The MVNO Flop: Why Ireland's MVNOs have failed to make an impact

Ireland's Mobile Virtual Network Operators are struggling to earn a profit, and here's why.

Published 02/08/18

The mobile market in Ireland is one of the most successful in Europe, with prices for pay as you go and bill pay plans being some of the least expensive out there. Whats more, we enjoy some of the largest data allowances on this continent. In the past, markets that had more individual competitors were seen as, well, more competitive. But if that was the case today, the mobile market in Ireland would be perceived as a major flop. In fact, there are really only three major mobile networks in Ireland, down from four just a few years ago.

There are a handful of smaller players, called Mobile Virtual Network Operators (MVNOs), that piggyback on the networks of Vodafone and Three. But these MVNOs have never managed to take off, never managed to put a dent in the customer base of the market leaders. But is that a problem? Does that mean the Irish market is less competitive than other countries where MVNOs enjoy a healthy portion of profits from mobile users?

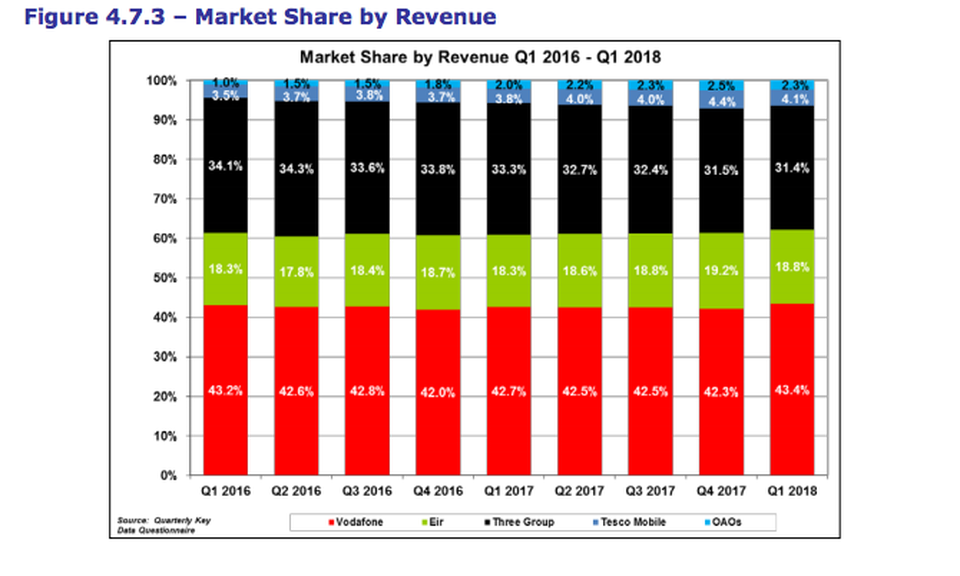

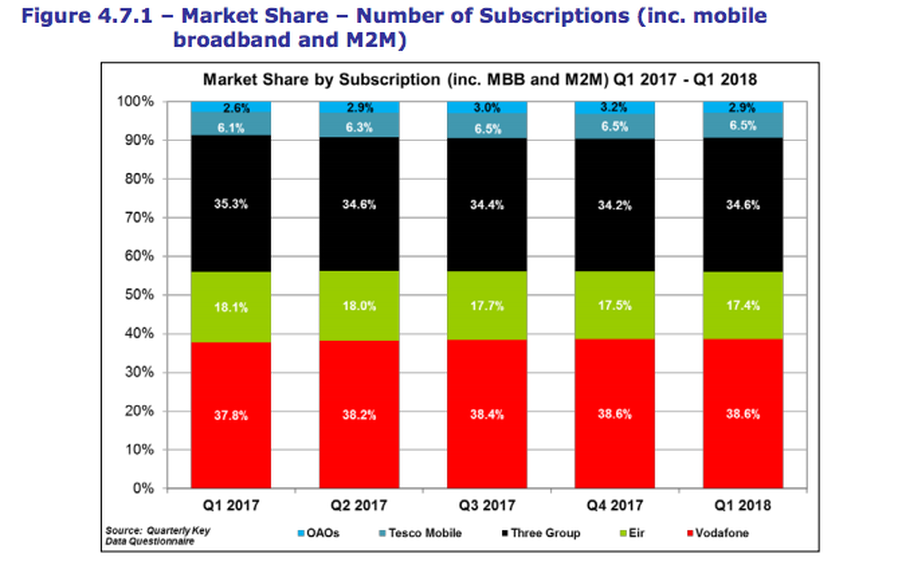

To gain a greater insight into this, we need to look at the statistics from ComReg's most recent report on the Irish market. Sure enough, the data paints a dismal picture for Irish MVNOs. Combined, MVNOs account for 9.4% of mobile subscriptions, however, their revenue makes up just 6.4% of the market. Based on this data, it is clear that MVNOs earn less revenue per user than their larger rivals. This is the reason they've struggled to grow.

The data is very worrying for MVNOs when we compare this quarter with that of previous years. Both the market share by revenue and subscriptions has fallen for Ireland's MVNOs.

There are a handful of smaller players, called Mobile Virtual Network Operators (MVNOs), that piggyback on the networks of Vodafone and Three. But these MVNOs have never managed to take off, never managed to put a dent in the customer base of the market leaders. But is that a problem? Does that mean the Irish market is less competitive than other countries where MVNOs enjoy a healthy portion of profits from mobile users?

To gain a greater insight into this, we need to look at the statistics from ComReg's most recent report on the Irish market. Sure enough, the data paints a dismal picture for Irish MVNOs. Combined, MVNOs account for 9.4% of mobile subscriptions, however, their revenue makes up just 6.4% of the market. Based on this data, it is clear that MVNOs earn less revenue per user than their larger rivals. This is the reason they've struggled to grow.

The data is very worrying for MVNOs when we compare this quarter with that of previous years. Both the market share by revenue and subscriptions has fallen for Ireland's MVNOs.

iD Mobile's struggles depict a Ruthless Market

