The Struggle to Monetise Data

How can we monetise something that, by nature, should be unlimited?

Published 29/10/18

The existence of "unlimited data plans" for your smartphone is nothing new, and in fact, Irish consumers began to enjoy a mobile experience without limits as far back as ten years ago. Year after year, the continued progression of technology has introduced innovative applications and services for a device that, fundamentally, remains the same as the one Steve Jobs euphorically revealed in 2007.

But, the one thing that has changed, on a seismic scale, is the capacity and speed of our mobile networks. Heck, sending an email, which is now considered an incredibly simple task, was once something that took several minutes or, in some cases, hours on a cripplingly slow 2G connection. The exponential uplift in network performance has been met with an equally rapid surge in data traffic generated by our smartphones. For many people, the smartphone represents their only way of connecting to the Internet, the only computer that they require in their lives.

So, while we guzzle more and more data every year, forcing mobile providers to spend big on capacity upgrades to their networks, we also expect less expensive mobile plans. The two may appear incompatible because capitalism has thought us that if we want more of something, we need to fork out more money for it. With data, that simply isn't the case, as the cost per megabyte reaches an all-time low and the cost to upgrade our nationwide networks to 5G enters scary territory. That leaves us, consumers, and our mobile providers with a dilemma: how can we monetise something that, by nature, should be unlimited?

But, the one thing that has changed, on a seismic scale, is the capacity and speed of our mobile networks. Heck, sending an email, which is now considered an incredibly simple task, was once something that took several minutes or, in some cases, hours on a cripplingly slow 2G connection. The exponential uplift in network performance has been met with an equally rapid surge in data traffic generated by our smartphones. For many people, the smartphone represents their only way of connecting to the Internet, the only computer that they require in their lives.

So, while we guzzle more and more data every year, forcing mobile providers to spend big on capacity upgrades to their networks, we also expect less expensive mobile plans. The two may appear incompatible because capitalism has thought us that if we want more of something, we need to fork out more money for it. With data, that simply isn't the case, as the cost per megabyte reaches an all-time low and the cost to upgrade our nationwide networks to 5G enters scary territory. That leaves us, consumers, and our mobile providers with a dilemma: how can we monetise something that, by nature, should be unlimited?

The Devil is in the Data

Anyone remotely familiar with the Irish telecoms industry will have predicted my use of Three in this article. After all, Three is the network that pioneered large and unlimited data allowances in this country, and in markets across the world. Let's not fluff the words, Three has revolutionised the Irish mobile market with its "All you can Eat Data" plans, allowing Irish consumers to enjoy data at a cost per megabyte that is amongst the lowest on this continent. In fact, the Three effect has been so powerful and so far-reaching that it is now considered unusual for a mobile provider not to offer an unlimited data plan. Yes, Vodafone, you are an outlier on this topic.

With the company's unlimited philosophy, Three has driven down the price of data in Ireland far beyond what it would have been without its presence here. But, while Finnegan is happy for you to indulge in as much Netflix as you like on your smartphone, tethering that connection to your laptop or Xbox is a big no-no on Three. And there's a simple reason for this, Finnegan understands true unlimited data would decimate his business plan, that is, to make a profit. Sure, the proportion of profits that Three garners from data are markedly lower than those flaunted by the data grinch, Vodafone, but the company still relies on what I would deem "aggressive" tactics to perk up its revenues.

Are you one of the poor suckers who managed to achieve the impossible, surpass Three's "unlimited data"? Well, if you are, I'm sure the scar you endured is still fresh in your mind. Get this, while Three's mobile plans in Ireland are some of the least expensive in the developed world, on a cost per megabyte basis, the out-of-bundle charges that the company inflicts are exorbitant, and make Vodafone look like a network for penny-pinchers.

Three is the perfect analogy for the point that I am trying to put across in this article, our mobile providers are slowly but surely losing the battle to monetise data, leaving them searching frantically for another means by which they can prevent spooking out their shareholders. For Three, as I've explained, this has partly involved implementing a stringent out-of-bundle pricing policy, something that shouldn't exist if their so-called unlimited data was actually unlimited.

The same can said about the company's rather controversial approach to roaming, which caused quite a stir in the media landscape when the EU heroically introduced new rules to abolish roaming fees across Europe from June of 2017. Rather than bow to the new precedent which the EU set for a roam-like home Europe, a precedent which Vodafone has adopted and taken in its stride, Three decided it would continue to implement differentiated caps for roaming. By that, I mean, if you are a Three customer and you travel across Europe, you will not have access to unlimited data. The data allowance that you will receive will be multiple times smaller than the 60GB fair usage policy, and if you decide to breach it while roaming, get ready for an assault on your wallet.

