that kind of reputation has allowed Vodafone to maintain higher prices than its competitors, offset by the narrative that you must more for quality. Customer retention is made simpler with a better network, and Vodafone is a prime example of this phenomenon. In fact, ComReg routinely finds Vodafone to be the network with the least number of complaints relating to service issues, and that is directly tied to customer satisfaction.

Can you relate to a poor customer care experience with any of Ireland's mobile providers, because I sure can? The importance of fast, versatile and helpful customer support cannot be understated. Any company that is providing a sub-par customer care experience is committing a major mistake which will have severe co

How might a mobile provider endeavor to improve its churn rate, and in turn, switch from a growth model to retention? First and foremost, developing unique and valuable services that enhance the customer experience without adding to the price is a good place to start. A loyalty programme, in which customers are rewarded for staying with the company for an extended period of time, is an extremely effective method when implemented correctly. Three's 3Plus loyalty programme is a perfect example, offering discounts in various shops, restaurants, and cinemas. With 3Plus, the company has found a way to add value to customers plans.

On Vodafone's part, evolving and extending its "Fantastic Days" loyalty programme has allowed it to offer more value, providing free allowances, competitions, and food items. More than adding value to plans, these loyalty programmes work to improve customer's perception of a particular brand, a very important step to improve satisfaction with a service. Then there's eir, whose efforts to blur the lines between telecoms and media has led to the development of a sports channel exclusive to eir customers. eir Sport has been a major success, opening up a new unique selling point for the company, and expanding eir's brand into more places than ever before. For eir, the struggle to retain customers is made so much easier by its sports channel, which is hailed by many to add unparalleled value to plans.

Beyond the issue of loyalty programmes, there is the quality of a network. Vodafone has done an outstanding job of morphing a premium image around its brand in Ireland. The quality of its network is the sole contributor to this, the company is rightly perceived as having the best network in this country. Having that kind of reputation has allowed Vodafone to maintain higher prices than its competitors, offset by the narrative that you must more for quality. Customer retention is made simpler with a better network, and Vodafone is a prime example of this phenomenon. In fact, ComReg routinely finds Vodafone to be the network with the least number of complaints relating to service issues, and that is directly tied to customer satisfaction.

Can you relate to a poor customer care experience with any of Ireland's mobile providers, because I sure can? The importance of fast, versatile and helpful customer support cannot be understated. Any company that is providing a sub-par customer care experience is committing a major mistake which will have severe co

Bundling Services is a Difficult but Rewarding Task

Bundling services such as mobile, broadband and TV (dual, triple and quad-play) is a powerful method for a company to retain highly lucrative customers for a very long time. When a customer receives multiple services from the same company, the process of leaving becomes more troublesome, acting as a deterrent for many. For this reason, companies such as Vodafone, Virgin Media and eir have been eager to develop these bundled services.

When a customer accesses many services from a company such as eir, there is a unique opportunity to shape the experience in a more profound way as the company gains greater control over the different mediums, providing the potential to improve this experience thanks to increased data about customer's usage habits. As well as this, when a customer is exposed to the brand for a longer duration and for a greater proportion of products, their relationship of trust grows to a point where they are willing to stay, even in lieu of service issues or price hikes.

Obviously, the APRU climbs quite substantially when services are bundled, as multiple revenue streams are brought under one company. This a primary reason why such services are so powerful and lucrative.

When a customer accesses many services from a company such as eir, there is a unique opportunity to shape the experience in a more profound way as the company gains greater control over the different mediums, providing the potential to improve this experience thanks to increased data about customer's usage habits. As well as this, when a customer is exposed to the brand for a longer duration and for a greater proportion of products, their relationship of trust grows to a point where they are willing to stay, even in lieu of service issues or price hikes.

Obviously, the APRU climbs quite substantially when services are bundled, as multiple revenue streams are brought under one company. This a primary reason why such services are so powerful and lucrative.

Conclusion: Drifting from Growth to Retention

As a summary, with an Irish mobile market entering the mature and saturated stages of its life cycle, mobile providers have been forced to gravitate towards a business model that puts growth in the shadow of customer retention. It is no longer viable to add subscribers quarter after quarter without incurring significant expenses from aggressive marketing.

Vodafone acts as an example, a company which has long forgotten about strong growth and now prioritises customer retention, a low churn rate, and high APRU. Three is in the early stages of this transition, a transition which will completely shake up how the company approaches marketing and price points. Retaining customers is no easy task, and will only be achieved by enhancing existing services and developing new ones which add value to customer's plans.

Vodafone acts as an example, a company which has long forgotten about strong growth and now prioritises customer retention, a low churn rate, and high APRU. Three is in the early stages of this transition, a transition which will completely shake up how the company approaches marketing and price points. Retaining customers is no easy task, and will only be achieved by enhancing existing services and developing new ones which add value to customer's plans.