The trends that will shape Ireland's Mobile Market in 2019

Even without 5G, another flurry of innovation in mobile will trickle its way onto our island.

Published 15/12/18

Mobile is still in a phase of immense growth, and this is simply incredible for a technology which debuted decades ago. In the years gone by, few technologies have managed to match its sheer scale, and it's just the very beginning of a road that will see us creating more data in one day than that created in millions of years gone by. As a technology which knows no boundaries between the physical and digital worlds, there is a constant conveyor belt of innovation bombarding us from every angle.

But, innovation is futile if it does not have a positive and meaningful impact on society, and the number of innovations which fulfil this is very limited. The wireless networks of today, underpinned by standards set years ago, are prime examples of ecosystems which have flourished in the presence of a vision for a connected tomorrow. These innovations can be seen all around us: the smartphone, the smartwatch, the laptop and the IoT sensor.

In 2018, we gained a glimpse into the potential of 5G, gave the middle finger to hundreds of mobile black spots, witnessed further enhancement of our networks and dabbled with the idea of a wireless approach to the National Broadband Plan. The launch of the next generation of our mobile networks is looming, and the trends which will shape Ireland's mobile market next year will be the ones that influence the future of a society dependent on connectivity.

But, innovation is futile if it does not have a positive and meaningful impact on society, and the number of innovations which fulfil this is very limited. The wireless networks of today, underpinned by standards set years ago, are prime examples of ecosystems which have flourished in the presence of a vision for a connected tomorrow. These innovations can be seen all around us: the smartphone, the smartwatch, the laptop and the IoT sensor.

In 2018, we gained a glimpse into the potential of 5G, gave the middle finger to hundreds of mobile black spots, witnessed further enhancement of our networks and dabbled with the idea of a wireless approach to the National Broadband Plan. The launch of the next generation of our mobile networks is looming, and the trends which will shape Ireland's mobile market next year will be the ones that influence the future of a society dependent on connectivity.

Continuing to Banish Blackspots

Mobile blackspots are a hideous stain on our uncompromising vision to be champions of connectivity in Ireland, and they represent a collusion-tainted history of coverage cherry picking and tactical collusion between our mobile providers. This remains a major issue for those that happen to live, work or commute in a black spot area, and the level of desperation has led the government to establish an entire task force with the purpose of identifying and eliminating connectivity blackspots in Ireland.

The Mobile Phone and Broadband Taskforce has set out to banish the existence of black spots through encouraging mobile providers and ComReg to work together collectively, something that certainly hasn't always been the case in this country. Some of the fruits of that work have already delivered material benefits to those previously unable to place a call, send a text or stream YouTube.

Legalising mobile phone repeaters stands out as a momentous achievement, allowing consumers to improve their network experience with the implementation of a certified device which works with rather than against mobile provider's infrastructure. Other notable breakthroughs include the mandatory instalment of ducting in major road construction projects.

That said, the work performed by the task force has resulted in a very marginal improvement on a national basis, and with just over 18% of the landmass covered with 30Mbps coverage, we have an enormous amount of work yet to undertake. Thankfully, things are lining up nicely for 2019 to be a very progressive year in the assault on blackspots.

The Mobile Phone and Broadband Taskforce has set out to banish the existence of black spots through encouraging mobile providers and ComReg to work together collectively, something that certainly hasn't always been the case in this country. Some of the fruits of that work have already delivered material benefits to those previously unable to place a call, send a text or stream YouTube.

Legalising mobile phone repeaters stands out as a momentous achievement, allowing consumers to improve their network experience with the implementation of a certified device which works with rather than against mobile provider's infrastructure. Other notable breakthroughs include the mandatory instalment of ducting in major road construction projects.

That said, the work performed by the task force has resulted in a very marginal improvement on a national basis, and with just over 18% of the landmass covered with 30Mbps coverage, we have an enormous amount of work yet to undertake. Thankfully, things are lining up nicely for 2019 to be a very progressive year in the assault on blackspots.

