How Cheap can our Mobile Plans Get?

Published 22/08/2017

Cheap is Cheerful

How do I find the cheapest mobile plan? It's a gripe experienced constantly by anyone who happens to own a mobile phone. There are so many different plans on the market, with so many different features and offered by so many different companies it can become overwhelming. Most people look for the cheapest plan they can get, even if it means they'll have to deal with lackluster service. Thankfully, mobile plans have been getting cheaper on every network in Ireland and customers are benefiting from increased data, call and text allowances on their plans. In fact, Irish mobile customers pay less for their mobile plans than most other Europeans thanks to a highly competitive market. Cheap plans are cheerful for the consumer, but not so much for the mobile networks who are battling declining revenues.

Mobile Networks are facing an Unprecedented Challenge

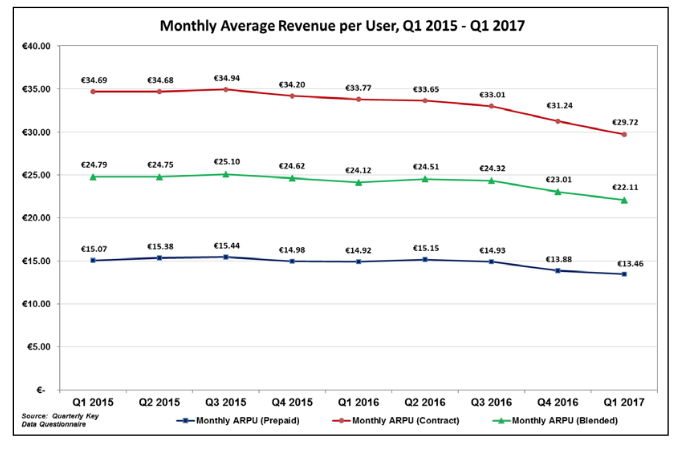

Average Monthly Revenue per User (APRU) has hit a new low in the Irish mobile industry across pay as you go and bill pay plans. ComReg reports that the Mobile APRU in the first quarter of this year fell to an all time low of €22.11, down €2 in just one year. That's a worrying statistic for all of the mobile networks, who are facing an upward battle when it comes to mobile revenues. It comes at bad timing also because the next generation of telecommunications technology, 5G is poised for roll out within the next three to four years. The continued roll out of 4G and especially 4G+ combined with the roll out of a next generation 5G network will require substantial capital investment from companies such as Eir, 3 and Vodafone.

However, even though consumers plans are becoming less expensive, they're expectations for quality continue to climb. That's challenging because networks will be forced to maintain a quality experience with smaller revenue streams. Consumers are using more data, paying less for it, and networks will have to invest more. These challenges are a result of increased competition in the mobile market. Even industry leaders such as Vodafone have begrudgingly decided to offer plans with more data, calls and texts and other features for cheaper to offset revenue losses and placate customers.

However, even though consumers plans are becoming less expensive, they're expectations for quality continue to climb. That's challenging because networks will be forced to maintain a quality experience with smaller revenue streams. Consumers are using more data, paying less for it, and networks will have to invest more. These challenges are a result of increased competition in the mobile market. Even industry leaders such as Vodafone have begrudgingly decided to offer plans with more data, calls and texts and other features for cheaper to offset revenue losses and placate customers.

SMS screams S.O.S.

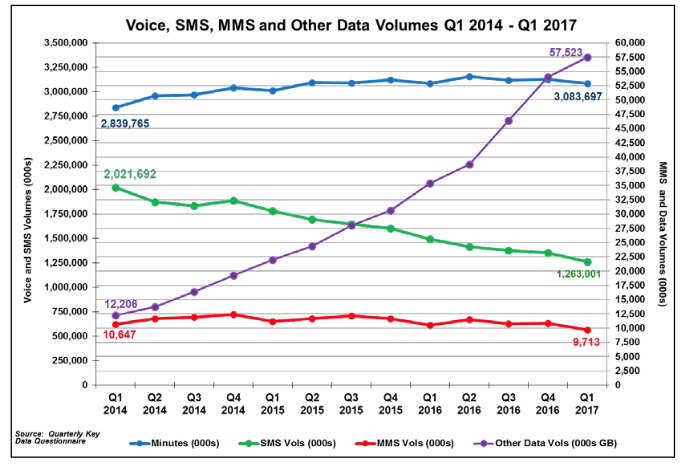

SMS, or traditional texting as it is more commonly known, has experienced a rapid fall from grace over the last number of years. Once the de facto form of quick communication, SMS is now reserved for use in a limited number of occasions. The technology, which remains the most reliable and ubiquitous form of sending messages has been killed by social giants such as Facebook and Snapchat. The services fall from grace can also be blamed on the mobile networks themselves who failed to see the rise of instant messaging services. MultiMedia Messaging Service (MMS) is also nearing the end of its life.