The change in EU roaming regulations has had a noticeable impact on Three's earnings, so much so that the company attributed the changes to a steep drop-off in revenue coming from data charges. However, they have found what I would classify as a loophole that allows them to offer dramatically smaller data allowances while roaming in Europe, and reap more out-of-bundle charges than if they were forced to offer the domestic unlimited data allowance abroad.

However, what strikes me is the realisation that Three's unlimited proposition, as wonderful as it is for customers, leaves the company limited to little wiggle room in the future. For example, it would be inconceivable that the company could ever perform a u-turn and reintroduce hard caps on domestic data allowances, because not only would it infuriate customers, it would undermine Three's entire brand and marketing efforts.

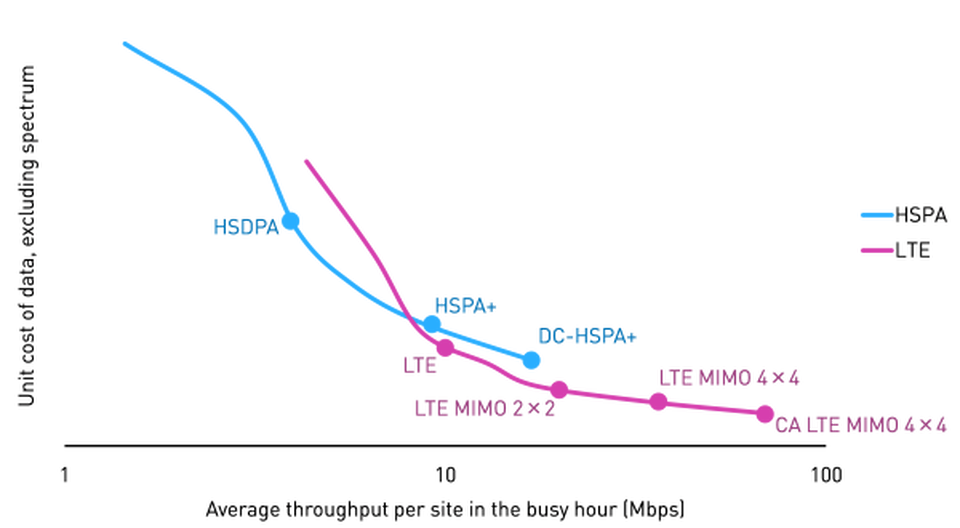

What is on Three's side, however, is the continued downfall in the cost of providing data. With each generational leap of wireless standards, there are huge trimmings to how much it costs a mobile provider to actually facilitate data traffic. So, while data traffic is increasing rapidly, the cost of providing that data is plummeting. It is a directly proportional relationship that Three has, up until this point, mastered. But, mobile providers are also witnessing an erosion of revenues from other areas such as SMS, so relying solely on data would be an incredibly risky move.

With the company's unlimited philosophy, Three has driven down the price of data in Ireland far beyond what it would have been without its presence here. But, while Finnegan is happy for you to indulge in as much Netflix as you like on your smartphone, tethering that connection to your laptop or Xbox is a big no-no on Three. And there's a simple reason for this, Finnegan understands true unlimited data would decimate his business plan, that is, to make a profit. Sure, the proportion of profits that Three garners from data are markedly lower than those flaunted by the data grinch, Vodafone, but the company still relies on what I would deem "aggressive" tactics to perk up its revenues.

Are you one of the poor suckers who managed to achieve the impossible, surpass Three's "unlimited data"? Well, if you are, I'm sure the scar you endured is still fresh in your mind. Get this, while Three's mobile plans in Ireland are some of the least expensive in the developed world, on a cost per megabyte basis, the out-of-bundle charges that the company inflicts are exorbitant, and make Vodafone look like a network for penny-pinchers.

Three is the perfect analogy for the point that I am trying to put across in this article, our mobile providers are slowly but surely losing the battle to monetise data, leaving them searching frantically for another means by which they can prevent spooking out their shareholders. For Three, as I've explained, this has partly involved implementing a stringent out-of-bundle pricing policy, something that shouldn't exist if their so-called unlimited data was actually unlimited.