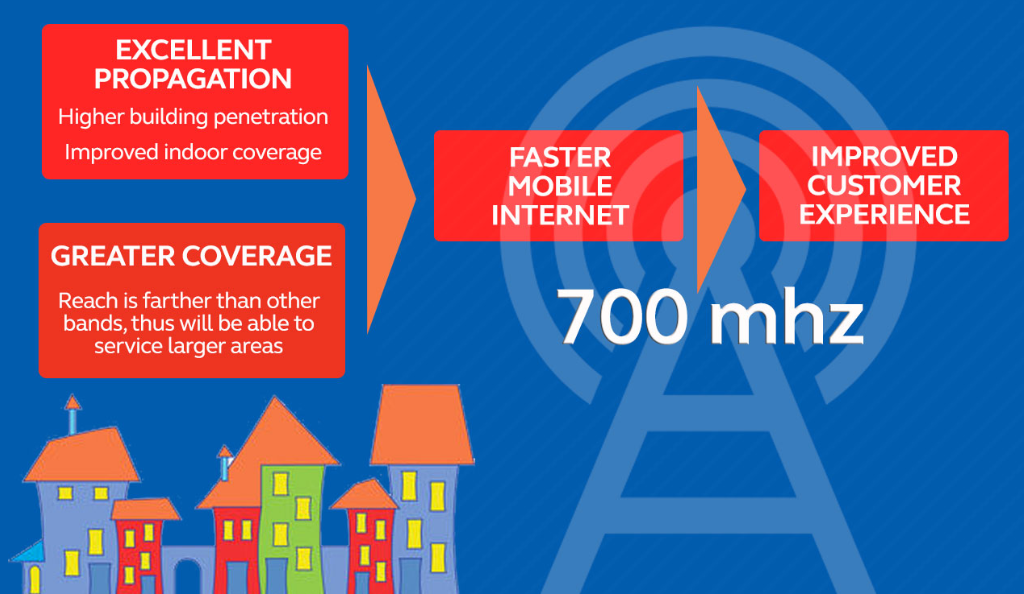

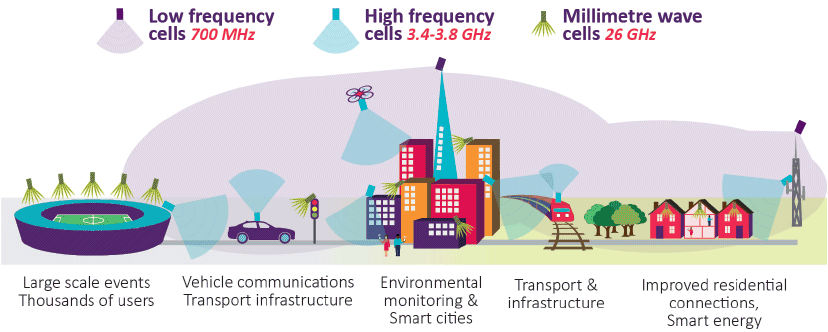

ComReg's planned release of spectrum in the 700MHz band will be music to the ears of those suffering today, and the auction will dramatically expand the number of locations in which mobile providers can target for coverage without the fear of not earning a return on their investment. The band boasts improved indoor penetration and a wider coverage footprint than any other band available for mobile in Ireland today, and this is one of the reasons why DTT services have utilised it up to now.

Another advantage which will result from the release of the 700MHz band will be an uplift in the level of capacity offered by our networks. Some may question the relevance of this in relation to coverage, however, when we dig deeper there are very obvious improvements. Carrier aggregation can dramatically enhance performance at the cell edge, and with the ability to aggregate more spectrum, the potential for improvement only multiplies. For example, if Vodafone gets its hands on a portion of the 700MHz band as expected, the company will be able to provide peak speeds of close to 600Mbps thanks to the aggregation of this band along with the existing 800MHz and 1800MHz 4G bands. (Of course, other techniques such as 256QAM, already present, will be necessary to achieve this speed).

Looking at mobile providers and infrastructure players directly, recent announcements by companies such as Cignal and eir are set to define the pace of improvement in 2019. For its part, eir is committing to providing 4G coverage to 99% of the Irish population within two years (not landmass as the company tried to flaunt intially), with the growth of its radio site portfolio from 2,000 to 2,500.

This is a quantum leap on two fronts. Firstly, it signals eir's renewed focus on a mobile network which has been neglected to a point of effective collapse in congestion-stricken urban areas. As a change in tune, eir is positioning itself to become more proactive in the mobile space, a transformation from the rather reactive strategy overshadowing the company in the past. Secondly, this move forces Vodafone, a company who has thrived in the absence of competition for decades, to accelerate its own technological advancements.

Another advantage which will result from the release of the 700MHz band will be an uplift in the level of capacity offered by our networks. Some may question the relevance of this in relation to coverage, however, when we dig deeper there are very obvious improvements. Carrier aggregation can dramatically enhance performance at the cell edge, and with the ability to aggregate more spectrum, the potential for improvement only multiplies. For example, if Vodafone gets its hands on a portion of the 700MHz band as expected, the company will be able to provide peak speeds of close to 600Mbps thanks to the aggregation of this band along with the existing 800MHz and 1800MHz 4G bands. (Of course, other techniques such as 256QAM, already present, will be necessary to achieve this speed).

Looking at mobile providers and infrastructure players directly, recent announcements by companies such as Cignal and eir are set to define the pace of improvement in 2019. For its part, eir is committing to providing 4G coverage to 99% of the Irish population within two years (not landmass as the company tried to flaunt intially), with the growth of its radio site portfolio from 2,000 to 2,500.

This is a quantum leap on two fronts. Firstly, it signals eir's renewed focus on a mobile network which has been neglected to a point of effective collapse in congestion-stricken urban areas. As a change in tune, eir is positioning itself to become more proactive in the mobile space, a transformation from the rather reactive strategy overshadowing the company in the past. Secondly, this move forces Vodafone, a company who has thrived in the absence of competition for decades, to accelerate its own technological advancements.

Cignal, the radio site infrastructure player which controls over 16% of the sites that support your calls and Netflix sessions in Ireland, is on a major expansion plan that will see the investment of €25 million across three hundred locations. The company was formed out of the acquisition of three hundred radio sites from state-owned Colite in 2015, and you can think of Cignal as a wholesale radio site provider for mobile providers and FWA operators. The plan involves the largest creation of new radio sites on this island in over a decade and is another example of how blackspots will be erased from our map, one by one, during the course of 2019 and beyond.

