The Changing Face of Broadband in Ireland.

With change comes challenge, with progress comes prosperity.

Published 20/02/19

Our society, for the most part, recognises the fundamental necessity for pervasive high-speed broadband availability on the island of Ireland. This consensus is not one merely linked to the merits of instant, international connectivity and its benefits, rather, the demand for continued evolution of our broadband networks spawns from the realisation that our economy is increasingly underpinned by it, and in its absence, an existential threat looms.

Ireland's economic growth and prosperity is intrinsically attached to the state of our telecoms networks in a way that is uniquely bound to an island which has experienced unprecedented interest and investment from multinational corporations. Acting as the roads or essential utilities of this era, just in a radically different dimension and format, telecoms networks carry colossal volumes of information beneath our feet and above our heads.

When that grinds to an abrupt halt, so too does our society. It's a relationship of dependence that will only intensify as the ecosystem of services extrapolates in new ways. For us, as a diminutive island on an expansive continent, developing telecoms infrastructure which brings future-proof, resilient connectivity to every person is a daunting and mammoth challenge, but one that we can and need to overcome.

Ireland's economic growth and prosperity is intrinsically attached to the state of our telecoms networks in a way that is uniquely bound to an island which has experienced unprecedented interest and investment from multinational corporations. Acting as the roads or essential utilities of this era, just in a radically different dimension and format, telecoms networks carry colossal volumes of information beneath our feet and above our heads.

When that grinds to an abrupt halt, so too does our society. It's a relationship of dependence that will only intensify as the ecosystem of services extrapolates in new ways. For us, as a diminutive island on an expansive continent, developing telecoms infrastructure which brings future-proof, resilient connectivity to every person is a daunting and mammoth challenge, but one that we can and need to overcome.

Copper Wanes

Once a hallmark of the telecoms industry, and an integral player in the rapid ascension of the Internet as we know it, copper is now on a crash course to extinction in modern broadband deployments. That's a harsh reality which percolates throughout the world, and it renders the vast majority of telecoms infrastructure on this island obsolete.

Why? Because the form of copper that traces every road and climbs every hill in Ireland is incapable of meeting the connectivity needs of today, not to mention tomorrow. Cheap, it may be, but with cost-effectiveness being one of the last meaningful features of copper, it's clear that this form of broadband provisioning has passed its use-by date.

In fact, fibre, which is poised to become the dominant replacement for copper, is beginning to out-compete it in areas that once seemed impossible, from offering reduced long-term operational expenses to providing an unforeseen level of scalability.

Copper is the bottleneck for today's connectivity goals, and with millions of Irish people still being forced to access the Internet via rotting wires, it's clear that dramatic change is required, not just in our affluent urban regions, but across the entirety of Ireland.

To that tune, telecoms companies have an answer.

Why? Because the form of copper that traces every road and climbs every hill in Ireland is incapable of meeting the connectivity needs of today, not to mention tomorrow. Cheap, it may be, but with cost-effectiveness being one of the last meaningful features of copper, it's clear that this form of broadband provisioning has passed its use-by date.

In fact, fibre, which is poised to become the dominant replacement for copper, is beginning to out-compete it in areas that once seemed impossible, from offering reduced long-term operational expenses to providing an unforeseen level of scalability.

Copper is the bottleneck for today's connectivity goals, and with millions of Irish people still being forced to access the Internet via rotting wires, it's clear that dramatic change is required, not just in our affluent urban regions, but across the entirety of Ireland.

To that tune, telecoms companies have an answer.

Poking holes in eir's "ambitious" plans

If you took notice of the news in recent weeks, the chances are that you read hyperbolic language used to refer to eir's network investment plans. That media phenomenon is understandable given the level of desperation which exists for improvements to connectivity. And, just to make it clear, eir's commitment to providing FTTH broadband to every town and city with more than 1,000 premises is excellent news for the future of high-speed broadband on this island, and for Ireland's long-term economic position.

Remember, the current spectrum of FTTC connections capable of speeds up to 100Mbps in urban areas is just not future-proof, especially while competitors such as Virgin Media have provisioned speeds of 360Mbps with its proprietary DOCSIS 3.0 cable network for some time now. This is a situation which has prevailed as a result of eir's volatile history, being flipped from investor to investor, sucked dry of investment, and left hung out to dry with huge piles of debt.

Outstandingly, some would say, eir has survived. With the company now in the hands of Xavier Niel, a French Billionaire widely accredited for causing a reformation in a stagnant French telecoms market through the establishment of Free, eir claims to find itself in a long-term relationship with an investor biting at his nails to pump money into the Irish market.

Remember, the current spectrum of FTTC connections capable of speeds up to 100Mbps in urban areas is just not future-proof, especially while competitors such as Virgin Media have provisioned speeds of 360Mbps with its proprietary DOCSIS 3.0 cable network for some time now. This is a situation which has prevailed as a result of eir's volatile history, being flipped from investor to investor, sucked dry of investment, and left hung out to dry with huge piles of debt.

Outstandingly, some would say, eir has survived. With the company now in the hands of Xavier Niel, a French Billionaire widely accredited for causing a reformation in a stagnant French telecoms market through the establishment of Free, eir claims to find itself in a long-term relationship with an investor biting at his nails to pump money into the Irish market.

As you could guess, the last point mentioned is a product of the company's bombastic marketing strategy and does not reflect a reality which eir has tried precariously to hide. Chronic underinvestment in its infrastructure is the reality, from missing basic obligations as an incumbent to, reportedly, delivering a sub-standard level of craftsmanship during the deployment stages of its FTTH network.

The 300,000 premises, or low-hanging fruit, that open eir removed from the National Broadband Plan and pursued with its own commercial FTTH rollout will be connected in June of this year. On top of this, the company will pass an additional 35,000 premises within the National Broadband Plan intervention area, slicing the pie even smaller for the eventual winner of the state-subsidised contract.

State intervention in the form of the National Broadband Plan will not be legal where open eir, a commercial operator, provides fixed services. This is wonderful news for eir, now having access to the most lucrative premises covered within the original National Broadband Plan catchment area, while at the same time delaying and compromising the integrity of the original plan, one in which the company was once a leading bidder.

The 300,000 premises, or low-hanging fruit, that open eir removed from the National Broadband Plan and pursued with its own commercial FTTH rollout will be connected in June of this year. On top of this, the company will pass an additional 35,000 premises within the National Broadband Plan intervention area, slicing the pie even smaller for the eventual winner of the state-subsidised contract.

State intervention in the form of the National Broadband Plan will not be legal where open eir, a commercial operator, provides fixed services. This is wonderful news for eir, now having access to the most lucrative premises covered within the original National Broadband Plan catchment area, while at the same time delaying and compromising the integrity of the original plan, one in which the company was once a leading bidder.