Once a key part of a mobile networks revenue, SMS and MMS now lie at the bottom of the revenue pile. This rapid decline, which is depicted in ComReg's graph below, could have been slowed if mobile networks stopped charging customers ridiculous fees for sending a picture or text. Did 3 and Vodafone actually think people were prepared to fork out money to send a picture message when they could send the same message using a service such as WhatsApp or iMessage for free? It remains a huge mistake by mobile networks, even today networks insist people pay to send MMS messages. The same is true for standard SMS text messages. Mobile networks often limit how much texts their customers can send, even if a single text costs a company such as Vodafone a fraction of a cent. If text messages had been made unlimited on all plans, maybe the decline in usage would have been slowed or less severe.

This decline has obviously had an effect on revenues. With people sending less texts and MMS, networks are receiving less revenue from the customer. Whats even more comical is that these SMS and MMS replacements like Whatsapp wouldn't even exist without mobile networks in the first place, so how did the networks allow them to sabotage their own service?

Once a key part of a mobile networks revenue, SMS and MMS now lie at the bottom of the revenue pile. This rapid decline, which is depicted in ComReg's graph below, could have been slowed if mobile networks stopped charging customers ridiculous fees for sending a picture or text. Did 3 and Vodafone actually think people were prepared to fork out money to send a picture message when they could send the same message using a service such as WhatsApp or iMessage for free? It remains a huge mistake by mobile networks, even today networks insist people pay to send MMS messages. The same is true for standard SMS text messages. Mobile networks often limit how much texts their customers can send, even if a single text costs a company such as Vodafone a fraction of a cent. If text messages had been made unlimited on all plans, maybe the decline in usage would have been slowed or less severe.

This decline has obviously had an effect on revenues. With people sending less texts and MMS, networks are receiving less revenue from the customer. Whats even more comical is that these SMS and MMS replacements like Whatsapp wouldn't even exist without mobile networks in the first place, so how did the networks allow them to sabotage their own service?

Roaming bites the dust

Roaming fees for calling, texting and using data within the EU were abolished in June 2017, wiping out another stream of revenue for mobile networks. Customers can now use their call and text domestic allowance abroad, and they can use their domestic data allowance in the EU also (Only Vodafone Customers can use their Full Domestic Data Allowance). The movement, which was undertaken by the European Commission has removed a massive pain point for customers who use their phone abroad. The changes were delayed thanks to mobile networks who spent millions lobbying against them.

It's not surprising that networks weren't happy with the changes, now they no longer profit from their customers when they roam in the EU. There's also another challenge facing networks, customers want 4G access abroad. This feature remains exclusive to Vodafone in Ireland as only their customers can access 4G networks while traveling abroad. However, for networks such as 3 and Eir, who have a much smaller international presence than Vodafone, it's going to be more difficult and costly to provide 4G roaming. 3 and Eir will have to negotiate new roaming contracts with networks in dozens of countries if they want to provide their customers with 4G. It will be much more costly for 3 and Eir to provide 4G roaming because they don't have near as many sister networks as Vodafone does.

Customers are still being charged outrageous amounts for using their phone in countries outside of the EU. But increased competition has led networks to introduce cheaper international roaming rates via roaming passes which allow customers to purchase a certain amount of data to use for their trip to a different country. The increasing presence of free WiFi hotspots has allowed customers to access the internet without the need for using mobile data also. Again, roaming joins SMS and MMS as another area where networks revenues are quickly diminishing.

It's not surprising that networks weren't happy with the changes, now they no longer profit from their customers when they roam in the EU. There's also another challenge facing networks, customers want 4G access abroad. This feature remains exclusive to Vodafone in Ireland as only their customers can access 4G networks while traveling abroad. However, for networks such as 3 and Eir, who have a much smaller international presence than Vodafone, it's going to be more difficult and costly to provide 4G roaming. 3 and Eir will have to negotiate new roaming contracts with networks in dozens of countries if they want to provide their customers with 4G. It will be much more costly for 3 and Eir to provide 4G roaming because they don't have near as many sister networks as Vodafone does.

Customers are still being charged outrageous amounts for using their phone in countries outside of the EU. But increased competition has led networks to introduce cheaper international roaming rates via roaming passes which allow customers to purchase a certain amount of data to use for their trip to a different country. The increasing presence of free WiFi hotspots has allowed customers to access the internet without the need for using mobile data also. Again, roaming joins SMS and MMS as another area where networks revenues are quickly diminishing.

Bundled Plans drive Prices Down

Total Communications Providers such as Eir and Vodafone have managed to bundle their TV, Broadband, Home Phone and Mobile Phone plans to deliver a total package which gives the customers access to a range of services. These plans, which have achieved huge momentum in the past number of years thanks to Eir's offering, push prices down further. These bundled plans are extremely attractive for companies like Eir and Vodafone because they force customers to use all of a single companies services. This means that practically all of a customers internet and TV usage is managed by the one company. However, in order to promote these bundled plans companies have had to offer promotional prices which often drive revenue per user down.

For example, many of Eir's plans which bundle broadband and mobile offer customers a 'free' smartphone as an incentive to choose the plan. These kinds of incentives are required to get customers signing up and reduce revenue for networks. Many of Eir's plans are also discounted significantly for their first few months of usage to create another incentive for customers to sign up.