The same can said about the company's rather controversial approach to roaming, which caused quite a stir in the media landscape when the EU heroically introduced new rules to abolish roaming fees across Europe from June of 2017. Rather than bow to the new precedent which the EU set for a roam-like home Europe, a precedent which Vodafone has adopted and taken in its stride, Three decided it would continue to implement differentiated caps for roaming. By that, I mean, if you are a Three customer and you travel across Europe, you will not have access to unlimited data. The data allowance that you will receive will be multiple times smaller than the 60GB fair usage policy, and if you decide to breach it while roaming, get ready for an assault on your wallet.

The change in EU roaming regulations has had a noticeable impact on Three's earnings, so much so that the company attributed the changes to a steep drop-off in revenue coming from data charges. However, they have found what I would classify as a loophole that allows them to offer dramatically smaller data allowances while roaming in Europe, and reap more out-of-bundle charges than if they were forced to offer the domestic unlimited data allowance abroad.

However, what strikes me is the realisation that Three's unlimited proposition, as wonderful as it is for customers, leaves the company limited to little wiggle room in the future. For example, it would be inconceivable that the company could ever perform a u-turn and reintroduce hard caps on domestic data allowances, because not only would it infuriate customers, it would undermine Three's entire brand and marketing efforts.

What is on Three's side, however, is the continued downfall in the cost of providing data. With each generational leap of wireless standards, there are huge trimmings to how much it costs a mobile provider to actually facilitate data traffic. So, while data traffic is increasing rapidly, the cost of providing that data is plummeting. It is a directly proportional relationship that Three has, up until this point, mastered. But, mobile providers are also witnessing an erosion of revenues from other areas such as SMS, so relying solely on data would be an incredibly risky move.

The Data Grinch stands Strong

As a polar opposite to Three, Vodafone has stood firmly with its portfolio of plans which, for the most part, offer tiny data allowances in comparison. This has allowed Vodafone to reign as the king of data monetisation in Ireland because it is the only mobile provider that can rely on its current revenues from data charges going into the future. That gives Vodafone the leeway which Three would aspire to, for example, the company has abolished roaming charges across the continent of Europe and allows every customer to utilise their full domestic allowance of calls, texts and data anywhere on the continent. Besides the obvious perks that its large global presence introduces, Vodafone has been able to do this because the company is not as reliant on roaming charges as Three is.

It is pretty obvious that the company will have to boost its data allowances at some point to prevent a mass exodus of customers, but I think Vodafone already knows and understands that. In fact, previous trends have shown that Vodafone is an expert in finding a balance between how much data to give and how much money to charge for it. As a quick example, just over a year ago, the company announced a wide-spread makeover of its mobile plans that involved pushing the data allowances higher by several gigabytes. At the time, Vodafone was experiencing an outflow of predominantly low-paying prepay customers to competitors for the precise reason of tiny data allowances. Seeing this, the company implemented the explained changes, and voilà, there has been a quarterly increase in the number of mobile customers ever since.

This is a never-ending cycle. Vodafone's data allowances become unfit for people's use cases as new services are developed, and customers leave, then the company loosens the restrictions, and people drift back. Call this greedy if you will, but one thing is for sure, it is good business and the primary reason why Vodafone remains the most profitable mobile provider on this island.

The higher cost per megabyte of data on Vodafone has also afforded the company other liberties that are a relic of the past with Three, namely, the ability to use your device as a mobile hotspot. Big Red can support this feature because they know that there is a very finite limit to your usage, meaning it will have a very minimal impact on the performance of their network, and they will earn lucrative out-of-bundle charges when you exceed the limit.

So, while the cost of facilitating data traffic plunges, Vodafone isn't passing those savings on to customers, as the cost of its plans has remained stagnant for quite some time now. Yet, on a broader scale, Big Red has struggled to grow its revenues as areas of the business begin to wither, such as revenues from calls and SMS. The company has also found itself splurging on loyalty programmes intended to maintain its customer base and improve customer retention.

And this trend is replicated across the telecoms industry as a whole, with huge companies finding themselves caught in the headlights of declining revenues. On Vodafone's part, the company certainly hasn't stood still and is indeed proactively diversifying its range of products and services to offset any declines that are arising.