Welcoming WiFi Calling and VoLTE

VoLTE and WiFi Calling are two features which directly complement our plan to banish blackspots in Ireland, and the former has enabled thousands of consumers to place and receive calls on eir's network in locations where coverage remains non-existent. I will go as far as to say that eir's implementation of WiFi Calling has radically transformed the calling experience for many of its customers, in a very positive way.

Sure, hand-off between WiFi networks and the RAN during these VoIP calls is less than perfect, but that's a tiny blip on an otherwise outstanding innovation. In my view, WiFi Calling is a superior method to mitigate our coverage woes over signal repeaters because it's a cost-effective, simple and reliable solution that will work on virtually every fixed network in Ireland, with a bandwidth requirement of as little as 80Kbps.

Vodafone will launch WiFi Calling in 2019, and Three has suggested a similar move. These two mobile providers facilitate more customers that of every other Irish network combined, and it is of paramount importance that the introduction of WiFi Calling is a swift and intuitive experience. Education will play a pivotal role in informing people of WiFi Calling's arrival, and in teaching them that this is a feature worth adopting, not merely admiring.

Sure, hand-off between WiFi networks and the RAN during these VoIP calls is less than perfect, but that's a tiny blip on an otherwise outstanding innovation. In my view, WiFi Calling is a superior method to mitigate our coverage woes over signal repeaters because it's a cost-effective, simple and reliable solution that will work on virtually every fixed network in Ireland, with a bandwidth requirement of as little as 80Kbps.

Vodafone will launch WiFi Calling in 2019, and Three has suggested a similar move. These two mobile providers facilitate more customers that of every other Irish network combined, and it is of paramount importance that the introduction of WiFi Calling is a swift and intuitive experience. Education will play a pivotal role in informing people of WiFi Calling's arrival, and in teaching them that this is a feature worth adopting, not merely admiring.

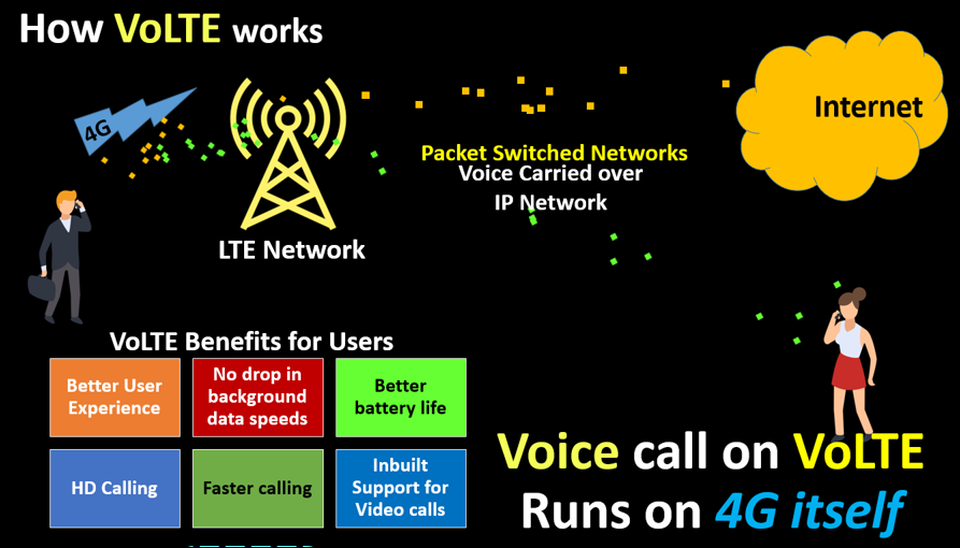

Honestly, it really is an embarrassment that Ireland's mobile providers have failed to implement VoLTE before now. Remember, our calls are still handled by 2G and 3G networks, both standards which are now rendered archaic in a world of advanced 4G networks and even primitive 5G trials. VoLTE is a feature that has been available in countries across the world for many years, and while the set of benefits that it introduces may be limited, every little helps.

Vodafone and eir are preparing to launch their VoLTE service very soon, and while Three has taken a more subdued approach to the feature, it would be inconceivable that a modern mobile network could ignore it entirely in a competitive marketplace. An important component of VoLTE is ubiquitous 4G coverage, and the aforementioned 700MHz auction will play an integral role in ensuring there is a smooth calling experience on the RAN during handoff between different radio sites. This feature will also allow mobile providers to shift more spectrum away from legacy 2G and 3G networks, bolstering the capacity of 4G and 5G deployments in the future.

Faster call set up times and enhanced audio quality are just the tip of the iceberg when it comes to the potential of VoLTE, and 2019 will see the first major improvement to our beloved calling experience in years.

Vodafone and eir are preparing to launch their VoLTE service very soon, and while Three has taken a more subdued approach to the feature, it would be inconceivable that a modern mobile network could ignore it entirely in a competitive marketplace. An important component of VoLTE is ubiquitous 4G coverage, and the aforementioned 700MHz auction will play an integral role in ensuring there is a smooth calling experience on the RAN during handoff between different radio sites. This feature will also allow mobile providers to shift more spectrum away from legacy 2G and 3G networks, bolstering the capacity of 4G and 5G deployments in the future.

Faster call set up times and enhanced audio quality are just the tip of the iceberg when it comes to the potential of VoLTE, and 2019 will see the first major improvement to our beloved calling experience in years.

