How Fibre is shaping 5G.

The future of a wireless ecosystem hinges on fibre, pixie dust in Ireland.

Published 21/04/2019

In its absence lurks a black hole so cosmic in size that it jolts the very foundations of the modern world, a world in which the touch of a fingertip wields as much power for change as the trigger of a gun. This world is home to a people accustomed to its existence. The sudden wrenching of that existence from them would be, in frank terms, unfathomable.

Those who are not members of the world long to become one, awaiting its arrival in a fashion that resembles a messiah. For them, writhing to be free from oppressive social and economic restrictions is a facet of life.

Describing the current state of connectivity in Ireland is complex. The reflections detailed of our digital divide will be cryptic to those that are fortunate to live in a bubble. This bubble provides them with the liberty to work from home, the power to educate their children and the joy to indulge in modern forms of entertainment. Burst that bubble and you expose the harsh reality of rural Ireland.

Across lands left forgotten, the basic building block of connectivity is missing, not just a block that serves today's needs but one that also promises competency moving forward. In the scenarios explained above, a stark contrast is highlighted, between life with and without access to fibre infrastructure.

You see, categorising access to something that is fundamental to the operation of modern society as a flippant luxury is wrong, on so many different levels. As many in the industry like to articulate, fibre is the lifeblood for every bit of information that moves across the world. Its relevance cascades down in a waterfall effect, supporting both fixed and wireless access networks.

Moving forward, we will witness the development of a directly proportionate relationship between the prolificacy of fibre and that of 5G. Multi-gigabit wireless access networks will not be possible without fibre transport solutions. Likewise, achieving high levels of fibre penetration for fixed broadband will require 5G to exist as a use case, acting as a catalyst for more rapid deployment of fixed fibre infrastructure.

Much has been said about 5G, its implications for fixed offerings and whether pursuing a coverage obligation approach is viable to reduce the digital divide that exists. The latter issue is an important one to consider, especially given the fact that conditions attached to spectrum for mobile use in the past have blatantly failed to stimulate omnipresent coverage availability on this island.

Those who are not members of the world long to become one, awaiting its arrival in a fashion that resembles a messiah. For them, writhing to be free from oppressive social and economic restrictions is a facet of life.

Describing the current state of connectivity in Ireland is complex. The reflections detailed of our digital divide will be cryptic to those that are fortunate to live in a bubble. This bubble provides them with the liberty to work from home, the power to educate their children and the joy to indulge in modern forms of entertainment. Burst that bubble and you expose the harsh reality of rural Ireland.

Across lands left forgotten, the basic building block of connectivity is missing, not just a block that serves today's needs but one that also promises competency moving forward. In the scenarios explained above, a stark contrast is highlighted, between life with and without access to fibre infrastructure.

You see, categorising access to something that is fundamental to the operation of modern society as a flippant luxury is wrong, on so many different levels. As many in the industry like to articulate, fibre is the lifeblood for every bit of information that moves across the world. Its relevance cascades down in a waterfall effect, supporting both fixed and wireless access networks.

Moving forward, we will witness the development of a directly proportionate relationship between the prolificacy of fibre and that of 5G. Multi-gigabit wireless access networks will not be possible without fibre transport solutions. Likewise, achieving high levels of fibre penetration for fixed broadband will require 5G to exist as a use case, acting as a catalyst for more rapid deployment of fixed fibre infrastructure.

Much has been said about 5G, its implications for fixed offerings and whether pursuing a coverage obligation approach is viable to reduce the digital divide that exists. The latter issue is an important one to consider, especially given the fact that conditions attached to spectrum for mobile use in the past have blatantly failed to stimulate omnipresent coverage availability on this island.

5G needs Fibre: The Relationship

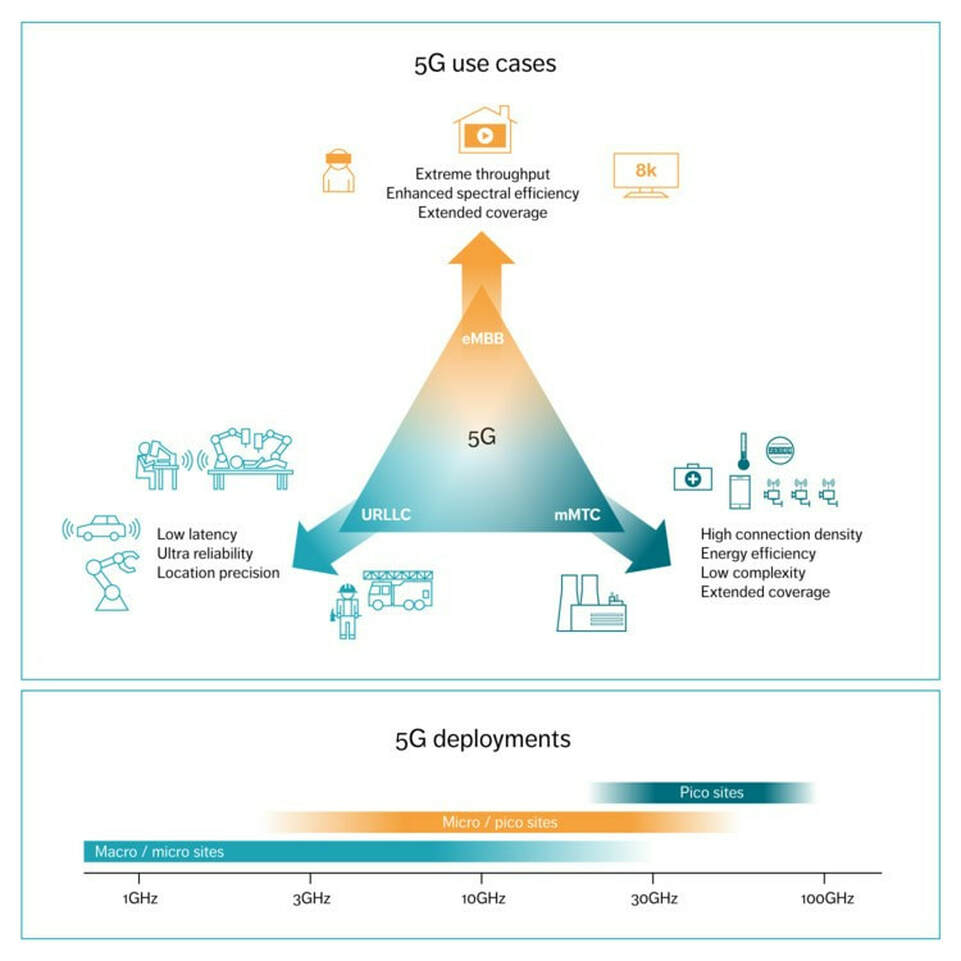

"5G needs fibre, but fibre does not need 5G". A powerful statement that correctly identifies the way in which fibre will shape the path of 5G. However, this same statement also undermines the impending criticality of 5G NR, a breakthrough cellular standard developed by 3GPP to meet the specific requirements of three core use cases: enhanced Mobile Broadband (eMBB), Ultra-Reliable Low-Latency Communication (URLLC) and massive Machine-Type Communication (mMTC).

These core use cases will extrapolate in ways that no one can foresee, mirroring the exponential ecosystem growth experienced by every generation before it. Our move towards a new generation of cellular is empowered by the sense of exasperation that is plaguing today's networks, and a renewed understanding of how we can leverage new technologies and spectrum to radically enhance the wireless experience, in every conceivable metric.