Dixons Carphone Warehouse launched their own MVNO in 2015, piggybacking on the newly combined Three and O2 network, and embarked on a marketing campaign that involved offering huge data allowances at low prices. This is the issue that all of Ireland's MVNOs are facing, a race to the bottom. Slowly but surely we've seen most of our mobile plans become cheaper. A nice way to put this is: cheap plans are getting good, and good plans are getting cheap. Think about that for a second.

If our mobile plans are getting cheaper, it tells us two things. We can verify that the market remains highly competitive, a stagnant market would result in rising prices. It also tells us that MVNOs are struggling, fighting fiercely to remain afloat. You see, when prices are low and continue to fall across the entire market, there's really no place for an MVNO.

Contrast this with a market such as Canada where consumers fork out close to €100 every month for data, calls and texts, and its a market that is ripe for an MVNO to make shockwaves. An MVNO can slash their prices, knowing they won't be quite as profitable as their competitors but anticipate a crowd of customers desperate for better prices. This can't be expected in Ireland, it just wouldn't make financial sense to cut prices further without hindering other aspects of the business.

iD Mobile sums up this analysis perfectly. The company waved goodbye to the Irish market this year, after attracting a minuscule amount of customers. The failure of iD Mobile should worry other MVNOs, the network had stores right across the country thanks to its link with Carphone Warehouse. But a strong retail presence was insufficient, outlining the strength of the brands developed by Vodafone, Three and Eir.

If our mobile plans are getting cheaper, it tells us two things. We can verify that the market remains highly competitive, a stagnant market would result in rising prices. It also tells us that MVNOs are struggling, fighting fiercely to remain afloat. You see, when prices are low and continue to fall across the entire market, there's really no place for an MVNO.

Contrast this with a market such as Canada where consumers fork out close to €100 every month for data, calls and texts, and its a market that is ripe for an MVNO to make shockwaves. An MVNO can slash their prices, knowing they won't be quite as profitable as their competitors but anticipate a crowd of customers desperate for better prices. This can't be expected in Ireland, it just wouldn't make financial sense to cut prices further without hindering other aspects of the business.

iD Mobile sums up this analysis perfectly. The company waved goodbye to the Irish market this year, after attracting a minuscule amount of customers. The failure of iD Mobile should worry other MVNOs, the network had stores right across the country thanks to its link with Carphone Warehouse. But a strong retail presence was insufficient, outlining the strength of the brands developed by Vodafone, Three and Eir.