Consumers embrace Dual-Play and Bill-Pay

Steering away from the technological breakthroughs upcoming in 2019, I want to take some time to analyse two market trends which will become more prominent next year. The rise to fame of dual-play bundles stands out as a promising development for both telecoms companies and Irish consumers as we fall further into disarray with traditional linear TV services and the ailing landline.

Dual-play bundles combine mobile with broadband in the same plan, two services which will continue to be the cash cows of the industry as the use of OTT services extrapolates. For consumers, the benefits are very obvious, with increased simplicity and value being the core drivers of appeal. In the eyes of the telecoms company, dramatically improved customer retention and greater revenues are like water flooding a parched tongue.

When consumers access two services from one company, the level of trust and loyalty that develops is incredibly valuable and easily exploitable over the long term. And because change is viewed as a pain in the world of technology, churn rates take a nose dive for those that subscribe to dual-play bundles. Hell, even if an issue arises, the chances that a customer will walk away from their company are pretty slim, and the same ignorance applies in the case of a competitor offering lower prices.

Eir, Virgin Media and Vodafone have all catered for the demand of dual-play, and with roaring success too. ComReg's data shows that churn in the Irish telecoms market reached record lows in Q2 and Q3 2018, and this has been a trend mirrored throughout multiple consecutive quarters in recent times. This will continue in 2019, and the companies that cash in on the opportunity are the ones that will reign supreme upon the inevitable death of linear TV and landline services.

Dual-play bundles combine mobile with broadband in the same plan, two services which will continue to be the cash cows of the industry as the use of OTT services extrapolates. For consumers, the benefits are very obvious, with increased simplicity and value being the core drivers of appeal. In the eyes of the telecoms company, dramatically improved customer retention and greater revenues are like water flooding a parched tongue.

When consumers access two services from one company, the level of trust and loyalty that develops is incredibly valuable and easily exploitable over the long term. And because change is viewed as a pain in the world of technology, churn rates take a nose dive for those that subscribe to dual-play bundles. Hell, even if an issue arises, the chances that a customer will walk away from their company are pretty slim, and the same ignorance applies in the case of a competitor offering lower prices.

Eir, Virgin Media and Vodafone have all catered for the demand of dual-play, and with roaring success too. ComReg's data shows that churn in the Irish telecoms market reached record lows in Q2 and Q3 2018, and this has been a trend mirrored throughout multiple consecutive quarters in recent times. This will continue in 2019, and the companies that cash in on the opportunity are the ones that will reign supreme upon the inevitable death of linear TV and landline services.