While network requirements vary wildly amongst use cases, features such as high bandwidth and throughput (1Gbps+), low latency (<5ms) and extreme availability (99.99%+) need to be at the forefront of 5G NR deployments. Because, crucially, it is the network characteristics on the RAN that will determine the applicability of 5G for different use cases.

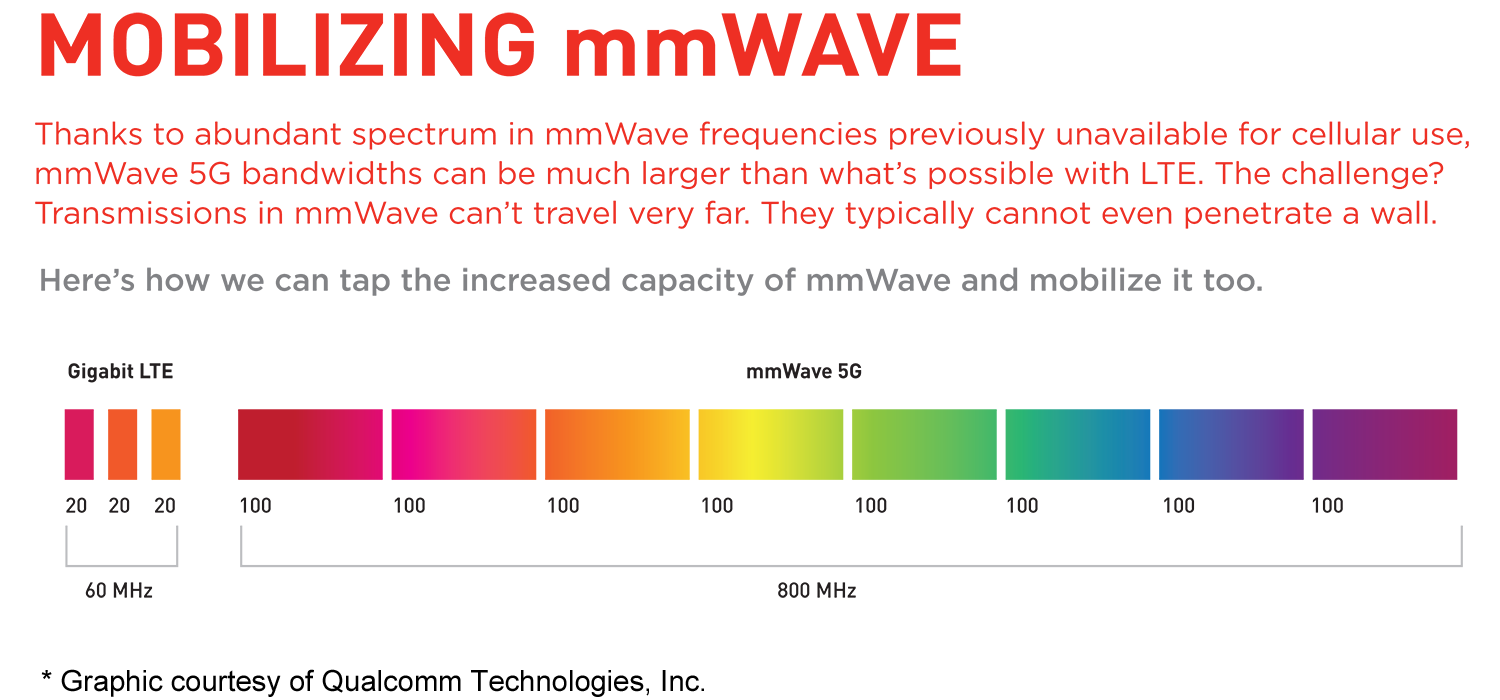

And, now add fibre to that 5G equation. While Radio Access Networks control the "last mile" (or last few metres in the case of mmWave) between a device and gNBs, their performance is impacted profoundly by the networking technology used to link the gNB and to an edge node. Fibre is and will remain the most performant transport solution, and the least expensive one to operate.

These core use cases will extrapolate in ways that no one can foresee, mirroring the exponential ecosystem growth experienced by every generation before it. Our move towards a new generation of cellular is empowered by the sense of exasperation that is plaguing today's networks, and a renewed understanding of how we can leverage new technologies and spectrum to radically enhance the wireless experience, in every conceivable metric.

While network requirements vary wildly amongst use cases, features such as high bandwidth and throughput (1Gbps+), low latency (<5ms) and extreme availability (99.99%+) need to be at the forefront of 5G NR deployments. Because, crucially, it is the network characteristics on the RAN that will determine the applicability of 5G for different use cases.

And, now add fibre to that 5G equation. While Radio Access Networks control the "last mile" (or last few metres in the case of mmWave) between a device and gNBs, their performance is impacted profoundly by the networking technology used to link the gNB and to an edge node. Fibre is and will remain the most performant transport solution, and the least expensive one to operate.

It is the exorbitant capital investment required to increase fibre density at the edge, necessary in a world where small cells will be an important fabric of the RAN, that makes deployment on a massive scale an effective financial suicide for commercial operators in Ireland. Sure, the CapEx intensity of fibre builds is diving for self-built networks and more dark fibre offerings are cropping up for those looking to rent capacity, but rural Ireland is still left floundering.

As one might expect, macrosites and small cells deployed within the veil of urban and suburban regions in Ireland benefit tremendously from simple and cost-effective access to fibre for backhaul. In cases where a site is to be located some distance away from existing fibre infrastructure, dark fibre capacity can be rented via an open-access provider which is present in the region. The operator must then bear the cost of linking its site with fibre to the open access provider's network.

This process has advanced by a substantial degree in recent years, a result that can be attributed to a shifting of investment from fibre distribution to fibre access networks. Achieving fibre density at the edge is a priority for providers such as open eir and SIRO because it allows retailers to sell new products atop a vastly enhanced fixed broadband experience with FTTH.

Obviously, the ballooning of fibre availability at the edge is of direct benefit to mobile operators seeking access to a future-proof backhaul solution. The density of this fibre access will be incredibly important to facilitate densification of the RAN with mmWave small cells, located on every street and within buildings, intended to shift traffic to fixed networks sooner in order to deliver low latency and high throughput.

As one might expect, macrosites and small cells deployed within the veil of urban and suburban regions in Ireland benefit tremendously from simple and cost-effective access to fibre for backhaul. In cases where a site is to be located some distance away from existing fibre infrastructure, dark fibre capacity can be rented via an open-access provider which is present in the region. The operator must then bear the cost of linking its site with fibre to the open access provider's network.

This process has advanced by a substantial degree in recent years, a result that can be attributed to a shifting of investment from fibre distribution to fibre access networks. Achieving fibre density at the edge is a priority for providers such as open eir and SIRO because it allows retailers to sell new products atop a vastly enhanced fixed broadband experience with FTTH.

Obviously, the ballooning of fibre availability at the edge is of direct benefit to mobile operators seeking access to a future-proof backhaul solution. The density of this fibre access will be incredibly important to facilitate densification of the RAN with mmWave small cells, located on every street and within buildings, intended to shift traffic to fixed networks sooner in order to deliver low latency and high throughput.

In a vacuum, demands for the existence of dense fibre access networks would appear to be nonsensical. This is an erroneous belief that must be put to rest. Sure, fibre transport solutions which serve 4G networks in urban and suburban regions perform remarkably well, today. But, in the 5G era, utilisation of mmWave spectrum means each small cell will cast narrower, more focused beams thanks to the emergence of beamforming.

Beamforming is a breakthrough for capacity and scalability on the RAN because it allows operators to deploy a larger number of links in a smaller geographical area. For urban and suburban mobile networks, this paves the way for reduced signal interference between sites, dramatically hastening the rate at which operators can densify their networks.