When we put eir's position into context, it is fair to say that its so-called "ambitious" €500m FTTH buildout to 1.4 million urban and suburban premises is not something that's worthy of great admiration. This is a company playing catch-up to valiant fibre-centric competitors such as SIRO whom, as eir's CEO Carolan Lennon likes to emphasise, put their money where their mouth is.

Let's remove the ambiguity surrounding eir's position as a major investor in the Irish telecoms market. When its wholesale and retail divisions are combined, eir is a cash cow, being identified as one of the most profitable telecoms companies in the world with respect to its size. With a broken regulatory regime in place, open eir has succeeded in maintaining its wholesale monopoly, keeping prices above what they should be and stifling investment from external operators.

The takeover of eir by Iliad and NJJ doesn't change any of this, contrary to what the company and its executives have spun, because it dunks more fuel onto a fire that continues to burn devilishly. A prime example of this is the planned reduction in the level of CapEx that will be pumped into both its fixed and mobile infrastructure over the coming years. These are reductions that will be applied to an already meagre budget, and further, deprive eir's infrastructure of the investment that it desperately needs.

Get this, if eir's financial performance remains on the up, the company will earn revenues of €6.24 billion in the coming five year period. In this time, eir will invest €500m in its fixed network, and €120 million in its mobile arm over the next two years. Factor in the fact that the company has now been given the green light by ComReg to raise the connection and migration charge on its wholesale FTTH network by 7,000% (from €2.50 to €170), and it becomes incredulously apparent that this company is seriously skimping on investment in Ireland, when we compare the ratio of capital investment to revenues over a five-year period.

On the front of those excessive price changes implemented by ComReg, Sky, a prominent broadband retailer and customer of open eir, is engaging in High Court action to prevent the catastrophe that would result from the 7,000% increase. Acting as the only fixed access network in much of Ireland, open eir's power is simply incredible, and any price inflation and competition degradation that would result from this decision would impact millions of Irish people and the wider telecoms industry on this island for decades to come.

Let's remove the ambiguity surrounding eir's position as a major investor in the Irish telecoms market. When its wholesale and retail divisions are combined, eir is a cash cow, being identified as one of the most profitable telecoms companies in the world with respect to its size. With a broken regulatory regime in place, open eir has succeeded in maintaining its wholesale monopoly, keeping prices above what they should be and stifling investment from external operators.

The takeover of eir by Iliad and NJJ doesn't change any of this, contrary to what the company and its executives have spun, because it dunks more fuel onto a fire that continues to burn devilishly. A prime example of this is the planned reduction in the level of CapEx that will be pumped into both its fixed and mobile infrastructure over the coming years. These are reductions that will be applied to an already meagre budget, and further, deprive eir's infrastructure of the investment that it desperately needs.

Get this, if eir's financial performance remains on the up, the company will earn revenues of €6.24 billion in the coming five year period. In this time, eir will invest €500m in its fixed network, and €120 million in its mobile arm over the next two years. Factor in the fact that the company has now been given the green light by ComReg to raise the connection and migration charge on its wholesale FTTH network by 7,000% (from €2.50 to €170), and it becomes incredulously apparent that this company is seriously skimping on investment in Ireland, when we compare the ratio of capital investment to revenues over a five-year period.

On the front of those excessive price changes implemented by ComReg, Sky, a prominent broadband retailer and customer of open eir, is engaging in High Court action to prevent the catastrophe that would result from the 7,000% increase. Acting as the only fixed access network in much of Ireland, open eir's power is simply incredible, and any price inflation and competition degradation that would result from this decision would impact millions of Irish people and the wider telecoms industry on this island for decades to come.

But the skeleton's in eir's lofty closet extend beyond the promises of renewed investment, and it is here that we enter a minefield territory of deception and lies, two nasty precedents which are now commonplace in the absence of competitors willing to call out the company publicly.

Here's an intriguing snippet from eir's most recent press release referring to its planned €150m mobile network upgrade over the next two years. "With a €150 million investment programme in its mobile network already underway, allowing eir to deliver 4G voice and data coverage across more than 99% of Ireland within two years, on the most expansive 4G mobile network in the world". I kid you not, eir is now claiming that it will provide the most expansive 4G network in the world on this island within two years. Remember that in 2021.

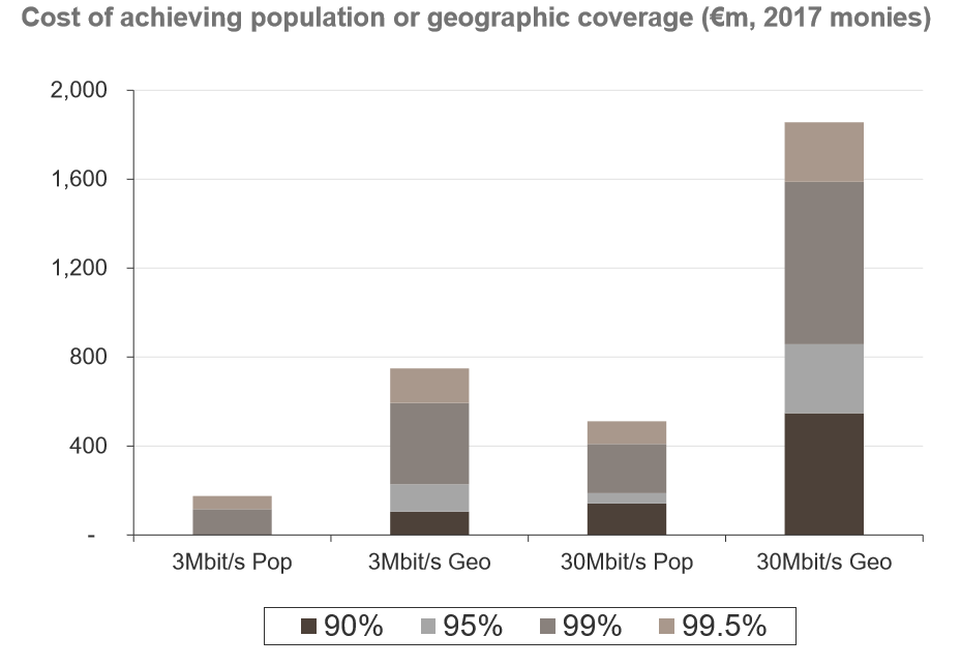

It is these kinds of claims that induce a foreboding euphoria in the media, but for everyone else, create a burning sense of scepticism. Referring to the facts presented in a report conducted on behalf of ComReg last year, deploying a network that has the capability to cover over 99% of Ireland's geography with a 30Mbps bandwidth (akin to basic 4G networks) would cost at least €1.5 billion, take decades to complete, and is not considered to be commercially viable. In other, more frank words, eir will not be able to deliver on this promise with the current budget, and in the absence of the 700MHz band.

Also, I couldn't help but include this after someone brought it to my attention. Carolan Lennon, eir's CEO, stated that the average cost of passing a premise under its urban fibre rollout will be €700, with an additional €400 charge for connection. If we do the maths, passing 1.4 million premises (€700 average each) would require an investment of €980 million. The company's planned investment of €500 million would net 714,285 premises based on these statistics.