It is pretty obvious that the company will have to boost its data allowances at some point to prevent a mass exodus of customers, but I think Vodafone already knows and understands that. In fact, previous trends have shown that Vodafone is an expert in finding a balance between how much data to give and how much money to charge for it. As a quick example, just over a year ago, the company announced a wide-spread makeover of its mobile plans that involved pushing the data allowances higher by several gigabytes. At the time, Vodafone was experiencing an outflow of predominantly low-paying prepay customers to competitors for the precise reason of tiny data allowances. Seeing this, the company implemented the explained changes, and voilà, there has been a quarterly increase in the number of mobile customers ever since.

This is a never-ending cycle. Vodafone's data allowances become unfit for people's use cases as new services are developed, and customers leave, then the company loosens the restrictions, and people drift back. Call this greedy if you will, but one thing is for sure, it is good business and the primary reason why Vodafone remains the most profitable mobile provider on this island.

The higher cost per megabyte of data on Vodafone has also afforded the company other liberties that are a relic of the past with Three, namely, the ability to use your device as a mobile hotspot. Big Red can support this feature because they know that there is a very finite limit to your usage, meaning it will have a very minimal impact on the performance of their network, and they will earn lucrative out-of-bundle charges when you exceed the limit.

So, while the cost of facilitating data traffic plunges, Vodafone isn't passing those savings on to customers, as the cost of its plans has remained stagnant for quite some time now. Yet, on a broader scale, Big Red has struggled to grow its revenues as areas of the business begin to wither, such as revenues from calls and SMS. The company has also found itself splurging on loyalty programmes intended to maintain its customer base and improve customer retention.

And this trend is replicated across the telecoms industry as a whole, with huge companies finding themselves caught in the headlights of declining revenues. On Vodafone's part, the company certainly hasn't stood still and is indeed proactively diversifying its range of products and services to offset any declines that are arising.

The Quest to unlock New Revenue Streams

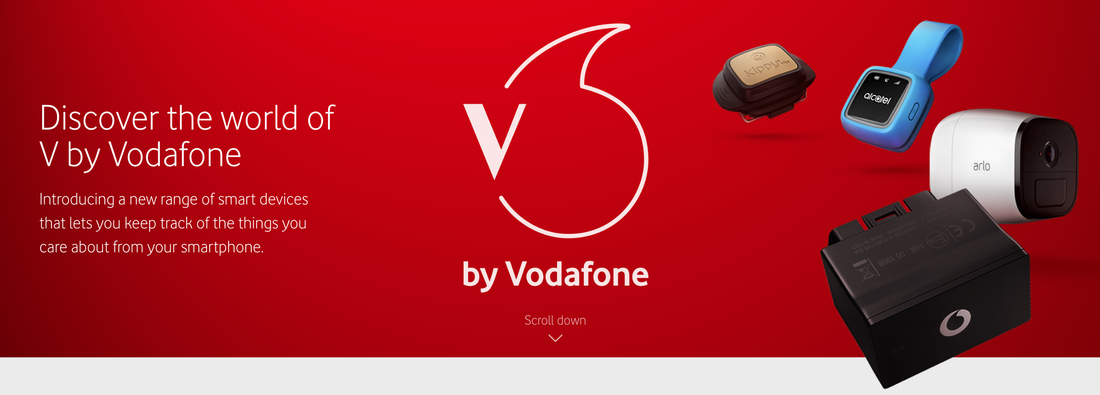

Unlocking new revenue streams is a difficult task, and in most cases, it forces companies to break the status-quo and innovate. The rewards of diversification are tantalising, especially when a company implements a plan before it is too late. For Vodafone, diversification has involved ploughing resources into the development of a dedicated IoT network and backing the NB-IoT standard with gigantic marketing budgets that are designed to inform consumers of how the IoT will radically transform their lives.

The fruits of that effort are yet to be realised, and I remain sceptical of the company's recently launched V by Vodafone IoT portfolio in its current state. The range of IoT devices, which includes a tracker for your car and child, makes use of Vodafone's existing 3G/4G cellular network. In summary, this translates to lacklustre battery life performance and a costly monthly subscription fee (€2.99). Don't get me wrong, I am thrilled that a company as large as Vodafone is pushing the IoT, something that I personally believe has huge potential to revolutionise our society. Unfortunately, I think the company should be advancing its NB-IoT network first, as this network is purpose-built for IoT applications and delivers significantly enhanced battery life (in the range of years) and reliability compared to an existing cellular network.

The V by Vodafone portfolio, if successful, will replace revenues from services such as SMS over time. This is a typical example of a company on a quest to unlock new revenue streams. But, it doesn't stop there, as we are seeing the same phenomenon across the entire telecoms landscape in Ireland.