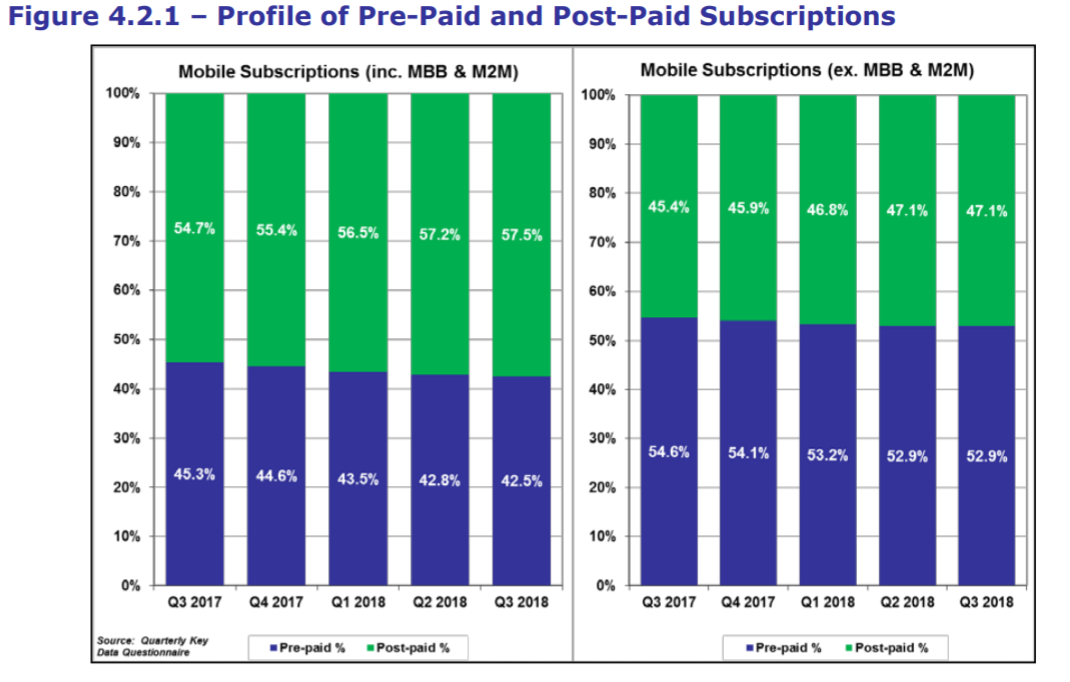

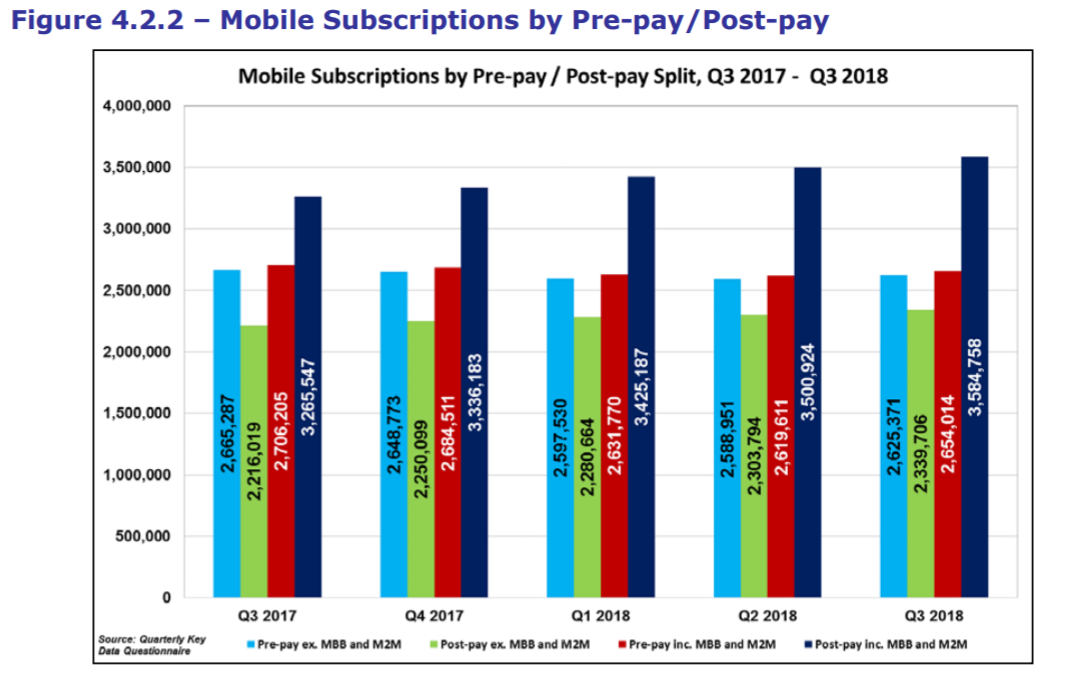

Another trend which will proceed in 2018 is the flourishing adoption of bill pay, and more specifically, bill-pay sim offerings. The lustre associated with pay as you go plans has faded and the chains attached to bill pay plans have deterred consumers from entering contracts which are akin to receiving a prison sentence in Guantanamo Bay. The combination of this, along with increasing stagnation in the smartphone market, is pushing consumers to bill pay sim only plans which mix the freedom of pay as you go with the allowance benefits of bill pay.

In Q3 of 2018, bill pay subscriptions accounted for 52.9% of the market, and this share is even greater on a mature provider such as Vodafone where over 65% of its customer base presides on a bill pay plan. With the smartphone market reaching a point of saturation in developed markets such as Ireland, consumers are holding onto their devices longer than ever before, and so there the requirement to upgrade year after year is a thing of the past.

There is, however, an imminent upset to the idea that the smartphone market has reached its maturity. With the launch of 5G, consumers will be inclined to upgrade to devices which support the new spectrum and associated technologies, inevitably driving further migration towards bill pay sim only plans. Remember, in the early years of a new wireless technology, there are sure to be phenomenal advances in the modem performance of smartphones, and churn in the mobile market will increase as consumers seek to take advantage of these innovations.

In Q3 of 2018, bill pay subscriptions accounted for 52.9% of the market, and this share is even greater on a mature provider such as Vodafone where over 65% of its customer base presides on a bill pay plan. With the smartphone market reaching a point of saturation in developed markets such as Ireland, consumers are holding onto their devices longer than ever before, and so there the requirement to upgrade year after year is a thing of the past.

There is, however, an imminent upset to the idea that the smartphone market has reached its maturity. With the launch of 5G, consumers will be inclined to upgrade to devices which support the new spectrum and associated technologies, inevitably driving further migration towards bill pay sim only plans. Remember, in the early years of a new wireless technology, there are sure to be phenomenal advances in the modem performance of smartphones, and churn in the mobile market will increase as consumers seek to take advantage of these innovations.

Physical SIMs will go the way of the Dinosaur

Who wants physical SIMs? We lose them, they're the first scapegoat that mobile providers pursue when a complaint about our service arises and they come in so many different sizes that we are required to haul around a bunch of adaptors. Yuck. Finally, an end to the SIM is in sight, and and as the IoT gains ground, the death will only accelerate.

You see, there is a simple equation pushing the IoT forward: an availability of low-cost devices which connect to low-cost networks. Physical SIMs break this equation because they add unnecessary cost and complexity, and that's why IoT standards such as Sigfox have given the chop to physical SIMs in exhange for eSIMs. One exception to this trend is NB-IoT, a technology which does integrate physical SIMs, leading to greater module costs. But, guess what, NB-IoT was developed by traditional telecoms companies whom remain hesitant to adopting eSIMs for a fear of change and a dip in their profits.