For example, many of Eir's plans which bundle broadband and mobile offer customers a 'free' smartphone as an incentive to choose the plan. These kinds of incentives are required to get customers signing up and reduce revenue for networks. Many of Eir's plans are also discounted significantly for their first few months of usage to create another incentive for customers to sign up.

Mobile Broadband declines

It's hardly surprising that mobile broadband subscriptions are slowly declining in Ireland. The service, which is mainly used by businesses for employees and in areas where fixed broadband is nonexistent, is less reliable than fixed broadband and is held back by data usage limits. I personally think it's foolish to pay for a plan for your phone and for mobile broadband. With data allowances reaching above 20GB on many plans, customers can use their phone to tether for internet access on a device such as a laptop or a tablet. Tethering or creating a personal hotspot using your phone doesn't require you to carry around a mobile broadband modem and significantly reduces the price you pay monthly.

I know plenty of people who use their phones to tether to other devices as an alternative to fixed broadband. Some networks such as 3 forbid tethering to prevent congestion on their network but I know people who have managed to bypass these rules. Declining mobile broadband subscriptions is another area where networks have seen their revenues decline. Whats ironic in this case is that the decline in mobile broadband subscriptions is partly due to enhanced features like the ability to tether on mobile plans and so the networks are cannibalizing themselves in some cases.

I know plenty of people who use their phones to tether to other devices as an alternative to fixed broadband. Some networks such as 3 forbid tethering to prevent congestion on their network but I know people who have managed to bypass these rules. Declining mobile broadband subscriptions is another area where networks have seen their revenues decline. Whats ironic in this case is that the decline in mobile broadband subscriptions is partly due to enhanced features like the ability to tether on mobile plans and so the networks are cannibalizing themselves in some cases.

We are on the Verge of Unlimited Data

Data is the holy grail at the moment when its comes to choosing a new mobile plan. Customers want more data as they increase their usage of services such as Netflix and YouTube. 3 is a prime example of a network that has experienced the difficulty in providing unlimited data to customers. The network has battled congestion as its customers take advantage of unlimited data. 3's customers use so much data that the network accounts for around 50% of internet traffic in Ireland today, more than all other Irish networks combined. 3's unlimited data plans have drastically decreased the cost per megabyte of data to a point that makes it cheaper to use mobile data than broadband. The cost of providing data via 4G networks has dropped drastically also so it does allow networks some leeway to provide unlimited.

3's offering of unlimited means it receives less revenue per customer than Vodafone does. This means that 3 will struggle to increase its revenues unless it continues to add new customers or converts existing customers to more expensive plans in the coming years. I see it inevitable that Vodafone will offer unlimited data, and thats good because customers will finally be free of fear.

I can understand why a company such as Vodafone is reluctant to offer unlimited data because there's really no going back. For example, the largest network in the US, Verizon, began offering unlimited data at the start of 2017 and has since seen its average 4G speed decline by more than 20%. If Vodafone launched unlimited data and its network wasn't prepared for the surge in usage, it could cripple the network and ruin Vodafone's reputation for offering the best network in Ireland.

Eir has already dipped its toes in the unlimited game by zero-rating services such as YouTube and WhatsApp so customers can use the services as much as they want. Offering unlimited data would wipe out revenues from overage fees which Vodafone and Eir receive when they punish their customers for exceeding their data allowance. But with smaller revenues, innovation could be stifled and capital investment to roll out a new state of the art networks may be reduced to maintain profits.

The demand for more data isn't going to go away anytime soon. As phones evolve and include higher resolution displays and faster modems and processors people will continue to use more and more data. So the ultimate question: Is unlimited data economical for mobile networks?

3's offering of unlimited means it receives less revenue per customer than Vodafone does. This means that 3 will struggle to increase its revenues unless it continues to add new customers or converts existing customers to more expensive plans in the coming years. I see it inevitable that Vodafone will offer unlimited data, and thats good because customers will finally be free of fear.

I can understand why a company such as Vodafone is reluctant to offer unlimited data because there's really no going back. For example, the largest network in the US, Verizon, began offering unlimited data at the start of 2017 and has since seen its average 4G speed decline by more than 20%. If Vodafone launched unlimited data and its network wasn't prepared for the surge in usage, it could cripple the network and ruin Vodafone's reputation for offering the best network in Ireland.

Eir has already dipped its toes in the unlimited game by zero-rating services such as YouTube and WhatsApp so customers can use the services as much as they want. Offering unlimited data would wipe out revenues from overage fees which Vodafone and Eir receive when they punish their customers for exceeding their data allowance. But with smaller revenues, innovation could be stifled and capital investment to roll out a new state of the art networks may be reduced to maintain profits.

The demand for more data isn't going to go away anytime soon. As phones evolve and include higher resolution displays and faster modems and processors people will continue to use more and more data. So the ultimate question: Is unlimited data economical for mobile networks?