Here's an intriguing snippet from eir's most recent press release referring to its planned €150m mobile network upgrade over the next two years. "With a €150 million investment programme in its mobile network already underway, allowing eir to deliver 4G voice and data coverage across more than 99% of Ireland within two years, on the most expansive 4G mobile network in the world". I kid you not, eir is now claiming that it will provide the most expansive 4G network in the world on this island within two years. Remember that in 2021.

It is these kinds of claims that induce a foreboding euphoria in the media, but for everyone else, create a burning sense of scepticism. Referring to the facts presented in a report conducted on behalf of ComReg last year, deploying a network that has the capability to cover over 99% of Ireland's geography with a 30Mbps bandwidth (akin to basic 4G networks) would cost at least €1.5 billion, take decades to complete, and is not considered to be commercially viable. In other, more frank words, eir will not be able to deliver on this promise with the current budget, and in the absence of the 700MHz band.

Also, I couldn't help but include this after someone brought it to my attention. Carolan Lennon, eir's CEO, stated that the average cost of passing a premise under its urban fibre rollout will be €700, with an additional €400 charge for connection. If we do the maths, passing 1.4 million premises (€700 average each) would require an investment of €980 million. The company's planned investment of €500 million would net 714,285 premises based on these statistics.

Serious Questions hang over enet

The optics of a fading divide between its retail and wholesale (commercial and non-commercial) arms and, not to mention, the uncontested renewal of a contract two years before expiry behind closed doors have irreversibly tarnished the reputation of both the Department of Communications and enet. As a managed service entity overseeing the operation of ninety-four Metropolitan Area Networks (MANs) on behalf of the state, enet's sole responsibility is to act as an open-access provider for retailers in regional towns throughout Ireland.

However, the problem is, and I don't say this lightly, enet was not likely in compliance with state-aid rules set out by the European Commission at the time its contract was renewed by the Department of Communication in 2017. Those rules clearly state that the managed service entity controlling the MANs should not be a telecoms operator with external infrastructure.

In 2004, when enet won the first contract to deploy the MANs in Ireland, the company qualified for the project because it was not an operator. Since that time, enet has dramatically expanded both its portfolio of services and infrastructure, diverging from the rules in place to protect the occurrence of a conflict of interest. Examining the operation of enet today, a very profitable managed service entity, it would be ridiculous to categorise it as anything other than an operator.

However, the problem is, and I don't say this lightly, enet was not likely in compliance with state-aid rules set out by the European Commission at the time its contract was renewed by the Department of Communication in 2017. Those rules clearly state that the managed service entity controlling the MANs should not be a telecoms operator with external infrastructure.

In 2004, when enet won the first contract to deploy the MANs in Ireland, the company qualified for the project because it was not an operator. Since that time, enet has dramatically expanded both its portfolio of services and infrastructure, diverging from the rules in place to protect the occurrence of a conflict of interest. Examining the operation of enet today, a very profitable managed service entity, it would be ridiculous to categorise it as anything other than an operator.

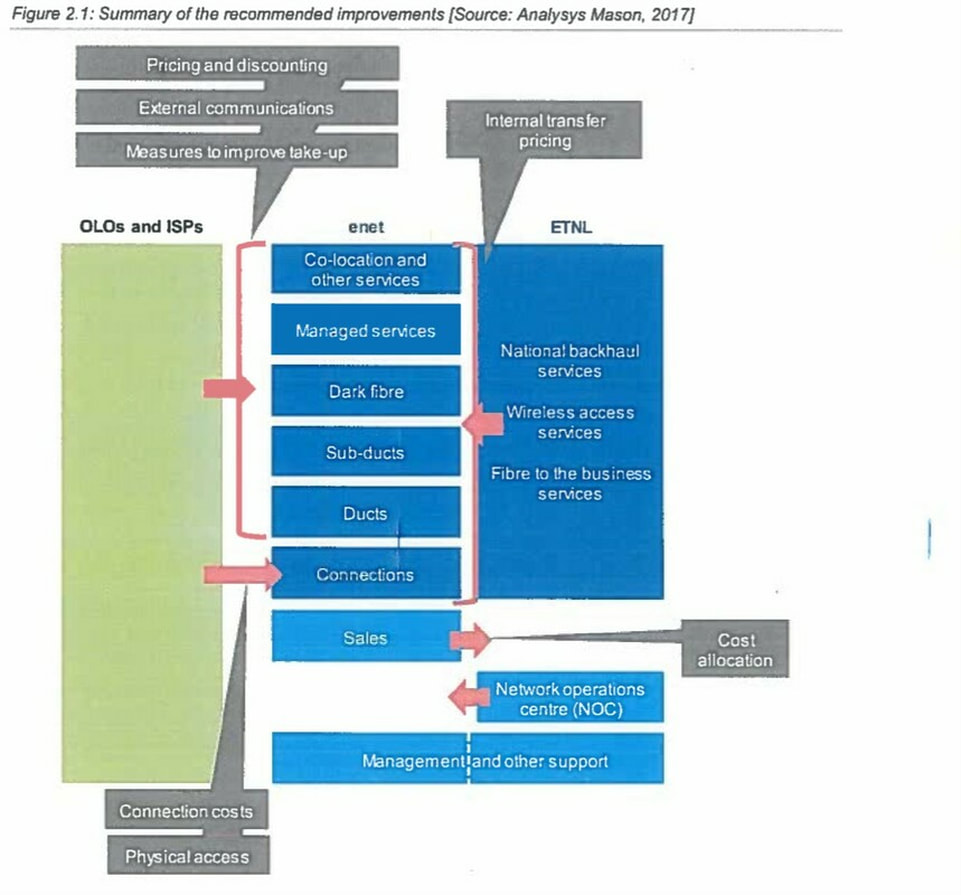

Enet's parent company, enet Telecommunications Networks Limited (ETNL), is the retail arm of the business that provides services using its own fixed and wireless backhaul infrastructure from its sister's MANs infrastructure. In fact, some of the services offered by ETNL such as FTTB combine the infrastructure of it and enet to present them in one unified service and bill.

Being members of the same parent company, the Irish Infrastructure Fund (IIF), there is an undeniable incentive for enet to offer services to ETNL at a discounted cost and price, and even more worryingly, favour customers whom access products and services using the company's combined infrastructure.

To create an example of this, imagine a retailer such as SIRO opting to purchase strands of fibre and ducting/sub-ducting within a section of enet's regional MANs, but decide to choose the ESB's NTFON for national backhaul. If another retailer, say BT, chooses the same dark fibre product as SIRO and purchases fixed or wireless backhaul from ETNL, rather than from a company external to enet, there is a financial case to provide BT with greater discounts than SIRO. This scenario would put enet in breach of its contractual obligations as an open-access provider of the MANs, and it is something that ComReg has been appointed to examine.