The ubiquitous availability of IoT devices which utilise eSIMs is acting as a catalyst for the entire industry, with even prominent smartphone manufacturers such Apple and Google incorporating the feature within their latest smartphones. Think of smartwatches such as the cellular-enabled Apple Watch and the dedicated plans launched by US providers: this is a massive opportunity for mobile providers to create new revenue streams through selling more diverse services, and missing such an opportunity as is the case in Ireland at the moment would be a preposterous mistake on behalf of providers here.

eSIMs will render the physical SIM obsolete, and this technology is a direct benefit to consumers, businesses and the telecoms industry as a whole. What are we waiting for?

You see, there is a simple equation pushing the IoT forward: an availability of low-cost devices which connect to low-cost networks. Physical SIMs break this equation because they add unnecessary cost and complexity, and that's why IoT standards such as Sigfox have given the chop to physical SIMs in exhange for eSIMs. One exception to this trend is NB-IoT, a technology which does integrate physical SIMs, leading to greater module costs. But, guess what, NB-IoT was developed by traditional telecoms companies whom remain hesitant to adopting eSIMs for a fear of change and a dip in their profits.

The ubiquitous availability of IoT devices which utilise eSIMs is acting as a catalyst for the entire industry, with even prominent smartphone manufacturers such Apple and Google incorporating the feature within their latest smartphones. Think of smartwatches such as the cellular-enabled Apple Watch and the dedicated plans launched by US providers: this is a massive opportunity for mobile providers to create new revenue streams through selling more diverse services, and missing such an opportunity as is the case in Ireland at the moment would be a preposterous mistake on behalf of providers here.

eSIMs will render the physical SIM obsolete, and this technology is a direct benefit to consumers, businesses and the telecoms industry as a whole. What are we waiting for?

Connecting Sensors, by the millions

The Internet of Things is on an unstoppable path to mass adoption across the world, and in Ireland. The chicken and egg problem of an ecosystem existing without a network or sensors is beginning to evaporate rapidly, and when it does, gathering data from every object around us will become easier, both technically and financially.

VT IoT, as the exclusive operator of the Sigfox network in Ireland, has been a devout advocate for the development of an IoT industry on this island, and their continued success has spurred smaller companies to launch their own devices on the Sigfox network. As we drift into 2019, and competition in the IoT space heats up, the pace of innovation will hasten.

For the providers which actually operate IoT networks in Ireland, Vodafone and VT IoT, the continued development of comprehensive solutions that cater to different business applications will be at the top of the agenda. In particular, Big Red has learned the hard way that simply showing up in a new industry and flashing its name is simply not enough to attract customers which are seeking full-fledged, vertically integrated IoT solutions.

VT IoT will continue to improve the availability of its network by increasing the number of base stations. In addition, the company will improve indoor and underground coverage penetration by carrying out network densification work. Such improvements will have the knock-on impact of removing barriers that exist today, sparking further interest in the IoT space and expanding the number of applications for the technology.

VT IoT, as the exclusive operator of the Sigfox network in Ireland, has been a devout advocate for the development of an IoT industry on this island, and their continued success has spurred smaller companies to launch their own devices on the Sigfox network. As we drift into 2019, and competition in the IoT space heats up, the pace of innovation will hasten.

For the providers which actually operate IoT networks in Ireland, Vodafone and VT IoT, the continued development of comprehensive solutions that cater to different business applications will be at the top of the agenda. In particular, Big Red has learned the hard way that simply showing up in a new industry and flashing its name is simply not enough to attract customers which are seeking full-fledged, vertically integrated IoT solutions.

VT IoT will continue to improve the availability of its network by increasing the number of base stations. In addition, the company will improve indoor and underground coverage penetration by carrying out network densification work. Such improvements will have the knock-on impact of removing barriers that exist today, sparking further interest in the IoT space and expanding the number of applications for the technology.

Vodafone has not been transparent as to where the company has actually activated its NB-IoT network in Ireland, and this needs to be something that it clarifies in 2019. At the moment, the ecosystem for NB-IoT sensors is still in the very early stages, and key components of the technology such as cost and battery life have yet to reach their full potential. The company's consumer IoT range, V by Vodafone, will continue to expand in 2019 with the addition of new devices and services. It is important to note, however, that these devices are supported by Vodafone's cellular network which results in disgustingly poor battery life performance. Honestly, Vodafone's categorisation of the V by Vodafone range as "IoT devices" is a stain on the technology on a cop-out.

Many of the trends that will have the greatest impact on the IoT market in 2019 will stem from advances in the sensor space. For example, we are beginning to witness the utilisation of dual-power sources for enhanced reliability and sustainability. Imagine a battery providing power for a weather station at night and a solar cell powering the sensors during the daytime light. Next year, 2019, will be a pinnacle time for the IoT, and we will gain a further glimpse into how this technology will disrupt industries around us for societal good.

Many of the trends that will have the greatest impact on the IoT market in 2019 will stem from advances in the sensor space. For example, we are beginning to witness the utilisation of dual-power sources for enhanced reliability and sustainability. Imagine a battery providing power for a weather station at night and a solar cell powering the sensors during the daytime light. Next year, 2019, will be a pinnacle time for the IoT, and we will gain a further glimpse into how this technology will disrupt industries around us for societal good.