Small Profits mean Small Investments

Irish MVNO's earn so little money from their customers that in most cases, it's just not feasible for them to invest in their business on the same scale that Vodafone or Three does. That can spell disaster from the very start. The reason established players manage to retain customers is the value-added services that they have developed, all services which require investment.

Three provides its customers with an excellent loyalty programme, 3Plus, and also provides a prepaid card service called 3Money. Vodafone's customers enjoy access to a network that boasts unparalleled quality and can also take advantage of the recently introduced Fantastic Days competitions. Meanwhile, Eir's mobile customers can use WiFi Calling, Eir Sport and avail of cheaper plans when they combine their broadband and mobile plan. It's a never-ending ecosystem of rewards and benefits that have taken years to develop, and it requires money and scale, both of which the established players clearly have.

Now let's look at two MVNO's as a comparison. Tesco Mobile's customers can't even access 4G in 2018, that's an outright joke, and customers don't benefit from any form of loyalty programme. Likewise, Virgin Media's mobile division provides little in the form of rewards, all I can think of is free access to Virgin WiFi hubs. This raises the question, why would you choose an MVNO as your mobile provider over a company like Vodafone? These MVNOs refused to invest in their business to provide value-added services for customers, and the irony is, these companies themselves will be the big loser, not the customer.

Another point that I would like to make is the fact that MVNOs are a mobile focused operation. In proverbial terms, they've got all their eggs in one basket. This makes them particularly vulnerable to competition, especially when they have no other revenue stream. Vodafone and Eir have a large base of broadband customers that provide added revenue. Three and Vodafone benefit from a large portfolio of business customers and machine to machine subscriptions. With an MVNO such as Tesco Mobile, the only revenue stream they can control is mobile.

Three provides its customers with an excellent loyalty programme, 3Plus, and also provides a prepaid card service called 3Money. Vodafone's customers enjoy access to a network that boasts unparalleled quality and can also take advantage of the recently introduced Fantastic Days competitions. Meanwhile, Eir's mobile customers can use WiFi Calling, Eir Sport and avail of cheaper plans when they combine their broadband and mobile plan. It's a never-ending ecosystem of rewards and benefits that have taken years to develop, and it requires money and scale, both of which the established players clearly have.

Now let's look at two MVNO's as a comparison. Tesco Mobile's customers can't even access 4G in 2018, that's an outright joke, and customers don't benefit from any form of loyalty programme. Likewise, Virgin Media's mobile division provides little in the form of rewards, all I can think of is free access to Virgin WiFi hubs. This raises the question, why would you choose an MVNO as your mobile provider over a company like Vodafone? These MVNOs refused to invest in their business to provide value-added services for customers, and the irony is, these companies themselves will be the big loser, not the customer.

Another point that I would like to make is the fact that MVNOs are a mobile focused operation. In proverbial terms, they've got all their eggs in one basket. This makes them particularly vulnerable to competition, especially when they have no other revenue stream. Vodafone and Eir have a large base of broadband customers that provide added revenue. Three and Vodafone benefit from a large portfolio of business customers and machine to machine subscriptions. With an MVNO such as Tesco Mobile, the only revenue stream they can control is mobile.

Using the Three Network was, and still is, a Mistake

MVNOs such as Tesco Mobile have developed a bad reputation amongst the public, and for good reason, they have used the Three network for the longest time. Anyone who uses the Three network and doesn't live in a city is bound to experience its shortcomings, namely, lacklustre coverage and speeds. The network is improving and is years ahead of its former state, but still can't hold a candle to the quality that Vodafone's customers enjoy. Every MVNO in Ireland uses Three's network, apart from Post Mobile, and this is another reason why customers have been reluctant to switch to an MVNO. In fact, things were so bad at one stage on the Three network that waiting a few hours for an app to update would be commonplace.

There are obvious reasons why MVNOs choose to use Three, the company appears to be more open to allowing others to access its network. Vodafone and Eir are more protective of their network, and that has helped them differentiate their offerings from competitors. I believe that if these MVNOs used the Vodafone network, complaints about the quality of service would be less problematic than they are with Three.

When you have a bad reputation, it's difficult to shake it off, and if there's anyone who knows that, it's Three. To make matters worse, only one MVNO provides 4G access to customers. I'm not kidding, only Virgin Mobile provides 4G access on Three's network. This comes as we hurtle towards the adoption of 5G, the next generation of mobile networks, that promises to catapult our society forward. Simply put, the fact that MVNO's use a network that has historically ranked as the worst in Ireland, and continue to shy away from providing 4G, is indicative of a failure to keep up with the rapid pace of technological change and support consumers demands.