For example, the beamwidth of a 70GHz link is four times as narrow as that of an 18GHz link, providing up to sixteen times the density. This, combined with other developments such as Massive MIMO, are extraordinary leaps for the mobile industry.

And moving back to the importance of fibre density at the edge, we need to ensure that access infrastructure is in place to support rapid deployment of smalls cells in close proximity to one another. This density of small cells will be required in urban and suburban regions, and the signal attenuation characteristics of mmWave spectrum mean the viability of rural mmWave links will be a distant future.

Beamforming is a breakthrough for capacity and scalability on the RAN because it allows operators to deploy a larger number of links in a smaller geographical area. For urban and suburban mobile networks, this paves the way for reduced signal interference between sites, dramatically hastening the rate at which operators can densify their networks.

For example, the beamwidth of a 70GHz link is four times as narrow as that of an 18GHz link, providing up to sixteen times the density. This, combined with other developments such as Massive MIMO, are extraordinary leaps for the mobile industry.

And moving back to the importance of fibre density at the edge, we need to ensure that access infrastructure is in place to support rapid deployment of smalls cells in close proximity to one another. This density of small cells will be required in urban and suburban regions, and the signal attenuation characteristics of mmWave spectrum mean the viability of rural mmWave links will be a distant future.

Without Fibre, Rural 5G flounders

Boasting pervasive rural mobile coverage in Ireland is difficult, regardless of which band is in use. The mountainous topography and dotting of a population across one-off premises mean covering a high percentage of people (>95%) requires an operator to blanket a large geographical area with coverage.

Unsurprisingly, the costs associated with this are scarily extortionate, and they will only grow as the demand for greater capacity requires the use of mid and high-band spectrum. As it stands today, Irish operators provide 4G services to over 98% of the population, employing a combination of the 800 and 1800MHz bands.

However, when we delve deeper into the 98% population coverage statistic, it becomes eerily apparent that much of this can be achieved by merely blanketing Irish cities and towns. For example, contrasting coverage data from ComReg with census data gathered by the Central Statistics Office (CSO) shows at least 63% of the 98% population coverage threshold can be fulfilled by covering urban areas where there is a population in excess of 1,500.

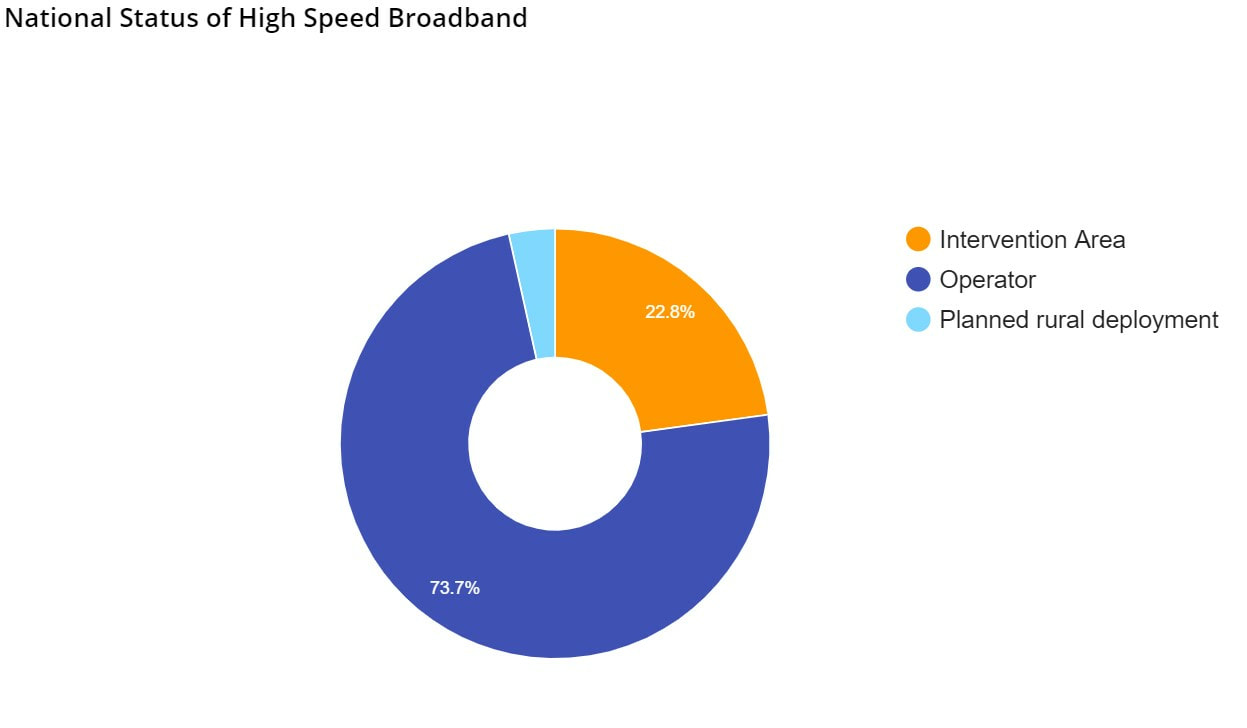

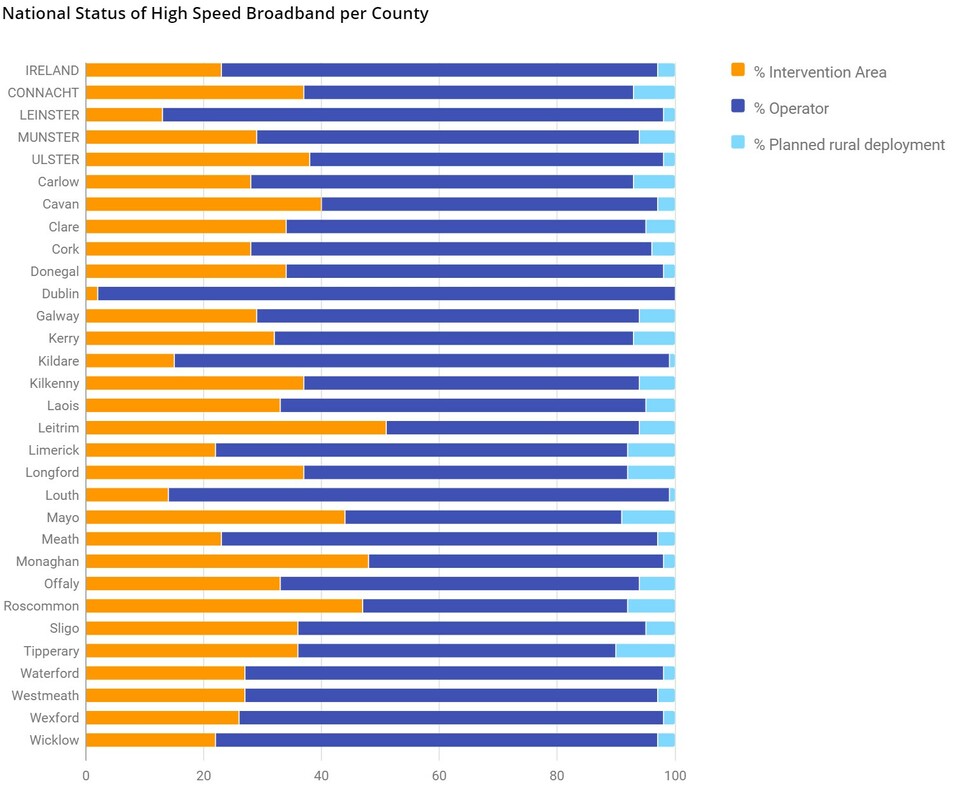

Beyond this, commercial operators have little incentive to provide coverage in rural areas. This is exacerbated by the fact that fixed infrastructure is lacking in rural Ireland. According to the Department of Communications, 26.3% of premises on this island cannot access high-speed broadband, with the highest rates of lacking connectivity identified in rural provinces such as Connacht (44%), Munster (35%) and Ulster (40%).