Wireless meets 3.6GHz

Perhaps the most profound technological advancement which will sweep across our island in 2019 will be the launch of advanced wireless networks, falling under the categorisation of sub-6GHz 5G NR. The goal of such networks is to bridge the performance gap between fixed networks and their inferior wireless counterparts. Mobile providers are eager to capitalise on the potential of 5G access networks, supported by fibre backhaul at their core.

Contrary to what all the hype may lead you to believe, the number of defined business cases for gigabit-class wireless networks today are few and far between. In fact, even the very vendors typically accustomed to glorifying every new generation of wireless technology are downplaying its potential in the short term because of the overreaching fragmentation concerns.

Vodafone is currently in possesion of the 5G torch in Ireland, with its multi-year partnership with Ericsson bearing fruits in the form of a pioneering 3.6GHz 5G commercial trial in Dublin's Docklands and the announcement of a plan to provide FWA broadband capable of 500Mbps to four pilot towns in Ireland.

Contrary to what all the hype may lead you to believe, the number of defined business cases for gigabit-class wireless networks today are few and far between. In fact, even the very vendors typically accustomed to glorifying every new generation of wireless technology are downplaying its potential in the short term because of the overreaching fragmentation concerns.

Vodafone is currently in possesion of the 5G torch in Ireland, with its multi-year partnership with Ericsson bearing fruits in the form of a pioneering 3.6GHz 5G commercial trial in Dublin's Docklands and the announcement of a plan to provide FWA broadband capable of 500Mbps to four pilot towns in Ireland.

Big Red is the first mobile provider in Ireland to publicly announce a commercial trial of its 3.6GHz network, with 20,0000 homes being targeted across Dungarvan, Clonmel, Gorey and Roscommon. An external antenna will act as the link between an internal router and an Ericsson-equipped radio site. In the initial trial, 250 premises will gain access to the FWA network, and this paves the way towards further wireless broadband deployments in Ireland which provide extreme capacity compared to the wireless networks available today.

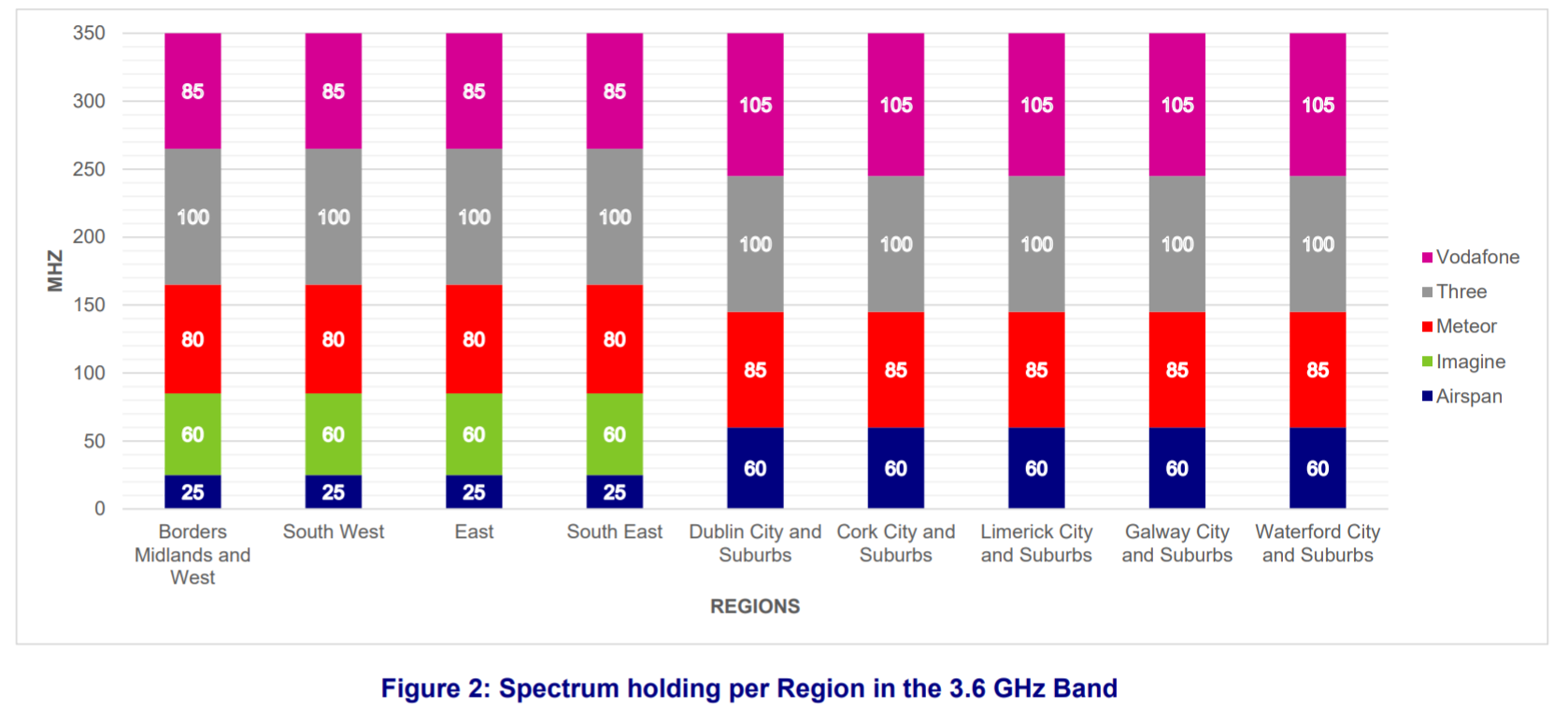

Both eir and Three hold a sizeable chunk of the 3.6GHz band, and with Huawei selected for the RAN , their ability to deploy a potent 5G network cannot be underestimated. However, as we've seen, the incessant drive to discredit Huawei for security concerns continues to grapple Chinese tech emergents and it remains unknown how this might affect the Irish RAN market in 2019. Just don't expect providers to be flashing the Huawei name prominently in their network upgrade announcements.