Being members of the same parent company, the Irish Infrastructure Fund (IIF), there is an undeniable incentive for enet to offer services to ETNL at a discounted cost and price, and even more worryingly, favour customers whom access products and services using the company's combined infrastructure.

To create an example of this, imagine a retailer such as SIRO opting to purchase strands of fibre and ducting/sub-ducting within a section of enet's regional MANs, but decide to choose the ESB's NTFON for national backhaul. If another retailer, say BT, chooses the same dark fibre product as SIRO and purchases fixed or wireless backhaul from ETNL, rather than from a company external to enet, there is a financial case to provide BT with greater discounts than SIRO. This scenario would put enet in breach of its contractual obligations as an open-access provider of the MANs, and it is something that ComReg has been appointed to examine.

This blurring in separation between enet and ETNL has materialised for a number of reasons, and the implications of it are too great to be pushed by the wayside. For one, and a pretty confounding situation, enet does not fall under the regulation of ComReg, instead, the Department of Communications assumes the role of a regulator. Clearly, such a system has not worked to date, and the expertise of ComReg are required to ensure that enet meets its obligations.

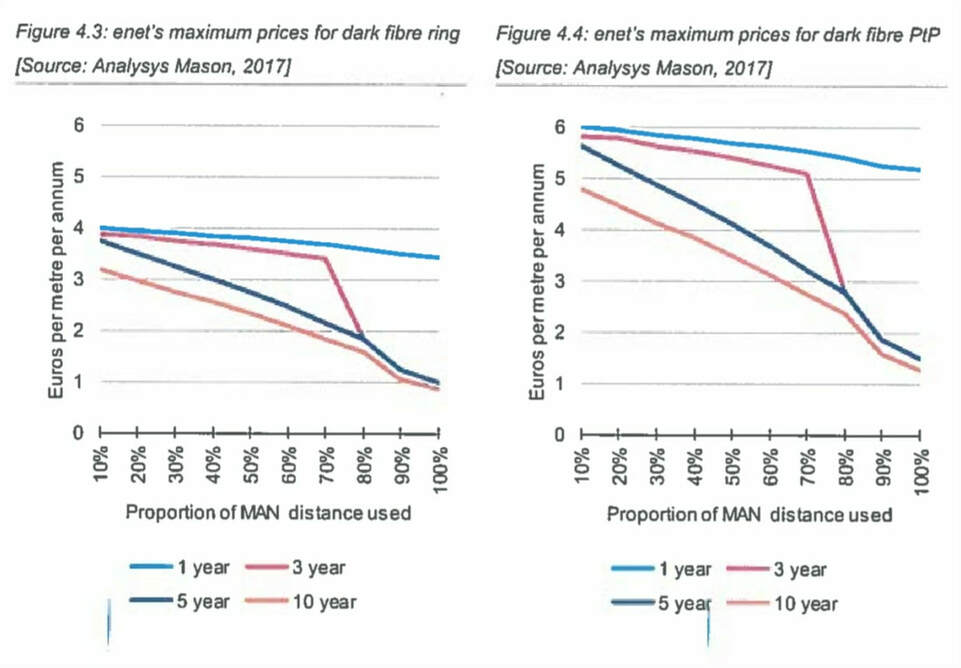

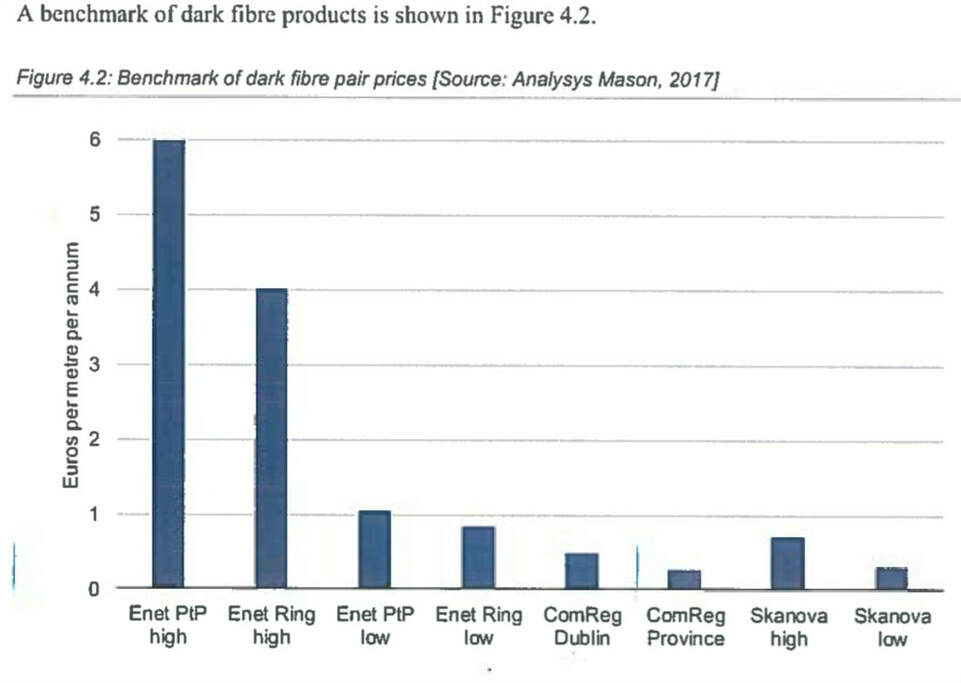

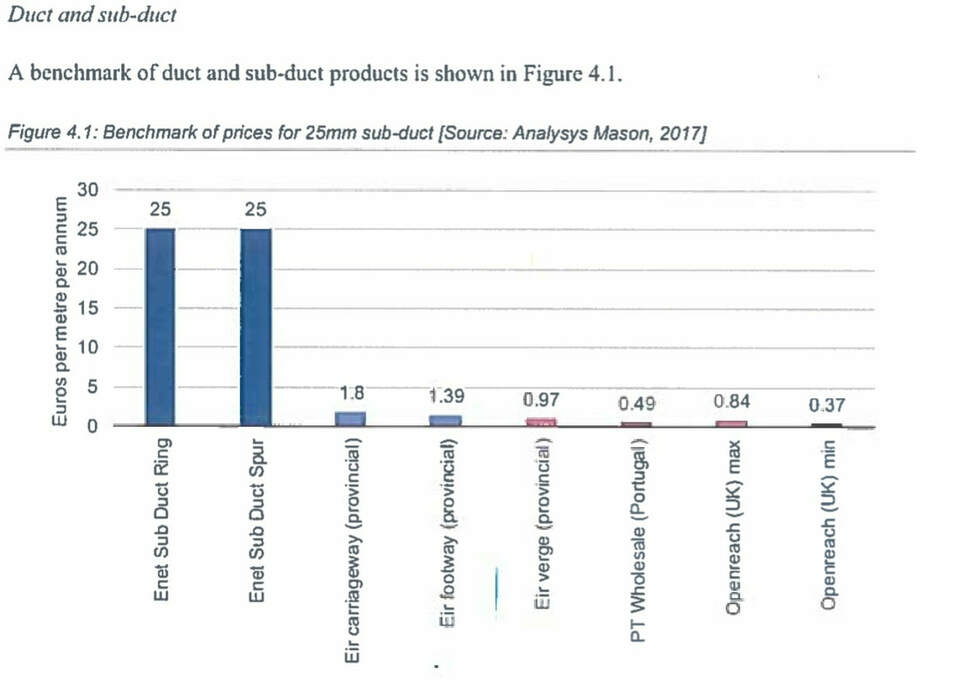

Increased regulatory oversight of enet must recognise the company as a bearer of Significant Market Power (SMP) in Ireland, and perform cost analyses to ensure that under-utilisation of the MANs infrastructure is not conducive to inflated prices. Furthermore, rigorous measures should be introduced to ensure that enet's dark fibre and managed MANs services do not provide a competitive advantage to ETNL's national managed services.