Unsurprisingly, the costs associated with this are scarily extortionate, and they will only grow as the demand for greater capacity requires the use of mid and high-band spectrum. As it stands today, Irish operators provide 4G services to over 98% of the population, employing a combination of the 800 and 1800MHz bands.

However, when we delve deeper into the 98% population coverage statistic, it becomes eerily apparent that much of this can be achieved by merely blanketing Irish cities and towns. For example, contrasting coverage data from ComReg with census data gathered by the Central Statistics Office (CSO) shows at least 63% of the 98% population coverage threshold can be fulfilled by covering urban areas where there is a population in excess of 1,500.

Beyond this, commercial operators have little incentive to provide coverage in rural areas. This is exacerbated by the fact that fixed infrastructure is lacking in rural Ireland. According to the Department of Communications, 26.3% of premises on this island cannot access high-speed broadband, with the highest rates of lacking connectivity identified in rural provinces such as Connacht (44%), Munster (35%) and Ulster (40%).

To add clarity to the fundamental meaning of"high-speed broadband", the Department of Communications has upgraded its bandwidth threshold from at least 30Mbps to 150Mbps. This is something that can only be delivered, in a reliable and future-proof manner, by fibre. As such, the above figures referring to the availability of high-speed broadband relate exclusively to the presence of fixed services.

Enhanced Mobile Broadband (eMBB) is a core use case of 5G, as mentioned earlier, and it is one that will be of particular interest to people in rural Ireland. Unfortunately, the target market for this use case will also be the most difficult one to reach.

You see, eMBB can only function with a network that provides sufficient capacity, requiring the deployment of bands such as 3.6GHz and higher.

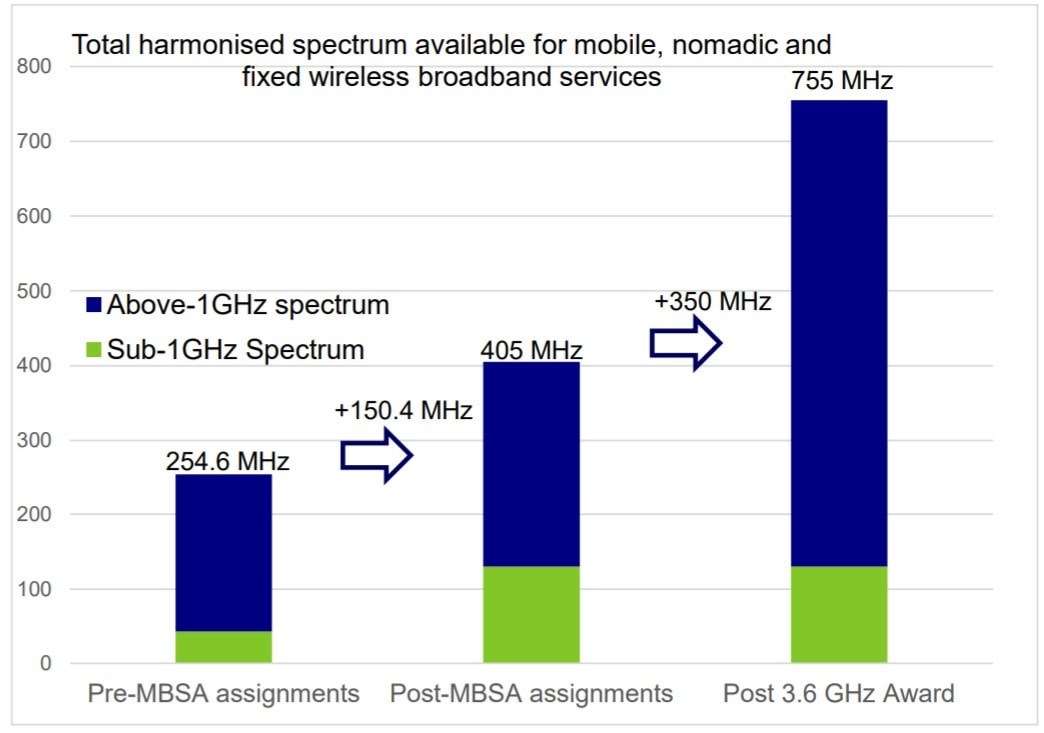

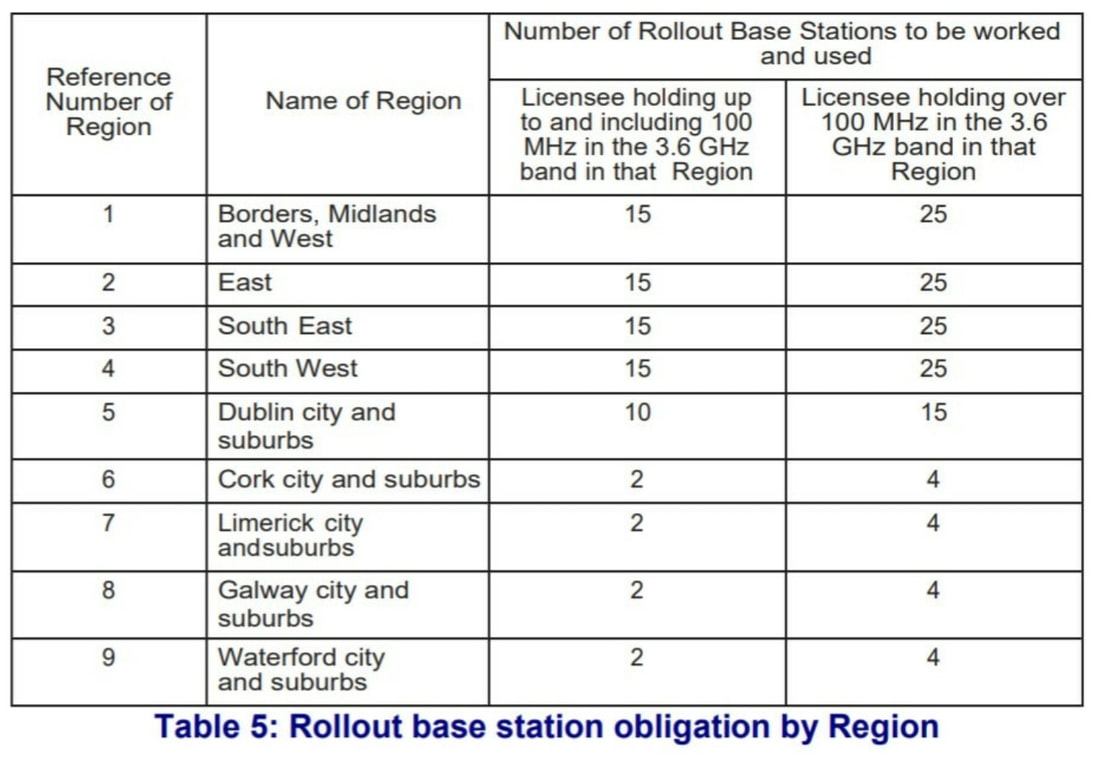

For rural 4G deployment, usage of the 800MHz band has been preferred by operators because the rate at which SINR degrades is lower than that with the 1800MHz band. In Ireland, 3.6GHz will be the pioneer mid-band for 5G deployments, and ComReg released 350MHz of this TDD spectrum in 2017 to operators including eir, Three and Vodafone.