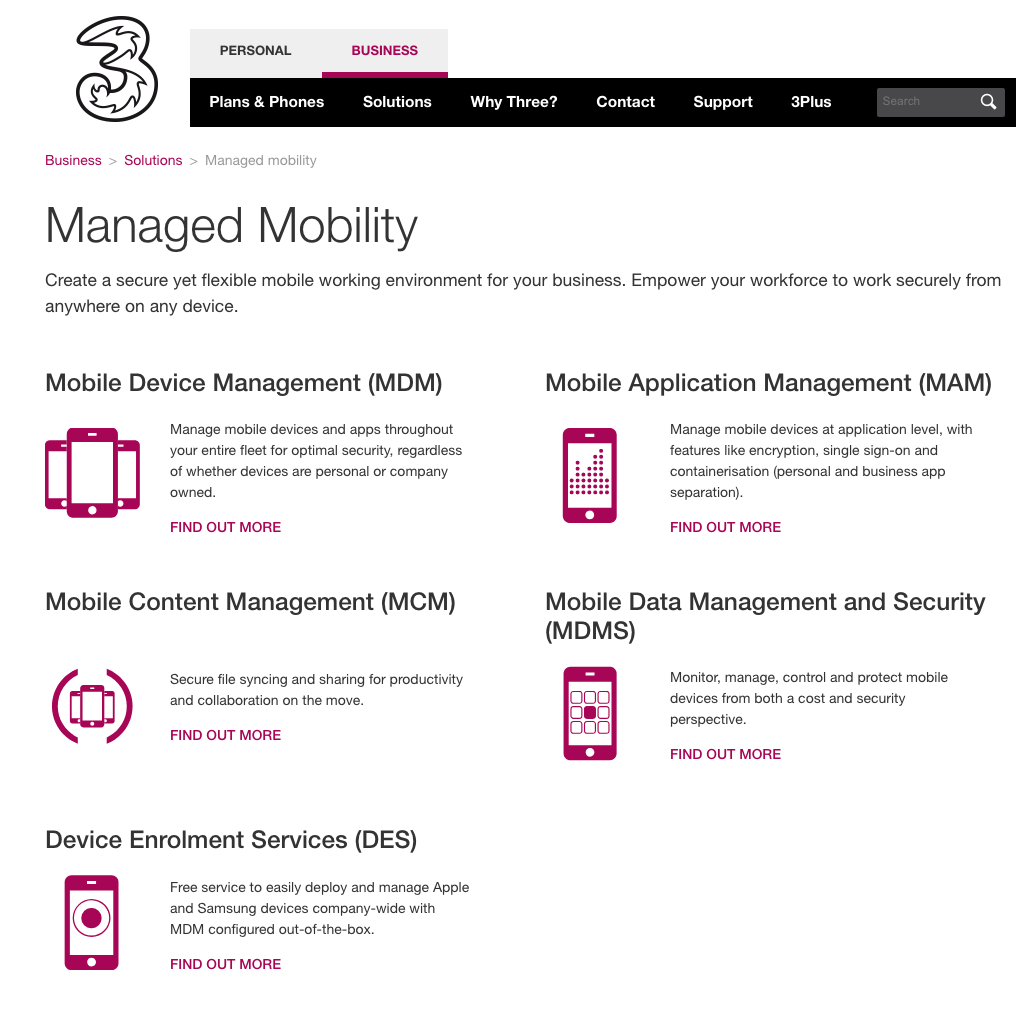

Three and eir have worked expeditiously to enhance their existing services with the hope of attracting new customers and encouraging existing ones to pay more for add-ons. These endeavours are most visible in the business division of each respective company, where Three has managed to develop a slew of services designed specifically to meet the needs of business customers. Going forward, the companies don't intend to merely provide mobile or broadband services for their customers, they intend to control and operate a multitude of solutions such as enhanced Unified Communications (UC).

Three's variety of solutions for businesses is vast and continues to grow, with 3Connect for UC and Managed Colocation for storing data in the company's state of the art Irish data centre (operated by Equinix), being just the tip of an enormous iceberg. The key point is that all of these solutions are accessible by businesses, at an additional monthly price. This is a method in which Three can increase its revenues from business customers without the need to increase prices or make negative changes to existing services.