However, the most damning evidence against enet does not come from the services that it sells, but from the shared nature of premises, staff, support and network operations centre. The level of overlap between the two companies is simply stunning, and it raises unpleasant questions.

Increased regulatory oversight of enet must recognise the company as a bearer of Significant Market Power (SMP) in Ireland, and perform cost analyses to ensure that under-utilisation of the MANs infrastructure is not conducive to inflated prices. Furthermore, rigorous measures should be introduced to ensure that enet's dark fibre and managed MANs services do not provide a competitive advantage to ETNL's national managed services.

However, the most damning evidence against enet does not come from the services that it sells, but from the shared nature of premises, staff, support and network operations centre. The level of overlap between the two companies is simply stunning, and it raises unpleasant questions.

Just to add greater clarity as to the internal separation between enet and ETNL, let's examine it. Enet offers co-location, managed services, dark fibre, sub-ducts and ducts using the MANs infrastructure. The company also manages connections to the MANs by external retailers such as BT. Its sales team is responsible for selling these services, and also those of ETNL. Internal transfer pricing is determined by ETNL, and its NOC oversees the infrastructure of both companies, which includes enet's MANs and ETNL's national fixed/wireless backhaul.

With such an operation having the potential to wreak havoc on competition, investment and prices in the Irish telecoms market, rival providers such as BT have called for action. Others, who are customers of enet and understand the disastrous situation that would develop if this were allowed to continue, have not voiced their concerns because of the underlying dependence on the company's infrastructure. This type of inaction and public apathy from most of Ireland's broadband retailers is shameful, and companies such as BT deserve praise for standing up against both enet and the government.

Speaking of the government, and in particular, the Department of Communications, its sloppy handling of the case has arguably dealt the greatest damage to enet and arouses a sense of suspicion that we are only nibbling at a scandal of massive magnitude. With the sudden release of a report on the eve before a meeting of the Public Accounts Committee (PAC) concerning the very issue of the MANs, and the subsequent announcement of a 50% reduction in the annual cost of dark fibre on enet's network occurring in the sequence that they did, one could only question the multiple coincidences.

With such an operation having the potential to wreak havoc on competition, investment and prices in the Irish telecoms market, rival providers such as BT have called for action. Others, who are customers of enet and understand the disastrous situation that would develop if this were allowed to continue, have not voiced their concerns because of the underlying dependence on the company's infrastructure. This type of inaction and public apathy from most of Ireland's broadband retailers is shameful, and companies such as BT deserve praise for standing up against both enet and the government.

Speaking of the government, and in particular, the Department of Communications, its sloppy handling of the case has arguably dealt the greatest damage to enet and arouses a sense of suspicion that we are only nibbling at a scandal of massive magnitude. With the sudden release of a report on the eve before a meeting of the Public Accounts Committee (PAC) concerning the very issue of the MANs, and the subsequent announcement of a 50% reduction in the annual cost of dark fibre on enet's network occurring in the sequence that they did, one could only question the multiple coincidences.

That report, by the way, titled "Review of pricing and access arrangements for the MANs", was conducted by Analyses Mason on behalf of the Department of Communications for 16th March 2018. In the report, numerous recommendations are provided to increase the separation of enet and ETNL, and it concludes that "enet was not in compliance with the agreed Code of Practice in relation to its approach to intercompany transfer pricing". Why the report wasn't published publicly for close to a year concerns many. A plausible answer to that is because its findings made a mockery of the Department of Communications and its grip on a major infrastructure project.

Don't forget, enet's two contracts were renewed in 2017, two years before its first one was scheduled to expire. There was no tender process, meaning rivals such as BT who expressed interest to compete against enet in a competitive nature were told that it was too late.

A report conducted by Norcontel was commissioned by the Department of Communications and published on 23rd June 2016, with its brief examining whether the MANs concessions should be extended or retendered. In line with the government's view, the report found that extending enet's contract would be more cost effective for the state in every scenario. However, it is obvious that these cost savings could have been achieved with a competitive tender process in which enet could win.

One argument that explains why the government renewed enet's contract two years early points to the possibility that the company would not invest in the MANs infrastructure if it was unsure whether its contract would be extended or go to tender. However, the ceasing of investment in the MANs by enet would violate its agreement with the government and therefore warrant the termination of its contract.

Don't forget, enet's two contracts were renewed in 2017, two years before its first one was scheduled to expire. There was no tender process, meaning rivals such as BT who expressed interest to compete against enet in a competitive nature were told that it was too late.

A report conducted by Norcontel was commissioned by the Department of Communications and published on 23rd June 2016, with its brief examining whether the MANs concessions should be extended or retendered. In line with the government's view, the report found that extending enet's contract would be more cost effective for the state in every scenario. However, it is obvious that these cost savings could have been achieved with a competitive tender process in which enet could win.

One argument that explains why the government renewed enet's contract two years early points to the possibility that the company would not invest in the MANs infrastructure if it was unsure whether its contract would be extended or go to tender. However, the ceasing of investment in the MANs by enet would violate its agreement with the government and therefore warrant the termination of its contract.