Of course, the signal attenuation experienced by the 3.6GHz band will be greater than that with low-band spectrum. However, operators can mitigate this issue with Massive MIMO, a fascinating innovation that leverages dozens if not hundreds of antennas to improve the reliability of wireless links, enhancing signal quality at the cell edge.

In fact, the power of Massive MIMO is to the extent that site grids which broadcast within the 3.6GHz band can provide a similar level of coverage to 1800MHz and 2100MHz bands. This can dramatically reduce the cost of deploying the band in rural Ireland while maintaining a similar level of performance than if the site grid were denser.

Enhanced Mobile Broadband (eMBB) is a core use case of 5G, as mentioned earlier, and it is one that will be of particular interest to people in rural Ireland. Unfortunately, the target market for this use case will also be the most difficult one to reach.

You see, eMBB can only function with a network that provides sufficient capacity, requiring the deployment of bands such as 3.6GHz and higher.

For rural 4G deployment, usage of the 800MHz band has been preferred by operators because the rate at which SINR degrades is lower than that with the 1800MHz band. In Ireland, 3.6GHz will be the pioneer mid-band for 5G deployments, and ComReg released 350MHz of this TDD spectrum in 2017 to operators including eir, Three and Vodafone.

Of course, the signal attenuation experienced by the 3.6GHz band will be greater than that with low-band spectrum. However, operators can mitigate this issue with Massive MIMO, a fascinating innovation that leverages dozens if not hundreds of antennas to improve the reliability of wireless links, enhancing signal quality at the cell edge.

In fact, the power of Massive MIMO is to the extent that site grids which broadcast within the 3.6GHz band can provide a similar level of coverage to 1800MHz and 2100MHz bands. This can dramatically reduce the cost of deploying the band in rural Ireland while maintaining a similar level of performance than if the site grid were denser.

Far-reaching restrictions are attached to the use of mid and high-band spectrum for access networks, with the density of sites required to cover a large geographical area growing exponentially as we enter mmWave territory such as 26GHz. This evolution of the site grid impacts deployment costs as the need for fibre at the edge will intensify.

These signal attenuation challenges must be understood before we hail 5G as a saving grace for connectivity-deprived rural Ireland. The complete lack of fixed infrastructure, in many cases, renders a 5G rollout not commercially viable for private operators. Remember, low-bands such as 700MHz will not be fit for purpose and only act as a short-term band-aid for a problem that will plague generations to come.

Supporting schemes which increase fibre penetration in Ireland is as important for fixed broadband as it is for our path to 5G. The extension of dark fibre networks beyond the realm of urban regions will be pivotal in bridging the digital divide, and this effort should form part of the National Broadband Plan and projects to extend the catchment of MANs on this island.

These signal attenuation challenges must be understood before we hail 5G as a saving grace for connectivity-deprived rural Ireland. The complete lack of fixed infrastructure, in many cases, renders a 5G rollout not commercially viable for private operators. Remember, low-bands such as 700MHz will not be fit for purpose and only act as a short-term band-aid for a problem that will plague generations to come.

Supporting schemes which increase fibre penetration in Ireland is as important for fixed broadband as it is for our path to 5G. The extension of dark fibre networks beyond the realm of urban regions will be pivotal in bridging the digital divide, and this effort should form part of the National Broadband Plan and projects to extend the catchment of MANs on this island.

Filling the Fibre Void with Microwave

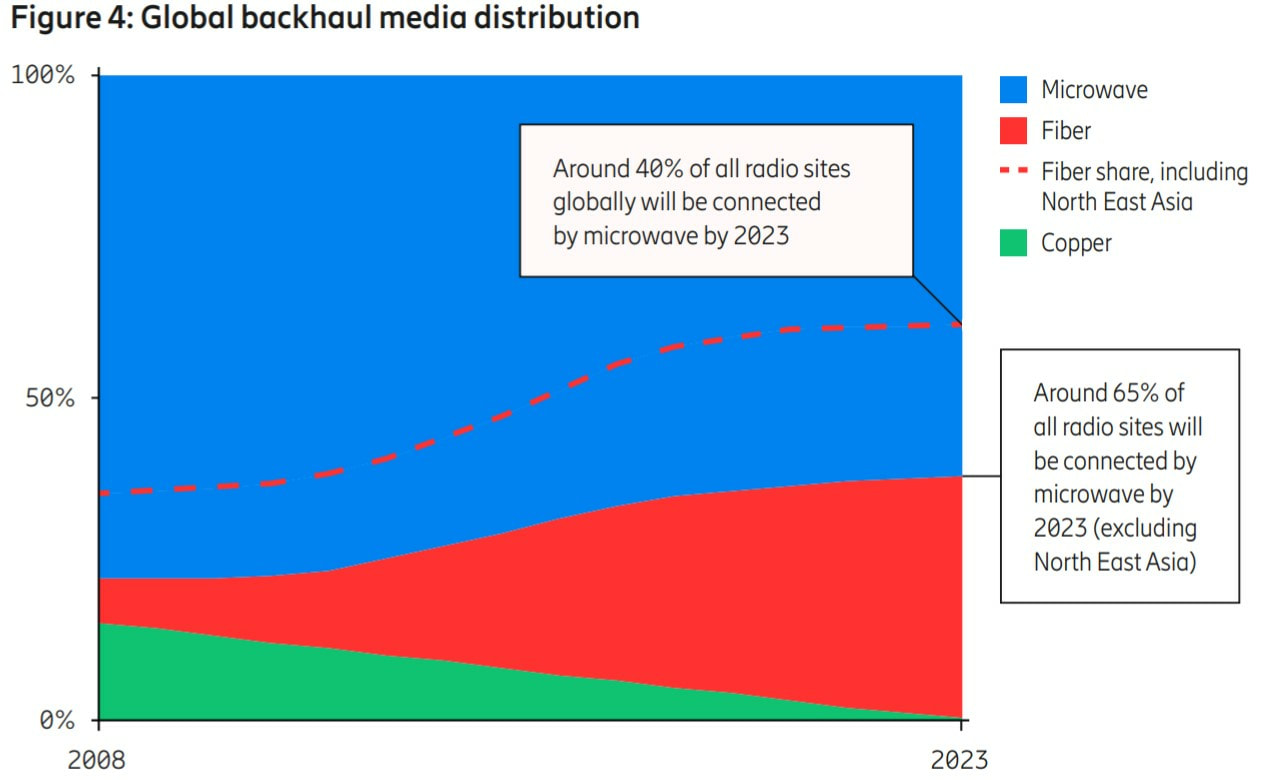

Taking a different angle, it would be ludicrous of me to confine 5G and its expansive ecosystem to a model that relies exclusively upon fibre for backhaul. To date, microwave links have been working to connect the disconnected in Ireland, trading performance for cost-effectiveness and ease of deployment.

There is no pixie dust that can suddenly render the deployment of fibre viable in every corner of Ireland, but microwave can act as a solution to fill the void. Mobile operators will have to weigh up the performance drawbacks of microwave with the cost and longevity of fibre on a site-by-site basis.