There are obvious reasons why MVNOs choose to use Three, the company appears to be more open to allowing others to access its network. Vodafone and Eir are more protective of their network, and that has helped them differentiate their offerings from competitors. I believe that if these MVNOs used the Vodafone network, complaints about the quality of service would be less problematic than they are with Three.

When you have a bad reputation, it's difficult to shake it off, and if there's anyone who knows that, it's Three. To make matters worse, only one MVNO provides 4G access to customers. I'm not kidding, only Virgin Mobile provides 4G access on Three's network. This comes as we hurtle towards the adoption of 5G, the next generation of mobile networks, that promises to catapult our society forward. Simply put, the fact that MVNO's use a network that has historically ranked as the worst in Ireland, and continue to shy away from providing 4G, is indicative of a failure to keep up with the rapid pace of technological change and support consumers demands.

What effect has the flop had on the Irish Market?

The MVNO flop has had little effect on the Irish market, and that's a good thing. As I've mentioned already, prices are continuing to fall, even on the most expensive of networks (Vodafone). It means that Vodafone, Three and Eir are able to maintain healthy competition by themselves and don't need the stimulation provided by MVNOs. This competitiveness stretches beyond the plans and extends to the network. Three and Eir are currently head to head in terms of coverage and speed, while Vodafone has maintained its position as the market leader.

Eir is losing its share of mobile customers, already the smallest share amongst the major providers. However, I am expecting to see some sweeping changes to Eir's mobile network in the coming months following a change in ownership of the company. Vodafone has managed to stop the bleeding after shedding thousands of customers over the last few years and enjoys the highest revenue per user out there. Three is a transformed company, compared to the disaster it was not so long ago, and the company's brand has appealed to the younger audience who love the offer of unlimited data.

Sky is the largest TV subscription service in Ireland, and has managed to grow its broadband user base faster than any other company here. In the UK, the company has launched its own MVNO on the O2 network, and it remains to be seen if the company will follow suit and do the same here. Sky will be in a pretty good position to launch an MVNO here, as it will be able to provide quad play services in the same way that Eir does, combining mobile, broadband, tv, and landline on one plan.

The mobile market is probably at its healthiest state in a long time, iD Mobile's demise is an example of this. The Three-O2 merger has brought much more competition to Vodafone, and that was so desperately needed. Virgin Mobile will continue to grow its user base, helped by its expanding broadband network. If, and hopefully, when Tesco Mobile allows its customers to use 4G, it will reivigorate the MVNO's growth. The MVNO market isn't dead, it's just experiencing a period of decline and transition.

Eir is losing its share of mobile customers, already the smallest share amongst the major providers. However, I am expecting to see some sweeping changes to Eir's mobile network in the coming months following a change in ownership of the company. Vodafone has managed to stop the bleeding after shedding thousands of customers over the last few years and enjoys the highest revenue per user out there. Three is a transformed company, compared to the disaster it was not so long ago, and the company's brand has appealed to the younger audience who love the offer of unlimited data.

Sky is the largest TV subscription service in Ireland, and has managed to grow its broadband user base faster than any other company here. In the UK, the company has launched its own MVNO on the O2 network, and it remains to be seen if the company will follow suit and do the same here. Sky will be in a pretty good position to launch an MVNO here, as it will be able to provide quad play services in the same way that Eir does, combining mobile, broadband, tv, and landline on one plan.

The mobile market is probably at its healthiest state in a long time, iD Mobile's demise is an example of this. The Three-O2 merger has brought much more competition to Vodafone, and that was so desperately needed. Virgin Mobile will continue to grow its user base, helped by its expanding broadband network. If, and hopefully, when Tesco Mobile allows its customers to use 4G, it will reivigorate the MVNO's growth. The MVNO market isn't dead, it's just experiencing a period of decline and transition.

Please contribute to help keep LukeKehoe.com growing. Thank you.

Explained: Why Telecoms and Media Companies are MergingAs the telecoms market begins to plateau and media companies are under assault from Netflix and Amazon, telecoms and media have resorted to merging to maintain their power.

|