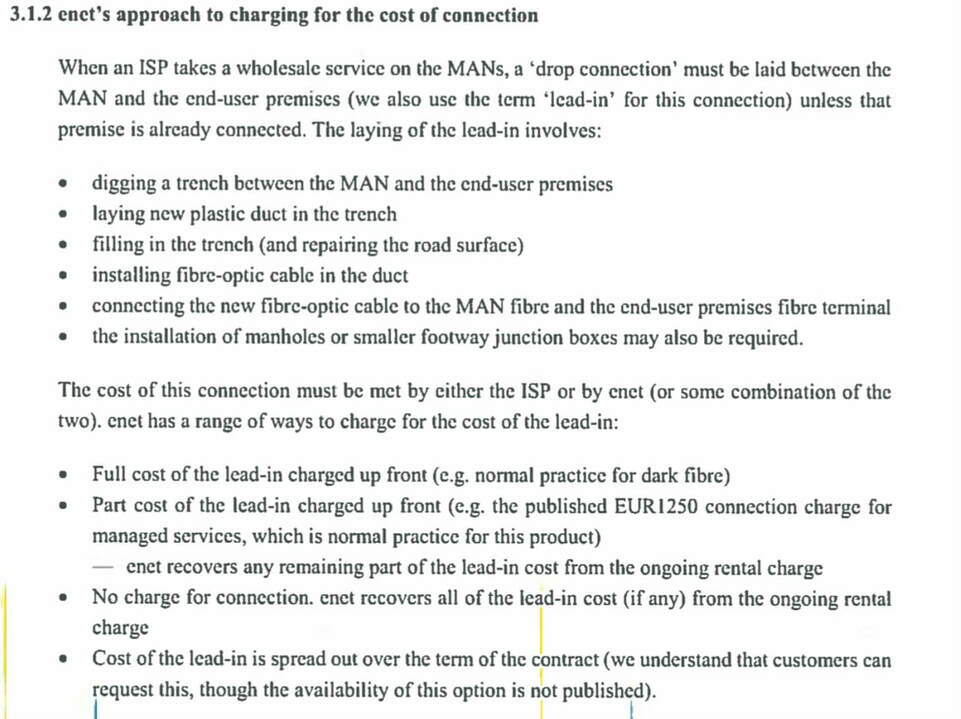

This entire mess with the MANs and enet is a consequence of lax regulatory oversight by the Department of Communications. It boggles my mind how the company was allowed to maintain the same annual dark fibre prices (per metre) from 2004 until the morning of the PAC meeting, while the entire telecoms industry around it has experienced decades of falling prices due to advancing technology and changing market conditions.

I will reiterate the stance that this is likely the tip of a distasteful iceberg, and given enet's membership within the National Broadband Ireland consortium, any further unravelling would be against the interests of the current government.

Setting an example that state contracts can be broken without hindrance ridicules the integrity of our government and the regulatory regimes in place to protect consumers and competition.

I will reiterate the stance that this is likely the tip of a distasteful iceberg, and given enet's membership within the National Broadband Ireland consortium, any further unravelling would be against the interests of the current government.

Setting an example that state contracts can be broken without hindrance ridicules the integrity of our government and the regulatory regimes in place to protect consumers and competition.

| MANs Review by Analysys Mason | |

| File Size: | 1395 kb |

| File Type: | |

Revolution in Wireless is inbound

Increasing penetration of fibre across Ireland acts as a catalyst for the expansion of wireless networks that target peripheral regions, bridging the stark digital divide. Efforts to bring fibre as close to the end user as possible, and in the case of wireless technologies, directly to the base station (FTTA), provide operators with the freedom of high-capacity, resilient and scalable backhaul. This trend of extending fibre beyond the core network will prove to be a key advantage in the race to create gigabit-class wireless networks that act as a more cost-effective alternative to fixed fibre access networks, especially in regions where the population distribution and topography prohibits investment.

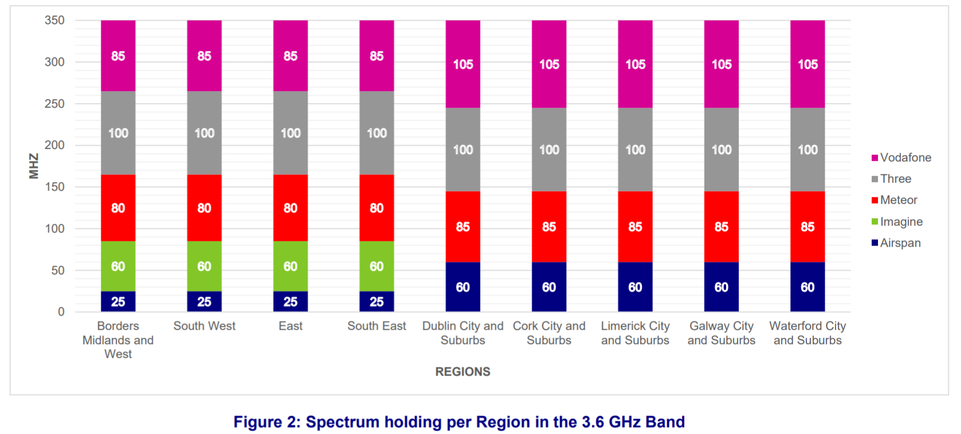

As a testament to the potential of 5G NR for FWA, Imagine, Ireland's largest FWA provider, will deploy the 3.6GHz band over at least 325 macrosites, with the intention of covering 1.1 million premises on this island within eighteen months. And, here's the polarising aspect of the company's plans: its network will be available to 400,000 premises falling under the intervention area of the National Broadband Plan, with throughput of up to 300Mbps promised at launch.

This investment by Imagine will demonstrate the practicality of FWA deployments on this island, utilising the pioneering sub-6GHz 5G NR band to provide enhanced peak capacity compared to the 800 and 1800MHz 4G bands available today. Imagine's 60MHz of the 3.6GHz band is now live in all blocks of the spectrum throughout the Border, Midlands and West, South West, East and South East. The company has vacated services in the 3680 MHz–3800 MHz band, and completed the transition of 46 of its 241 transition service areas to allow Vodafone to conducts its own trials of the 3.6GHz band in rural areas.

As a testament to the potential of 5G NR for FWA, Imagine, Ireland's largest FWA provider, will deploy the 3.6GHz band over at least 325 macrosites, with the intention of covering 1.1 million premises on this island within eighteen months. And, here's the polarising aspect of the company's plans: its network will be available to 400,000 premises falling under the intervention area of the National Broadband Plan, with throughput of up to 300Mbps promised at launch.

This investment by Imagine will demonstrate the practicality of FWA deployments on this island, utilising the pioneering sub-6GHz 5G NR band to provide enhanced peak capacity compared to the 800 and 1800MHz 4G bands available today. Imagine's 60MHz of the 3.6GHz band is now live in all blocks of the spectrum throughout the Border, Midlands and West, South West, East and South East. The company has vacated services in the 3680 MHz–3800 MHz band, and completed the transition of 46 of its 241 transition service areas to allow Vodafone to conducts its own trials of the 3.6GHz band in rural areas.

Currently, there are 46,000 FWA subscribers in Ireland according to ComReg. The majority of these connections are likely located in rural regions where fixed infrastructure is lacking, pointing to the importance of hybrid broadband deployments for rural connectivity in the absence of state intervention. However, the utilisation of FWA as a method of dual-broadband connectivity for businesses is increasing in an age where downtime is not an option.

Interestingly, the 3.6GHz band is already being accessed by 25,000 FWA subscribers on this island, and Imagine's rollout will only increase this. Other bands for FWA include 5.8 GHz, 10.5 GHz, 26 GHz band, with each of these on course to play a path in future 5G NR deployments. In particular, the mmWave 26GHz band, restricted to use for point to point microwave backhaul links in Ireland, will become the dominant high-capacity band for 5G NR access on this continent as backhaul services are moved to alternative bands such as 32GHz.