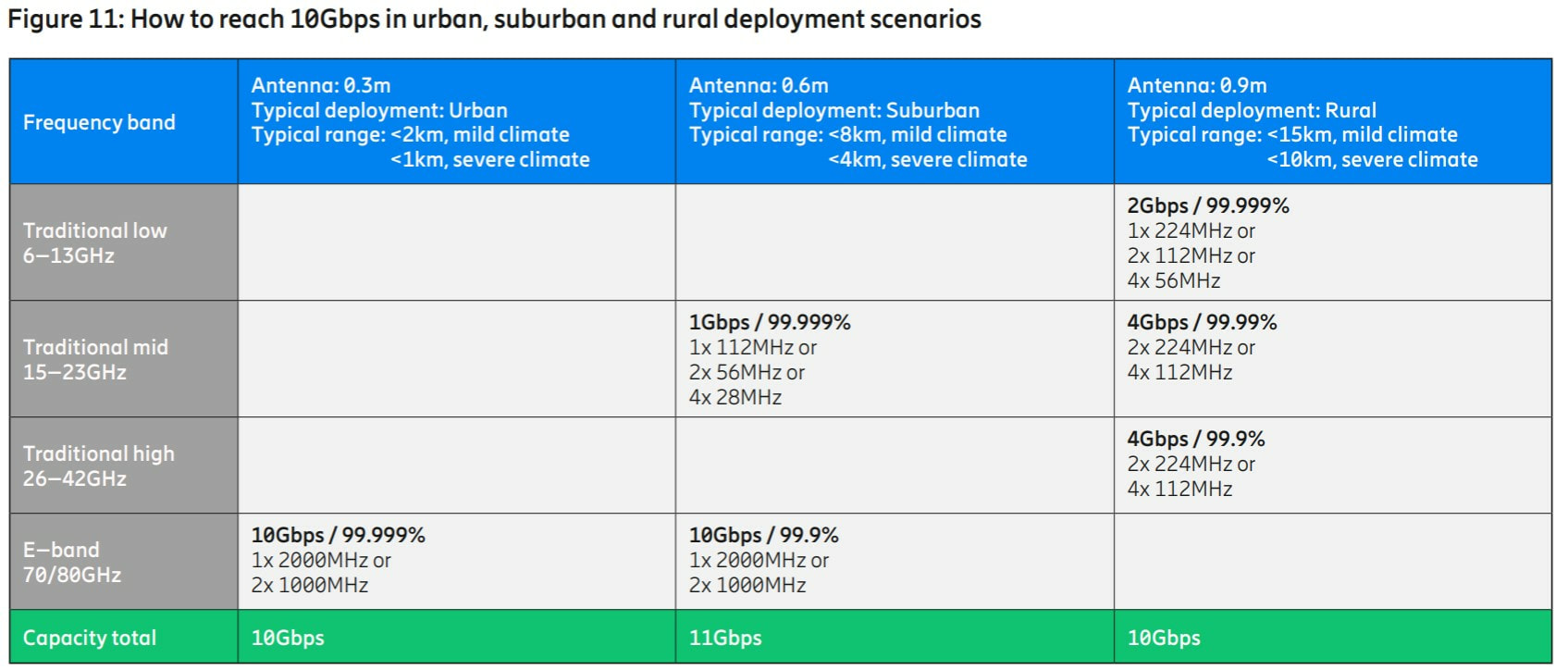

Undoubtedly, a consideration of paramount concern is to determine which microwave bands can facilitate the core use cases of 5G. While low-band microwave links (6-13GHz) are excellent for long hops (10km+), and by that extension, for sites located at the very fringe of society, their peak capacity of 2Gbps is just not sufficient in the 5G era.

With the repurposing of the 26 and 28GHz bands for access use in Europe, mid-band backhauling will be shifted to 32GHz, where peak capacity is up to 4Gbps. This level of performance makes the 32GHz band a perfect transport solution for sub-6GHz access networks in peripheral regions where fibre availability is lacking. Frankly, however, transitioning microwave links from one band to another is not a simple process, and it will likely take at least two years.

There is no pixie dust that can suddenly render the deployment of fibre viable in every corner of Ireland, but microwave can act as a solution to fill the void. Mobile operators will have to weigh up the performance drawbacks of microwave with the cost and longevity of fibre on a site-by-site basis.

Undoubtedly, a consideration of paramount concern is to determine which microwave bands can facilitate the core use cases of 5G. While low-band microwave links (6-13GHz) are excellent for long hops (10km+), and by that extension, for sites located at the very fringe of society, their peak capacity of 2Gbps is just not sufficient in the 5G era.

With the repurposing of the 26 and 28GHz bands for access use in Europe, mid-band backhauling will be shifted to 32GHz, where peak capacity is up to 4Gbps. This level of performance makes the 32GHz band a perfect transport solution for sub-6GHz access networks in peripheral regions where fibre availability is lacking. Frankly, however, transitioning microwave links from one band to another is not a simple process, and it will likely take at least two years.

Moving up the spectrum brings us closer to "fibre-like" territory. The E-Band (71–76GHz paired with 81–86GHz) is an impressive demonstration of this, supporting a vision for gigabit-class wireless networks. When deployed standalone, this band provides peak capacity of up to 10Gbps at 3km hop distances and up to 11Gbps at 5km hop distances in cases where it is aggregated with mid-bands.

As with fibre, microwave exhibits its own fair share of downsides, some of which will be amplified in Ireland. Availability is a metric in which fibre excels, and with microwave, it refers to the average percentage of the time a link is predicted to operate according to its specification. A core use case of 5G NR, mMTC, will require an extremely high availability rating given it is, oftentimes, a mission-critical function.

Factors such as the hop distance, transmit power, receive sensitivity, and beam divergence impact the availability rating. High-bands such as the E-Band will suffer from signal attenuation that is impacted by the atmospheric conditions in which a link operates. For example, the probability of rainfall occurring in Ireland is greater than it is in other regions assessed by the International Telecoms Union (ITU), inherently hindering the performance of these microwave bands.

Even on a micro level, the regions in Ireland which will be most dependent on microwave for backhaul, such as those along the Western Seaboard, are also the ones that experience the greatest volume of rainfall. This speaks to the greater complexity of reverting to microwave for backhaul when fibre is unavailable, a complexity that will only grow as the network requirements of 5G advance to meet those of its use cases.

As with fibre, microwave exhibits its own fair share of downsides, some of which will be amplified in Ireland. Availability is a metric in which fibre excels, and with microwave, it refers to the average percentage of the time a link is predicted to operate according to its specification. A core use case of 5G NR, mMTC, will require an extremely high availability rating given it is, oftentimes, a mission-critical function.

Factors such as the hop distance, transmit power, receive sensitivity, and beam divergence impact the availability rating. High-bands such as the E-Band will suffer from signal attenuation that is impacted by the atmospheric conditions in which a link operates. For example, the probability of rainfall occurring in Ireland is greater than it is in other regions assessed by the International Telecoms Union (ITU), inherently hindering the performance of these microwave bands.

Even on a micro level, the regions in Ireland which will be most dependent on microwave for backhaul, such as those along the Western Seaboard, are also the ones that experience the greatest volume of rainfall. This speaks to the greater complexity of reverting to microwave for backhaul when fibre is unavailable, a complexity that will only grow as the network requirements of 5G advance to meet those of its use cases.

The Optics of Coverage Obligations

Coverage obligation debates precede virtually every generation of wireless network, and a cohort of people in Ireland are fixated with the concept of attaching stringent coverage conditions to spectrum licenses assigned by ComReg. If you lie on the wrong side of the digital divide today, enforcement of coverage obligations seemingly paves the way for a more connected tomorrow. In reality, this is not so explicit.