The fruits of that effort are yet to be realised, and I remain sceptical of the company's recently launched V by Vodafone IoT portfolio in its current state. The range of IoT devices, which includes a tracker for your car and child, makes use of Vodafone's existing 3G/4G cellular network. In summary, this translates to lacklustre battery life performance and a costly monthly subscription fee (€2.99). Don't get me wrong, I am thrilled that a company as large as Vodafone is pushing the IoT, something that I personally believe has huge potential to revolutionise our society. Unfortunately, I think the company should be advancing its NB-IoT network first, as this network is purpose-built for IoT applications and delivers significantly enhanced battery life (in the range of years) and reliability compared to an existing cellular network.

The V by Vodafone portfolio, if successful, will replace revenues from services such as SMS over time. This is a typical example of a company on a quest to unlock new revenue streams. But, it doesn't stop there, as we are seeing the same phenomenon across the entire telecoms landscape in Ireland.

Three and eir have worked expeditiously to enhance their existing services with the hope of attracting new customers and encouraging existing ones to pay more for add-ons. These endeavours are most visible in the business division of each respective company, where Three has managed to develop a slew of services designed specifically to meet the needs of business customers. Going forward, the companies don't intend to merely provide mobile or broadband services for their customers, they intend to control and operate a multitude of solutions such as enhanced Unified Communications (UC).

Three's variety of solutions for businesses is vast and continues to grow, with 3Connect for UC and Managed Colocation for storing data in the company's state of the art Irish data centre (operated by Equinix), being just the tip of an enormous iceberg. The key point is that all of these solutions are accessible by businesses, at an additional monthly price. This is a method in which Three can increase its revenues from business customers without the need to increase prices or make negative changes to existing services.

How Sustainable is the Current Path?

Mobile providers can continue to rely on revenues from data, SMS, calls and other services to satisfy their shareholders. But the clinching point is hurtling towards us, and if preemptive action isn't taken to lessen the impact that will be the complete decimation of revenues from the above services, a bleak future awaits these companies.

Vodafone's long-standing lead in APRU has allowed it to invest in a superior network on this island, while Three's action to open the floodgates on unlimited data means the need for sustainable revenue alternatives will arrive in the very near future.

V by Vodafone, apart from being one of the first consumer-focused IoT ranges, represents an opportunity for the company to diversify its business before the comet hits, rather than after. It is an attempt to test people's willingness to pay for an additional monthly service, on top of their existing mobile bill. Not only will this work to solidify customer retention, but it will also inadvertently catapult Vodafone into the realm of the IoT challenges, which introduces far-reaching concerns with it, not least relating to privacy.

Three's approach has been to groom its portfolio of businesses services and solutions that go far beyond 4G connectivity. Three wants to be your cloud, your data centre and your safe keeper on the Internet. Whether today's security-conscious companies will be willing to access all of their services from one company remains to be seen and it will undoubtedly multiply the number of complexities that exist within Three, a mobile provider at their core, not a technology company.

We can expect to see more attempts by telecom companies going forward to unlock new revenue streams. Just remember this: 5G is cruising to the initial stages of adoption, bringing with it unprecedented capital expenditure requirements, and all the while, APRU crashes to an all-time low. The current path is an unsustainable one, a correction is over the horizon.

Vodafone's long-standing lead in APRU has allowed it to invest in a superior network on this island, while Three's action to open the floodgates on unlimited data means the need for sustainable revenue alternatives will arrive in the very near future.

V by Vodafone, apart from being one of the first consumer-focused IoT ranges, represents an opportunity for the company to diversify its business before the comet hits, rather than after. It is an attempt to test people's willingness to pay for an additional monthly service, on top of their existing mobile bill. Not only will this work to solidify customer retention, but it will also inadvertently catapult Vodafone into the realm of the IoT challenges, which introduces far-reaching concerns with it, not least relating to privacy.

Three's approach has been to groom its portfolio of businesses services and solutions that go far beyond 4G connectivity. Three wants to be your cloud, your data centre and your safe keeper on the Internet. Whether today's security-conscious companies will be willing to access all of their services from one company remains to be seen and it will undoubtedly multiply the number of complexities that exist within Three, a mobile provider at their core, not a technology company.

We can expect to see more attempts by telecom companies going forward to unlock new revenue streams. Just remember this: 5G is cruising to the initial stages of adoption, bringing with it unprecedented capital expenditure requirements, and all the while, APRU crashes to an all-time low. The current path is an unsustainable one, a correction is over the horizon.