However, despite the pace of advancement and hype in the wireless industry for 5G NR, the superiority of fixed networks still stands. Moreover, it is important to understand that site densification will be required to support the growing usage of FWA networks, and Imagine's planned portfolio of 325 sites addresses coverage availability, not capacity. The process of densification is incredibly CapEx intensive, and on an island of physical obstructions such as hills and valleys, signal attenuation multiplies both the financial and technological challenges.

Interestingly, the 3.6GHz band is already being accessed by 25,000 FWA subscribers on this island, and Imagine's rollout will only increase this. Other bands for FWA include 5.8 GHz, 10.5 GHz, 26 GHz band, with each of these on course to play a path in future 5G NR deployments. In particular, the mmWave 26GHz band, restricted to use for point to point microwave backhaul links in Ireland, will become the dominant high-capacity band for 5G NR access on this continent as backhaul services are moved to alternative bands such as 32GHz.

However, despite the pace of advancement and hype in the wireless industry for 5G NR, the superiority of fixed networks still stands. Moreover, it is important to understand that site densification will be required to support the growing usage of FWA networks, and Imagine's planned portfolio of 325 sites addresses coverage availability, not capacity. The process of densification is incredibly CapEx intensive, and on an island of physical obstructions such as hills and valleys, signal attenuation multiplies both the financial and technological challenges.

Deployment of mmWave spectrum and extreme-capacity microwave bands such as the E-Band, W-Band and D-Band represent the ultimate end-goal for second-stage 5G NR deployments, and for "fibre-like" wireless networks. To reach those scenarios, work to increase the penetration of fibre access networks in peripheral regions must continue, and new planning legislation needs to be introduced to facilitate the rapid deployment of small cells as means of network densification.

The Mobile Phone and Broadband Taskforce has facilitated these efforts, and its quarterly report offers an in-depth insight into the telecoms industry on this island. For fixed backhaul, Transport Infrastructure Ireland (TII) has installed more than 1,000km of ducting across our road networks, with it now becoming mandatory to install and geo-code ducting on all new road schemes.

In terms of mobile, ComReg will publish an interactive coverage map portraying the availability of 2G, 3G and 4G coverage based on data provided by eir, Three and Vodafone in Q1 of 2019. This is important with respect to broadband because there are almost 300,000 mobile broadband subscriptions in Ireland, most of which rely upon 3G and 4G macrosites in rural areas.

The Mobile Phone and Broadband Taskforce has facilitated these efforts, and its quarterly report offers an in-depth insight into the telecoms industry on this island. For fixed backhaul, Transport Infrastructure Ireland (TII) has installed more than 1,000km of ducting across our road networks, with it now becoming mandatory to install and geo-code ducting on all new road schemes.

In terms of mobile, ComReg will publish an interactive coverage map portraying the availability of 2G, 3G and 4G coverage based on data provided by eir, Three and Vodafone in Q1 of 2019. This is important with respect to broadband because there are almost 300,000 mobile broadband subscriptions in Ireland, most of which rely upon 3G and 4G macrosites in rural areas.

| Mobile Phone and Broadband Taskforce Report | |

| File Size: | 1321 kb |

| File Type: | |

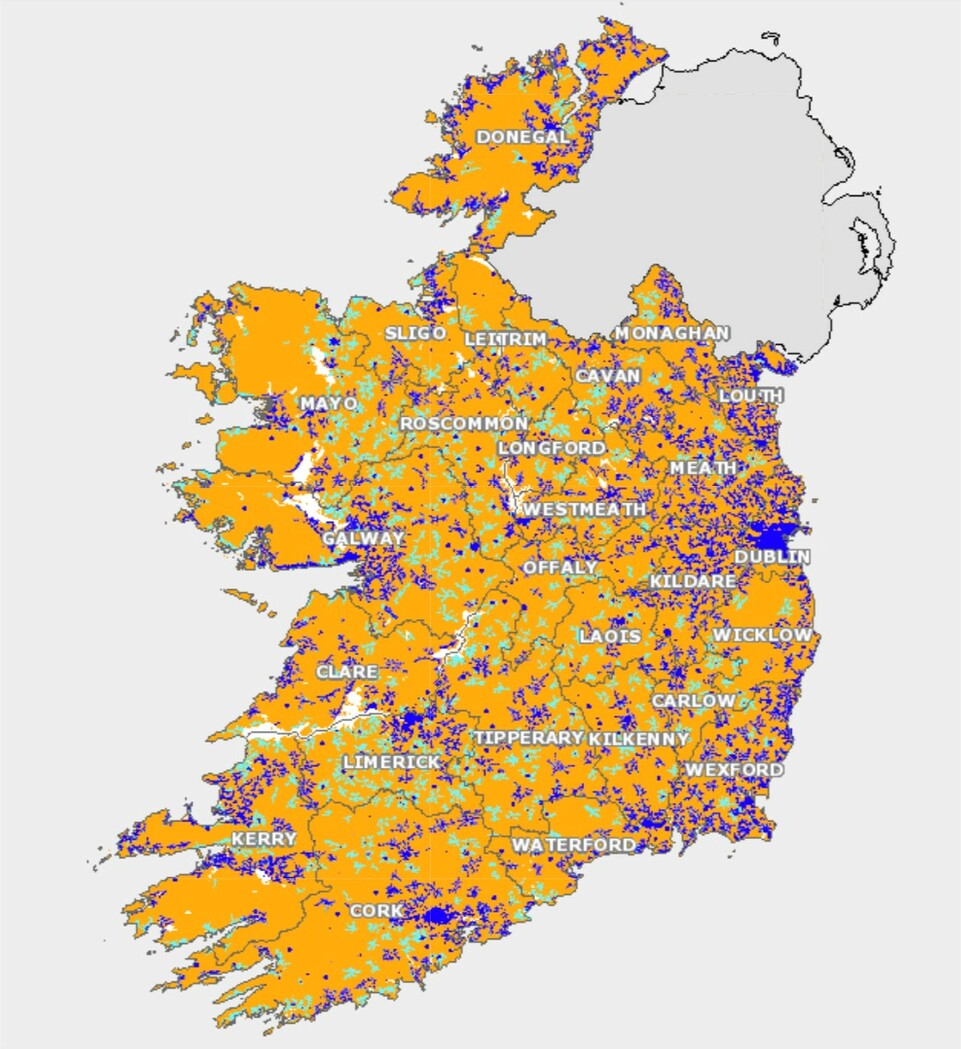

The National Broadband Plan and State Intervention

It appears the exasperation left in the wake of a stagnant National Broadband Plan has pushed the private industry to expand its services into more rural areas, and most notably, covering premises that the state considered were not commercially viable without subsided intervention. An abstract view of this is to consider that while the National Broadband Plan itself has not reduced the digital divide in Ireland, its concept and presence has indeed encouraged telecoms companies to collaborate in an effort to bring high-speed broadband to underserved Irish premises.