Sure, there needs to be a clear-cut incentive for private operators to provide their services to as many people as possible, and that includes regions which have been snubbed to date. However, at the same time, we need to ensure that these incentives don't adversely impact market competition or leave the state and high-speed broadband access at the mercy of private operators.

The concept of coverage obligations is nothing new, after all, ComReg has attached them to many spectrum assignments in the past. What is new, however, is the emergence of a desire for geographic coverage obligations, which force operators to achieve a certain level of service availability on the Irish landmass within a specified time frame.

Sure, there needs to be a clear-cut incentive for private operators to provide their services to as many people as possible, and that includes regions which have been snubbed to date. However, at the same time, we need to ensure that these incentives don't adversely impact market competition or leave the state and high-speed broadband access at the mercy of private operators.

The concept of coverage obligations is nothing new, after all, ComReg has attached them to many spectrum assignments in the past. What is new, however, is the emergence of a desire for geographic coverage obligations, which force operators to achieve a certain level of service availability on the Irish landmass within a specified time frame.

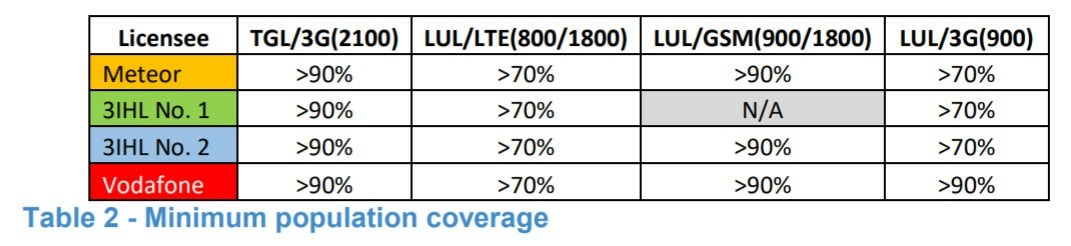

ComReg ensures Irish operators are in compliance with their population coverage obligations in the 2100MHz (3G), 900MHz (GSM/3G), 800MHz (4G) and 1800MHz (4G) bands by conducting a drive testing programme across 550km of Ireland's national primary and secondary road network.

A byproduct of this programme is a portfolio of maps portraying the RSRP performance of the 800 and 1800MHz bands across operators. This acts as an excellent indication of 4G network performance on the Irish road network, and importantly, it represents real-world scenarios in which the handoff experience between sites is gauged.

From the perspective of an operator such as Vodafone, meeting population coverage obligations that form part of its spectrum licenses can be achieved with relative ease. For example, the operator launched its 4G network in 2013, and after just three years, Vodafone announced that it had passed a 90% 4G population coverage milestone.

Most of the initial 4G roll-out in Ireland was based on the 800MHz band, with large towns and cities benefiting from access to the 1800MHz band. As Irish operators provide 4G coverage to over 98% of the population today, investment has moved to efforts which concern capacity enhancement, extending the availability of carrier-aggregated 4G and technologies such as 256QAM.

A byproduct of this programme is a portfolio of maps portraying the RSRP performance of the 800 and 1800MHz bands across operators. This acts as an excellent indication of 4G network performance on the Irish road network, and importantly, it represents real-world scenarios in which the handoff experience between sites is gauged.

From the perspective of an operator such as Vodafone, meeting population coverage obligations that form part of its spectrum licenses can be achieved with relative ease. For example, the operator launched its 4G network in 2013, and after just three years, Vodafone announced that it had passed a 90% 4G population coverage milestone.

Most of the initial 4G roll-out in Ireland was based on the 800MHz band, with large towns and cities benefiting from access to the 1800MHz band. As Irish operators provide 4G coverage to over 98% of the population today, investment has moved to efforts which concern capacity enhancement, extending the availability of carrier-aggregated 4G and technologies such as 256QAM.

As detailed earlier, Ireland's population distribution is such that increasing 4G population coverage beyond 95% requires an operator to cover a much greater geographical area. This is where costs escalate. ComReg estimates that 95% population coverage is equal to 75% coverage of Ireland's landmass. The regulator also determined that providing a 30Mbps wireless service to 99.5% of Ireland's geographical area would cost €4,250 per person.

Where do we draw the line? To what level of geographic coverage do we expect commercial operators to achieve? These are very valid questions with no definitive answer. Remember, 5G will be underpinned by fibre, and access to fibre for backhaul is lacking in regions where mobile operators would be forced to cover under geographic coverage obligations.

Perhaps the trickiest aspect in this debate about geographic coverage is spectrum, fundamental lifeblood of mobile networks. The upcoming release of the 700MHz band for mobile services appears to be the most viable opportunity to impose geographic coverage obligations, but this band will not fulfil the broadband requirements of rural Ireland.

Neither high nor low, mid-bands such as 3.6GHz provide a meaningful capacity uplift compared to today's networks, and can offer a similar coverage footprint to 1800 and 2100MHz bands in the presence of Massive MIMO. The deployment of mid-bands and mmWave spectrum will increase network density by an order of magnitude, but fibre density is not at an optimal level to support this.

Where do we draw the line? To what level of geographic coverage do we expect commercial operators to achieve? These are very valid questions with no definitive answer. Remember, 5G will be underpinned by fibre, and access to fibre for backhaul is lacking in regions where mobile operators would be forced to cover under geographic coverage obligations.

Perhaps the trickiest aspect in this debate about geographic coverage is spectrum, fundamental lifeblood of mobile networks. The upcoming release of the 700MHz band for mobile services appears to be the most viable opportunity to impose geographic coverage obligations, but this band will not fulfil the broadband requirements of rural Ireland.

Neither high nor low, mid-bands such as 3.6GHz provide a meaningful capacity uplift compared to today's networks, and can offer a similar coverage footprint to 1800 and 2100MHz bands in the presence of Massive MIMO. The deployment of mid-bands and mmWave spectrum will increase network density by an order of magnitude, but fibre density is not at an optimal level to support this.

As you could guess, this geographic approach is a radical break from the population coverage obligations that hover at the 70% mark today, and if implemented, geographic obligations will change the nature of network deployments, instantly prompting the value of low-band spectrum to skyrocket.

There are major and potentially irreversible consequences of this for consumers. In the realm of competition, the shift towards coverage forces operators to utilise low-band spectrum in an effort to keep costs down, sacrificing capacity and giving operators with more expansive low-band assets a competitive advantage.

The culmination of a required increase in CapEx to meet geographic coverage obligations distorting prices, creation of a competitive advantage for operators that have access to a greater chunk of low-band spectrum (700, 800MHz) and the development of an environment which thwarts deployment of high-capacity, future-proof high-band spectrum are overriding concerns that must be addressed.

There are major and potentially irreversible consequences of this for consumers. In the realm of competition, the shift towards coverage forces operators to utilise low-band spectrum in an effort to keep costs down, sacrificing capacity and giving operators with more expansive low-band assets a competitive advantage.

The culmination of a required increase in CapEx to meet geographic coverage obligations distorting prices, creation of a competitive advantage for operators that have access to a greater chunk of low-band spectrum (700, 800MHz) and the development of an environment which thwarts deployment of high-capacity, future-proof high-band spectrum are overriding concerns that must be addressed.

Pondering Alternative Incentives

Industry-wide rumination on coverage issues in rural Ireland will be the key to unlock a more connected tomorrow. Recognition of the fact that coverage obligations form only a small part of a lofty puzzle is important, allowing us to explore new ways of overcoming an old problem - the combined hostility of topography and population distribution to omnipresent coverage in Ireland.