Given the propagation characteristics of the 3.6GHz band, its availability will be limited to hotpots in cities and towns next year, particularly where there are congestion issues. Moreover, when we factor in the fact that the 700MHz auction will occur in 2019, there is a strong likelihood that providers will prioritise this low-band spectrum for covering rural areas with 4G and 5G, but this spectrum is certainly not a competent or future-proof replacement for fixed networks due to its capacity limitations.

Both eir and Three hold a sizeable chunk of the 3.6GHz band, and with Huawei selected for the RAN , their ability to deploy a potent 5G network cannot be underestimated. However, as we've seen, the incessant drive to discredit Huawei for security concerns continues to grapple Chinese tech emergents and it remains unknown how this might affect the Irish RAN market in 2019. Just don't expect providers to be flashing the Huawei name prominently in their network upgrade announcements.

Given the propagation characteristics of the 3.6GHz band, its availability will be limited to hotpots in cities and towns next year, particularly where there are congestion issues. Moreover, when we factor in the fact that the 700MHz auction will occur in 2019, there is a strong likelihood that providers will prioritise this low-band spectrum for covering rural areas with 4G and 5G, but this spectrum is certainly not a competent or future-proof replacement for fixed networks due to its capacity limitations.

The locations ideal for 3.6GHz FWA are medium to large towns which provide extensive fixed infrastructure, and these locations are already being targeted as part of SIRO's FTTH rollout. As such, the chances of Vodafone embarking on a mission to expand the 3.6GHz band into towns currently or soon to be covered by SIRO are incredibly slim because such a move would be an effective cannibalisation of their market.

Of course, we couldn't talk about the future of 5G without mentioning the integral role which mmWave spectrum will ultimately play to provide high capacity coverage in dense urban settings with the deployment of millions of small cells. Don't expect to see the utilisation of mmWave spectrum for large 5G deployments in Ireland next year. The technologies which underpin mmWave spectrum remain primitive, and the process of actually providing indoor coverage is a seemingly insurmountable barrier at present. Moreover, given the fact that the use license for the 26GHz band in Ireland is currently limited to microwave backhaul from radio sites, ComReg is required to liberalise this band or release further spectrum before any such mmWave deployment can occur.

Of course, we couldn't talk about the future of 5G without mentioning the integral role which mmWave spectrum will ultimately play to provide high capacity coverage in dense urban settings with the deployment of millions of small cells. Don't expect to see the utilisation of mmWave spectrum for large 5G deployments in Ireland next year. The technologies which underpin mmWave spectrum remain primitive, and the process of actually providing indoor coverage is a seemingly insurmountable barrier at present. Moreover, given the fact that the use license for the 26GHz band in Ireland is currently limited to microwave backhaul from radio sites, ComReg is required to liberalise this band or release further spectrum before any such mmWave deployment can occur.

Building the networks supporting a generation

In 2019, we will build the networks supporting a generation. A generation of forward thinkers, innovators, disruptors and revolutionaries, all bound together by one common necessity: a requirement for connectivity, not just any connectivity, but world-class connectivity. The decisions, network deployment strategies and regulatory moves undertaken next year will, quite literally, define the next chapter in our journey to creating a Gigabit Society on this island.

Just as 4G brought fingertip connectivity to the masses, a high point in human history, 5G will support the next wave of data-demanding applications which don't even exist today. There are very definite limits to physics and radio spectrum, but none to our imagination, so we have the ultimate power to create the next mobile ecosystem.

Banishing black spots and physical SIMs in 2019 will be a tremendous breakthrough on their own. Oh, don't forget the introduction of the 3.6GHz band, making gigabit-class wireless networks a reality, not some wild pipe dream filling tabloids. However, if I was pressured to select two of the most important mobile trends that will shape 2019, I would point us to the incoming 700MHz auction which has the potential to end the rural/urban digital divide and the acceleration of an IoT revolution in which data becomes the new oil.

The future is exciting. Ready?

Just as 4G brought fingertip connectivity to the masses, a high point in human history, 5G will support the next wave of data-demanding applications which don't even exist today. There are very definite limits to physics and radio spectrum, but none to our imagination, so we have the ultimate power to create the next mobile ecosystem.

Banishing black spots and physical SIMs in 2019 will be a tremendous breakthrough on their own. Oh, don't forget the introduction of the 3.6GHz band, making gigabit-class wireless networks a reality, not some wild pipe dream filling tabloids. However, if I was pressured to select two of the most important mobile trends that will shape 2019, I would point us to the incoming 700MHz auction which has the potential to end the rural/urban digital divide and the acceleration of an IoT revolution in which data becomes the new oil.

The future is exciting. Ready?