Unfortunately, that idyllic outlook takes a turn for the worse when we actually calculate the number of homes that are still without access to high-speed broadband. It is paramount to understand that each and every number mentioned represents a home or business which is actively being deprived of a right to Internet access and starved of an opportunity to excel in the digital age. These are harsh realities suffered by real people on a daily basis, and the faces behind the numbers will testify to the plight of their connectivity, or lack thereof.

The current National Broadband Plan intervention area targets the delivery of high-speed broadband to approximately 540,000 postal addresses on this island. In greater detail, this catchment represents 21% of the national population, 61% of national farms, 13% of schools and 4% of national business parks. open eir will provide FTTH services to 335,000 premises upon completion of its rural investment programme in June, with 35,000 of those premises falling under the intervention area of the National Broadband Plan.

Unfortunately, that idyllic outlook takes a turn for the worse when we actually calculate the number of homes that are still without access to high-speed broadband. It is paramount to understand that each and every number mentioned represents a home or business which is actively being deprived of a right to Internet access and starved of an opportunity to excel in the digital age. These are harsh realities suffered by real people on a daily basis, and the faces behind the numbers will testify to the plight of their connectivity, or lack thereof.

The current National Broadband Plan intervention area targets the delivery of high-speed broadband to approximately 540,000 postal addresses on this island. In greater detail, this catchment represents 21% of the national population, 61% of national farms, 13% of schools and 4% of national business parks. open eir will provide FTTH services to 335,000 premises upon completion of its rural investment programme in June, with 35,000 of those premises falling under the intervention area of the National Broadband Plan.

As state intervention is not legal in locations where commercial operators provide services, open eir's rollouts continue to reduce the number of premises included in the National Broadband Plan. The company's separate FTTH rollout to 1.4 million premises in urban Ireland includes 50,000 urban infill sites which are earmarked for state intervention, placing the total number of addresses to be removed from the National Broadband Plan by open eir above 85,000 within five years.

The aforementioned rollout by Imagine will cover 400,000 homes within the National Broadband Plan intervention area with the 3.6GHz band and FWA services. While this is excellent news for the premises set to benefit from Imagine's rural rollout, it must not be seen as a replacement for fixed fibre infrastructure, which is the only future-proof solution available today and the one that the National Broadband Plan should adopt. Imagine has outlined that it will not pursue legal action against the state in the event of a successful National Broadband Plan provisioning high-speed broadband services where its own commercial services are available.

Culminating these statistics paints a picture of a shrinking National Broadband Plan pie and one that leaves behind only the most remote and expensive of premises to connect with high-speed broadband. Unequivocally, the impact of this will be undesirable for the ultimate winner of the state's contract because it lessens the ability to earn a return on investment that could be attributed to premises which are less expensive to connect.

The aforementioned rollout by Imagine will cover 400,000 homes within the National Broadband Plan intervention area with the 3.6GHz band and FWA services. While this is excellent news for the premises set to benefit from Imagine's rural rollout, it must not be seen as a replacement for fixed fibre infrastructure, which is the only future-proof solution available today and the one that the National Broadband Plan should adopt. Imagine has outlined that it will not pursue legal action against the state in the event of a successful National Broadband Plan provisioning high-speed broadband services where its own commercial services are available.

Culminating these statistics paints a picture of a shrinking National Broadband Plan pie and one that leaves behind only the most remote and expensive of premises to connect with high-speed broadband. Unequivocally, the impact of this will be undesirable for the ultimate winner of the state's contract because it lessens the ability to earn a return on investment that could be attributed to premises which are less expensive to connect.

Adapting the National Broadband Plan as technology and time progress is a fundamental element of the process to keep it relevant. As detailed, the constant chipping away at the intervention area radically disrupts the costs involved in the end rollout and the revenues that can be earned over the decades following its completion.

One method that deserves some consideration is to break down the intervention area on a region by region basis, determining which operator has the best and most pervasive infrastructure there. From that, contracts can be awarded to multiple different operators in many different parts of the country. This is an attractive approach because it selects the best solution for each particular region, rather than choosing one homogeneous standard of connectivity.

The National Broadband Plan contract at current is broken into two types: a national build and a north/south build. The latter would involve two separate operators, each targeting one of the regions. The former is one that would reduce complexity, but as we've come to learn, even this approach has many challenges.

From a regulatory standpoint, a hyper-local National Broadband Plan would be a nightmare. With our regulator struggling to oversee just a handful of operators at the minute, imagine the exponential uplift in manpower that would be required to ensure every operator in every region of the contract is performing their obligations.

One method that deserves some consideration is to break down the intervention area on a region by region basis, determining which operator has the best and most pervasive infrastructure there. From that, contracts can be awarded to multiple different operators in many different parts of the country. This is an attractive approach because it selects the best solution for each particular region, rather than choosing one homogeneous standard of connectivity.

The National Broadband Plan contract at current is broken into two types: a national build and a north/south build. The latter would involve two separate operators, each targeting one of the regions. The former is one that would reduce complexity, but as we've come to learn, even this approach has many challenges.

From a regulatory standpoint, a hyper-local National Broadband Plan would be a nightmare. With our regulator struggling to oversee just a handful of operators at the minute, imagine the exponential uplift in manpower that would be required to ensure every operator in every region of the contract is performing their obligations.

Glimmer of Light

For the people waiting on high-speed broadband, there is a glimmer of light, not just light in the form of hope but light in the form of electromagnetic radiation pulsating across our farmyards, our roads and our villages. This light is fibre, or in other, more impactful words, the electricity of tomorrow and the future of connectivity.

With its reach penetrating more and more peripheral regions thanks to the extension of commercial rollouts, both fibre access networks and high-speed wireless services can become a reality, not in years to come, but right now. This is not wishful thinking, just look to the 335,000 premises that will enjoy world-class connectivity by June of this year. These are premises, once shunned by the state, that can now contribute to our economy in the digital age.

The forthcoming race to 5G NR and new FWA services only supports our efforts to achieve connectivity parity on this island, and with industry collaboration growing on these important issues, Ireland's face of broadband continues to evolve, for the better.

With its reach penetrating more and more peripheral regions thanks to the extension of commercial rollouts, both fibre access networks and high-speed wireless services can become a reality, not in years to come, but right now. This is not wishful thinking, just look to the 335,000 premises that will enjoy world-class connectivity by June of this year. These are premises, once shunned by the state, that can now contribute to our economy in the digital age.

The forthcoming race to 5G NR and new FWA services only supports our efforts to achieve connectivity parity on this island, and with industry collaboration growing on these important issues, Ireland's face of broadband continues to evolve, for the better.

Mapping Ireland and Europe's Path to 5GGigabit-Class Wireless networks represent an elusive, but achievable, connectivity goal.

|