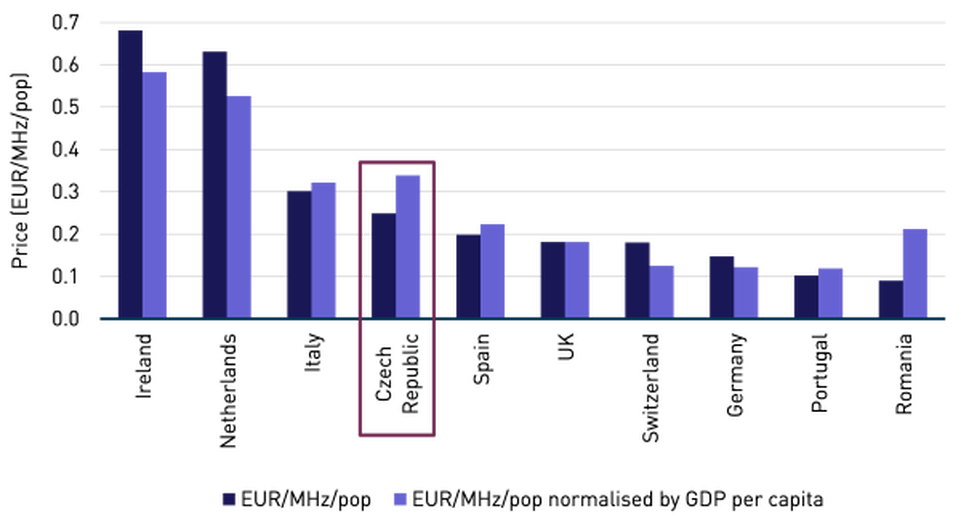

Reducing the spectrum license fees that must be made payable to the Irish exchequer upon awarding of bands is a simple but effective step to incentivise increased investment in mobile infrastructure. This is based on foundational economic principles concerning limited resources and opportunity cost.

Pushing the needle higher on the cost per MHz of spectrum consequently forces an operator to reduce its CapEx allocation for network deployment and to seek cost recovery from consumers. This method of cost recovery transpires in the form of price hikes, initiating a stagnation of competition in the mobile market.

Reducing the spectrum license fees that must be made payable to the Irish exchequer upon awarding of bands is a simple but effective step to incentivise increased investment in mobile infrastructure. This is based on foundational economic principles concerning limited resources and opportunity cost.

Pushing the needle higher on the cost per MHz of spectrum consequently forces an operator to reduce its CapEx allocation for network deployment and to seek cost recovery from consumers. This method of cost recovery transpires in the form of price hikes, initiating a stagnation of competition in the mobile market.

In fact, if we examine the nature of the multi-band spectrum auction in 2012, which amassed a staggering sum of €854.64m, it can be concluded that the high-price model has worked against Ireland and our shared connectivity goals. This auction represented a pivotal shift in the Irish mobile industry, setting the scene for an amalgamation of O2 and Three into a consolidated network.

Data from Analysys Mason paints a chilling picture of just how expensive this auction was for operators, with the highest cost per MHz of population anywhere on the continent of Europe. Lo and behold, today, 4G availability in Ireland is the sixth worst in the world according to OpenSignal. These are simple dots to join, but they haven't been joined by those steering the connectivity ship.

Thankfully, there is a sense that the tide is turning on the cost of acquiring spectrum in Ireland, and the successful release of the 3.6GHz band in 2017 should rinse us of some gloom for the future of our mobile industry. This award process for 350MHz of the mid-band will flood the Irish exchequer with close to €80m, a fraction of that exhibited in 2012's multi-band auction.

Data from Analysys Mason paints a chilling picture of just how expensive this auction was for operators, with the highest cost per MHz of population anywhere on the continent of Europe. Lo and behold, today, 4G availability in Ireland is the sixth worst in the world according to OpenSignal. These are simple dots to join, but they haven't been joined by those steering the connectivity ship.

Thankfully, there is a sense that the tide is turning on the cost of acquiring spectrum in Ireland, and the successful release of the 3.6GHz band in 2017 should rinse us of some gloom for the future of our mobile industry. This award process for 350MHz of the mid-band will flood the Irish exchequer with close to €80m, a fraction of that exhibited in 2012's multi-band auction.

Putting the importance of transforming our spectrum auctions aside, we should ponder alternative incentives to enhance coverage availability on this island. Dare I mention it, but network sharing agreements, when executed in a manner that equally benefits each operator, can work to push today's cell edge further out, chipping away at the digital divide.

An effective infrastructure sharing agreement is one that allows operators to maintain their existing competitive advantages such as network performance while also fostering an environment that drives deployment costs down. If we imagine a scenario in which Ireland's three operators are engaged in a sharing agreement with one another, transparency and mutual cooperation will be necessary.

For example, a viable model would be one that focuses on give-get sharing: Vodafone allows Three to mount equipment atop its existing rural site, and in return, Vodafone gains access to an alternative Three site. This ensures Vodafone does not relinquish its network advantage to Three and allows customers of both operators to enjoy enhanced coverage.

An effective infrastructure sharing agreement is one that allows operators to maintain their existing competitive advantages such as network performance while also fostering an environment that drives deployment costs down. If we imagine a scenario in which Ireland's three operators are engaged in a sharing agreement with one another, transparency and mutual cooperation will be necessary.

For example, a viable model would be one that focuses on give-get sharing: Vodafone allows Three to mount equipment atop its existing rural site, and in return, Vodafone gains access to an alternative Three site. This ensures Vodafone does not relinquish its network advantage to Three and allows customers of both operators to enjoy enhanced coverage.

Conclusion: Making Fibre and 5G an Embodiment of Our Progress

Quite frankly, the long-term impacts of a rush for short-term gain is often overlooked in Ireland, and we could contrast this exact mentality with that hindering the National Broadband Plan, a stain on the state in its absence. There is no excuse for successively committing the same mistakes because, after a while, it becomes complete ignorance.

And Ireland is no stranger to mistakes, with its people left lamenting in the firing line of cataclysmic connectivity failures. Those failures, which concern areas of regulation and strategic planning, should act as lessons to help the next generation build a better tomorrow, where the divide between urban and rural does not include access to connectivity.

Fibre and 5G are the stepping stones to achieve an omnipresent gigabit society in Ireland, and the relationship between the two is one of proportion. Fibre needs 5G to exist as a use case in order to accelerate its perceived importance for access networks. 5G needs fibre to deliver its three core use cases, and to support an expansive ecosystem of services.

On the front of fibre, increasing access density at the edge will be the most important breakthrough for Ireland. With 5G, putting concrete incentives in place to enhance availability, while also maintaining the integrity of competition, will be key to making it an embodiment of our progress in connectivity.

And Ireland is no stranger to mistakes, with its people left lamenting in the firing line of cataclysmic connectivity failures. Those failures, which concern areas of regulation and strategic planning, should act as lessons to help the next generation build a better tomorrow, where the divide between urban and rural does not include access to connectivity.

Fibre and 5G are the stepping stones to achieve an omnipresent gigabit society in Ireland, and the relationship between the two is one of proportion. Fibre needs 5G to exist as a use case in order to accelerate its perceived importance for access networks. 5G needs fibre to deliver its three core use cases, and to support an expansive ecosystem of services.

On the front of fibre, increasing access density at the edge will be the most important breakthrough for Ireland. With 5G, putting concrete incentives in place to enhance availability, while also maintaining the integrity of competition, will be key to making it an embodiment of our progress in connectivity.

Examining the viability of FWA in the 5G EraBeneath the lustre engulfing 5G for FWA are very real financial and technological challenges.

|